What is an Evening Star Pattern?

An evening star candlestick pattern is a bearish pattern that forms at the top of a trend or, at the end of a bearish continuation pattern.

This pattern has three candles. The first is a large green candle, the second a small candle (known as the star), and the last is a tall red candle. Notice that the second candle can be in any color.

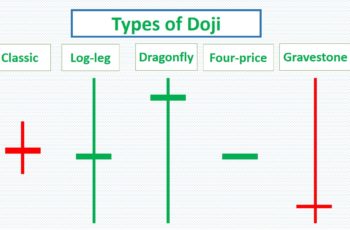

If the second candle is a doji, it is called an evening doji star.

Preferably, there should be gaps between the star and outer candles, specifically in the stock market. But in the forex and crypto markets, it is still an evening star pattern if there are no gaps.

In an evening star, the star warns the bulls about losing control. And with the completion of the third which is a red candle, the bulls officially lose control, and bears take the market control.

The opposite of the evening star is the morning star which is a bullish reversal pattern.

How to Trade the Evening Star Pattern?

An evening star can reverse the trend from upward to downward more successfully if it has more of the following features:

- There should be an uptrend before an evening star. Or, it should appear at the end of the bearish correction pattern.

- Longer first and third candles stress strength. Thus, evening star candlestick patterns are more powerful when their first and third candles are longer.

- A star with larger gaps between the star and two other candles leads to a more potent evening star.

- The highest price of the star in an evening star plays as a resistance line. So, it is a level that you should put your stop-loss.

- Look for other technical supporting signals such as candlestick patterns and technical indicators. More signals lead to a higher chance of reversal.

- Check the economic calendar and blend your analysis with news and fundamental data.

- Sell if you find sufficient supporting signals. If you have an open position against the pattern, close it.

Notice that a pattern with more supporting signals is more trustworthy than fewer. Take care of your capital.

Evening Star Pattern Example

In early December, the JP Morgan stock created an evening star pattern.

The constituents’ candle bodies were not tall. However, the price fell after this evening star.

The following reasons are available on the chart supporting the pattern as a bearish reversal structure.

- A candle that has a long upper shadow precedes the pattern. It suggests that the trend is almost over.

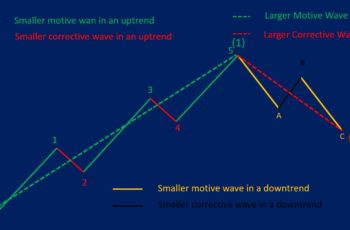

- Based on Wave Theory, the bearish correction pattern completed the third wave. After the completion of three correction waves, a reversal is expected.

- The CCI shows a relatively overbought condition. In an overbought condition, bulls are expected to lose control and bears take control.

In the stock market, shorting carries more risk than going long. If you sell in places like the above, you must (I believe though) put a stop loss above the evening star. And, if you have a short position, close it.

Evening Doji Star Pattern Example

On 4, 5, and 8th November, the Coca-Cola stock made an evening doji star. Even though the price hesitated to fall, but finally dropped.

Here are the top reasons that made this pattern successful:

- After a surprising earning (12% higher than expected) the stock continued to rise. However, the Commodity Channel Index (CCI) did not agree with rising, instead, it went down. A convergence by a leading indicator is a sign of reversal.

- The outer candles in this pattern are tall. It is another sign of reversal.

- The doji in the pattern moved upward to a potent resistance area but failed. Being unable to break a resistance area is a sign of reversal from an uptrend to a downtrend.

There were not sufficient supporting signals. That is why the price hesitated to fall after the trend. However, the above three reasons were enough for this stock.

Selling like the above placed should be done with extra caution. Because the next movement can be sideways, and then the market starts rising. If you sell, never forget to put a stop-loss above the star. And, if you have a long position, the closing can be a good thing.

Difference Between an Evening Star and Tri-Star Top

Both of these patterns are bearish reversal patterns.

But, all candles in the tri-star are doij. And it is less reliable than the morning star pattern. To work, a tri-star needs more confirmation.

Moreover, tri-star patterns occur less often than other reversal patterns.

Final Words

The evening star pattern is a bearish reversal pattern forming at the top and predicting a future downtrend.

Because it is a reversal pattern, it needs confirmation to reverse a trend. More is better.