The Housing Starts indicator states the number of new residential construction projects started in the USA in the specified month. The report also includes units in structures starting to rebuilt on an existing foundation.

In other words, the Housing Starts indicator reflects the number of privately owned new houses when excavation begins for the foundation of a building.

This indicator and building permits are released by the Census Bureau of the USA in the middle of each month. It obtains data from a survey of homeowners and developers.

The Housing Starts is a reliable indicator because its sample size covers about 95% of all residential construction projects in the USA.

The number of new housing starts is highly dependent on weather conditions, geographic location, and season of the year. So, to give a clear picture data are adjusted for weather and season variations and analysts consider the indicator change for several months.

What Kind of Building Are Counted as Housing Start?

Broadly Housing Starts includes three groups: single-family houses, townhouses, and apartment buildings with five or more units.

Every unit in multi-family houses counts as a single start. For example, if an apartment building construction has 50 units, it is counted as 50 housing starts.

Every building that people live in is not counted as a housing start.

Group quarters are buildings where people live in a group living arrangement. Generally, they are managed by an organization that provides housing and services for the residents. Examples are dormitories, residential treatment centers, and military barracks.

Importance of Housing Starts Indicator

An increase in the Housing Starts means that there are demand for houses. And a higher demand for new houses reflects the economic improvement in the country or region.

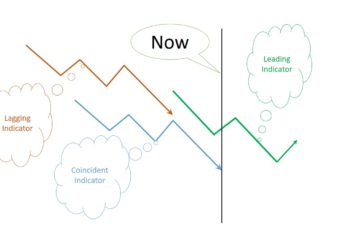

This indicator is also a leading indicator of the unemployment rate. Construction is a labor-intensive project that leads to a decreased unemployment rate.

The Housing Starts indicator is also an indicator for price indexes such as retail sales and inflation. Newly built houses require furniture, appliances, etc.

Importantly, a house is the biggest purchase of most people. So, an increase in Housing Starts reading should be taken into account while analyzing markets.

Taking into account the above points, higher readings of Housing Starts may have a positive impact on the US stock market indexes and USD quotes.

How to Analyze Housing Starts?

The Housing Experts indicator indeed has a lot to say about the economy.

However, because it is seasonally adjusted, and constructing buildings takes time, it has less impact on investors’ decisions and the USD quotes than other indicators such as GDP and interest rate.

That is why it is not as followed as other leading indicators. But traders and investors should follow, in my personal opinion.

The best way to trade this indicator is to look at forecasted and real data. If there is a big surprise, then expect a movement in the stock market and the USD.

Recent Housing Starts Indicator Chart

The following chart contains two graphs. The blue graph represents the actual data, and the dotted line represents forecasted data.

It shows that on average Housing Starts went up from late 2021 until May 2022. However, new data didn’t show the number as high as April 2022. Probably, new constructions did not start as many as they did back in April due Russian invasion of Ukraine and interest rate hikes.

Final Words

The housing Starts indicator tracks the number of new houses that construction starts in a given month.

It is a good economic indicator. However, its impact on the market is not as strong as other indicators, such as the unemployment rate and interest rate.

![Consumer Confidence Index [A Comprehensive Guide] Consumer Confidence Index [A Comprehensive Guide]](https://srading.com/wp-content/uploads/2023/10/consumer-condfidence-index-350x230.png)