What is a Morning Star Pattern?

The morning star is a bullish reversal candlestick pattern that appears at the bottom of a trend or end of a bullish continuation pattern.

The Morning star has three candles. The first candle is a large red candle, the second candle is small (known as the star), and the third candle is a large bullish candlestick.

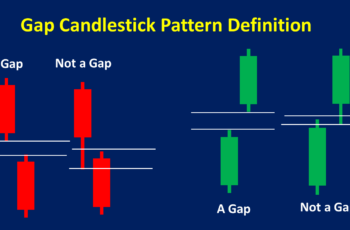

Ideally (not necessarily), in the stock market, the second candle should open after a gap-down, and the third candle should open after a gap-up. However, in the forex and crypto markets, gaps don’t occur because, generally, the closing price of a candle is the same as the opening price of the next candle.

The star in a morning star indicates that the bears are losing strength. After completion of the third session (a large green candlestick), the bears lose, and the bulls grab the power.

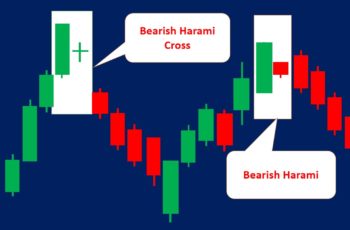

If the second candle in a morning star is a doji, the pattern is called the morning doji star pattern.

The counterpart of the morning star is the evening star which is a bearish reversal pattern.

How to Trade Morning Star Candlestick Pattern?

Because this pattern is a reversal structure, it needs more supporting signals to reverse a trend.

A morning star becomes more reliable if it has more of the following features:

- There should a downtrend is before a morning star.

- Longer first and third candles stress strength. Thus, the morning star is more powerful when its first and third candles are longer.

- A star with larger gaps between the star and two other candles is more potent than a general star.

- The highest price of the star in the morning star plays as a support line. So, put the stop-loss under the star.

- Look for other technical supporting signals. More signals lead to a higher chance of reversal.

- Check the economic calendar and blend your analysis with fundamental data.

- If you are assured, at the closing price of the third candle. If you have an open position against the pattern, close it.

All the above signals don’t need to be present for the morning star pattern to reverse the trend. Generally, two or three powerful confirmations are enough to change the direction.

Morning Star Pattern Example

From 13- 14 Oct, the Apple stock made a morning star candlestick pattern.

After this pattern, Apple stock skyrocketed and the chart shows the following reasons:

- This pattern was created after almost touching a strong resistance line, which previously three large candles failed to break downward.

- A hammer before the morning star shows the fight between bulls and bears. Even bulls managed to push the price high but failed to maintain it. The phenomenon is an indication of a possible trend reversal.

- Previously, the CCI indicator had predicted a possible trend reversal.

Because of the above reasons, there was a great buying opportunity. In situations like the above chart, put your stop loss somehow lower than the low of the star. If you have an open trade close it.

Morning Doji Star Pattern Example

On 20, 23, and 24 of October, the MasterCard stock made a strong morning doji star.

And, became successful in reversing the trend.

The chart says that this “morning doji star” worked for the following reasons:

- It formed after a trend that was losing momentum. And the Commodity Channel Index (CCI) clearly shows it by not following the price direction.

- The first and third candles are tall. And taller candles are more potent than short ones.

- Before this pattern, other candles show vulnerability. These candles indicate that bears are not sure about dragging the price down further.

- Gaps before and after doji are big which supports the strength of the pattern.

Based on the above reasons, there was an outstanding buying opportunity, specifically because the CCI signaled days ahead of the reversal. If you go long in places like this, put your stop loss below the morning doji star. If you have a short position already, close it.

Morning Star vs Tri-Star Bottom

Morning star and tri-star bottom are both bullish reversal candlestick patterns. And both have three candles.

However, all three tri-star candles are doji and less reliable than the morning star. And the tri-star needs more confirmation.

Final Thoughts

The morning star pattern is a bullish reversal pattern. To predict successfully, it does need more confirmation.

In fact, all reversal structures need more validators than continuation patterns.