The flag pattern is a continuation structure appearing on any financial asset chart.

And a flag pattern resembles a flag or a rectangle.

Flags are short-term structures. And they are among the most reliable structures which around 70% of the time predict correctly.

There are bullish and bearish flag patterns. And this article explains both of them.

Bullish Flag Pattern

A bullish flag pattern forms in the middle of a strong uptrend. It is a bullish continuation pattern.

A bullish flag structure appears in the middle of an uptrend. It suggests that the underlying bullish trend will continue.

Moreover, it indicates that bulls have huge control over the market.

A flag pattern starts with a flagpole, a bullish trend with heavy volume. Then, a small correction appears that has a slight downward slope. Finally, after breaking the flag’s resistance line, it spikes with heavy volume.

It is buying signal when the price breaks the upper line (resistance line). Usually, there is a pullback. So, it is better to put SL low enough not to close the position too early.

Bearish Flag Pattern

A bearish flag pattern appears in the middle of a steep downtrend. And it suggests the continuation of the underlying falling direction.

A bearish flag structure is an indication of bears’ control.

Bearish flag chart patterns start with a flagpole, generally a sharp trend. Then the flag forms that has a small upward slope. Finally, the price breaks the support line of the flag and continues falling with heavy volume.

It is a selling signal when the price breaks the support line. And the stop loss should be put at the top of the flag.

In the stock and crypto markets, bearish flags take less time to develop than bullish flags. They take less time because of panic associated with downtrends in the stock market.

However, in the forex market, there are no differences.

How to Trade Flag Patterns?

Flag patterns form very frequently, and they are reliable continuation patterns.

A flag pattern shows a pause after a full attack by bulls (in an uptrend) or bears (in a downtrend). And it is powerful because of the trend strength.

Here are things to consider when you discover these patterns:

- Before the breakout, look for candlestick patterns inside the flag. A candlestick pattern confirms if the breakout is false or right.

- A technical indicator helps you find if the market is in an overbought or oversold condition.

- Buy when the price breaks the resistance trendline of the bullish flag and sell when the price breaks the support trendline of the bearish flag. Moreover, look at the inside of the flag in a lower timeframe to see what happens there.

- Notice that the distance between the support and resistance lines of the flag suggests how long it will take to break the pattern. A higher distance leads to a longer time to complete the structure, and a short distance leads to a shorter time required for the development.

- Check fundamental tools (ex: economic calendar) and news to make a better decision.

- Put your stop-loss below the resistance trendline of the bullish flag pattern and above the resistance line of the bearish version. Do not forget to put a stop-loss because the v-shaped pattern can form after the breakout, which is a reversal pattern.

- If you want to place a take-profit, its distance from the breakout should be the size of the flagpole. Often, professional traders do not place a take-profit instead, adjust the stop-loss level. It is up to you to choose which one suits you.

Examples of Flag Patterns

This article provides you with four flag pattern examples, two from each bullish and bearish version.

Bullish Flag Pattern Examples

Example #1

In late July and Early August of 2021, the Meta made a bullish flag pattern after a gap-up. The gap itself followed a bullish engulfing candlestick pattern. In this pattern, the flagpole is the gap.

The flag lasted 4 sessions (days) and then the price continued rising.

Going to a lower time frame helps with timing. It decreases your risk since you can put stop-loss tighter.

The above pattern, in the hourly chart, also made a flag. Moreover, at the end of the flag, there was a hammer.

Thus, a flag at a higher time frame, a flag at a lower time frame, and finally the hammer decreases your risk and increases your reward.

Example #2

In mid-January 2017, the Meta chart made a bull flag pattern with a series of red candles.

It formed in the middle of a spike and continued rising.

This flag was a zigzag structure in lower time frames which is another confirmation of the continuation of the trend.

Bearish Flag Pattern Examples

Example #1

The Meta chart made a bearish flag pattern that started in late January and lasted till late February.

The flagpole started after the earning report of full 2019 fiscal year. Even though the earnings were better than expected, the price fell due to a 51% rise in expenses related to privacy and security issues. And it reminds us of the importance of blending fundamental analysis with technical analysis.

The stock price of Meta fluctuated and completed the flag. It broke the support trendline of the flag probably due to coronavirus fears.

Moreover, the spinning top candle is another confirmation for bears becoming series about dropping the price.

Moreover, a bear flag pattern appeared in the hourly chart after a long red candle. And this pattern, in addition to news of the coronavirus, was supporting signals for future falls.

Example #2

In mid-April 2022, the Amazon stock made a bearish flag pattern.

At the end of the flag, two candles formed a bearish harami pattern, which is a downtrend signal.

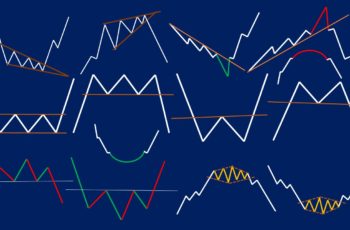

Flag and Pennant Patterns

Flags and pennants are similar.

However, there are some differences.

The followings are key points regarding both of them:

- They are both continuation patterns that appear in the middle of a sharp trend.

- Both are short-lived structures

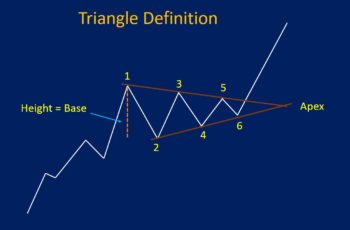

- A pennant is similar to a symmetrical triangle. However, their size is small.

- The flag is similar to a parallelogram. However, it is smaller and tilts a little bit against the trend.

- Both of these patterns are common. However, flags appear more frequently than pennants.

Practice What You Learned

Here is a live chart allowing you to study the past. Find flag patterns and study deeply.

Click on the pencil icon to add drawing tools.