The Shooting Star Candlestick Pattern is a single reversal candlestick that forms at the top of a trend. It suggests a future downtrend.

In other words, a shooting star candlestick is a single bearish pattern.

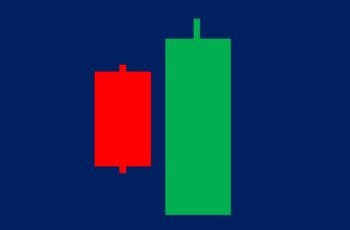

A shooting star has a long upper shadow/tail and a small body at the bottom of the candle, with or without a tiny shadow.

Technically, the length of the upper shadow of the shooting star should be twice its body. Otherwise, it is just a regular candle showing somehow volatility.

Shooting stars can be red or green. It does not matter. However, a red candle is preferred.

How to Trade Shooting Star Candlestick?

Because shooting star candlestick is a single reversal pattern, it is not very potent. In other words, candlestick patterns with more than one candle are stronger than shooting stars. Engulfing, piercing, and morning star and evening star are examples of candlestick structures owning more than one candle.

Anyway, here are factors to consider when you discover shooting stars:

- Since it is a single candle pattern, it should appear after a long bullish trend or at the end of a correction wave/pattern to reverse the direction. Otherwise, it might not be effective and only indicate that bears did a try.

- Due to being a single candle pattern, other technical tools and charts should confirm it. For example, candles with long upper shadows before a shooting star and indication of an overbought condition by a leading indicator are good signals.

- A taller upper shadow expresses more bullishness. It means that bears drag down the price in full force.

- Blend your analysis with fundamental analysis. And check the economic calendar.

- If you found a few strong signals from this list, sell when the shooting star is completed or, close your long position. If you sold, put your stop loss a little bit higher than the high price of the shooting star.

I may not have mentioned everything about this pattern. The more pieces of evidence you gather, the more will be the reversal chance. Treat shooting stars with caution.

Shooting Star Candlestick Pattern Examples

In the following, I have brought you two examples from the forex EURUSD pair.

The first example is a green shooting star. And the second example is a red shooting star.

Green Shooting Star Example

In late February (25 Feb 2021), the EURUSD pair made a green shooting star. And several signals supported this pattern.

Here are those techniques that confirmed the shooting star as a reversal pattern:

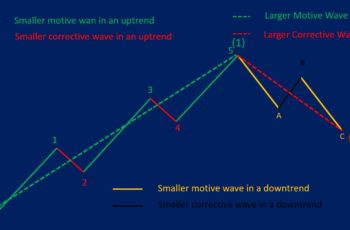

- Earlier, you read that a shooting star should appear after an extended wave/trend or at the end of a correction pattern. And this shooting star formed at the end of the third wave of a correction.

- The candle before the shooting star is a hanging man, another supporting signal.

- The shadow of the shooting star almost touched the 0.78 area (a golden ratio) of Fibo retracement. Golden ratios are the most potent support and resistance line, according to Fibonacci Principles.

- For the USD, the economic calendar showed data that have high impacts better than expected. See below image.

The above four signals were enough to drag down the price. And the price dropped by about 450 PIPs before resuming moving upward.

Selling after completion of the above shooting star was an opportunity. And the stop loss should have been around 1.22500 area, which is above the pattern.

Red Shooting Star Example

On 1 Sep 2020, the EURUSD made a red shooting star. It became the start of a new correction wave.

In the following, I give you the two reasons that helped the shooting star succeed.

- This shooting star formed after a prolonged bullish trend. It is probably the most critical reason.

- The RSI indicator at the bottom triggered a reversal signal by divergence, which is a leading indicator. It started falling 36 days ahead of the price, which is a powerful signal.

- The economic calendar did not show any bad events for the USD to make it lose value. See the below image!

- Closing an already long position after the shooting star was the best option. Selling in places like this is not a good idea because the overall trend is upward. If you sell in situations like the above chart, put your stop loss above the shooting star, and try to manage your risk by changing the stop loss position once the market dropped.

Technically, there were only three signals. However, these three signals are very potent compared to other tools such as another candlestick pattern.

Do not forget to put a stop loss above the shadow of the shooting star after going short.

What Are Differences Between a Shooting Star and a Hanging Man?

Shooting star and hanging man both are bearish reversal candlestick patterns. Both can be red or green.

However, two things differentiate them, and they are: first, the shooting star has a mall body at the bottom of the candle and the hanging man at the top. Second, a “hanging man” is less reliable than a “shooting star” and requires more supporting signals.

What Are the Differences Between a Shooting Star and a Hammer?

Shooting star and hammer are reversal patterns. But the hammer is a bullish reversal pattern, and the shooting star is a bearish reversal pattern.

A hammer has a tiny body at the top and a long lower shadow. Meanwhile, a shooting star has a small body at the bottom and a long upper shadow.

What Is the Difference Between a Shooting Star and a Gravestone Doji?

A shooting star is another version of a gravestone doji.

Both are reversal patterns after an extended uptrend.

The only difference is the size of their bodies. A shooting star has a little bit bigger body. Meantime, a gravestone has no body or miniature body.

Bottom Line

A shooting star is a bearish reversal candlestick pattern if supported by other signals. Because of being a single candle reversal structure, caution is essential. It should be after a prolonged uptrend or at the end of a correction. Or else, it has little chance of reversing the trend.