What is Piercing Pattern?

A piercing pattern is a bullish candlestick structure that forms at the bottom of a trend or the end of a bullish continuation structure.

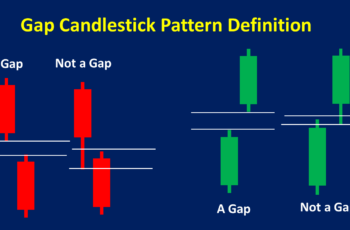

Piercing candlestick patterns consist of two large candles in opposite colors. The first candle is a tall red candle, and the second candle opens after a gap-down but closes around the middle of the first candle.

A piercing pattern in the stock market says that in pre-market and after-hours, bears dropped the price. So, the next day the market opens after a gap-down. However, the bulls reverse market direction and closes even above the last price of the preceding day. This way, the chance of reversal increases and may truly reverse.

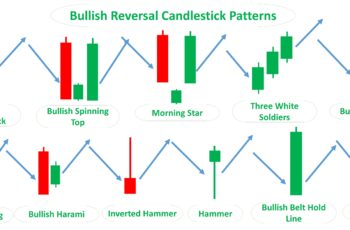

Combining the two candles of piercing patterns, we get a red hammer. For example, combining hourly chart piercing candlestick pattern provide us with a two-hour chart hammer.

A hammer is also a bullish reversal pattern.

The opposite of the piercing pattern is the dark cloud cover. It is a bearish reversal structure forming at the top of the trend.

How to Trade Piercing Pattern?

Because it is a reversal structure, it needs more confirmation to reverse the direction. Some of those confirmations are the followings:

- There should be a downtrend before the piercing or a bearish correction structure.

- The greater the size of the candles, the more powerful these patterns will be.

- The more the second candle penetrates the first candle, the greater becomes the reversal chance.

- In this pattern, taller size of candles with tiny or no shadows are better. It increases the reversal chance. A large candle without shadows means that the bulls are in control and fewer barriers for the controlling side to continue in its direction.

- If a piercing pattern breaks a resistance line and closes above the resistance line, the bulls have control of the market. And this increases the chance of reversal.

- Use a technical indicator such as MACD and Bollinger Bands. These indicators show the overbought and oversold conditions by diverging and converging. Moreover, look for chart patterns for confirmation too.

- Do not forget to check fundamentals. They can be great validators.

- If the supporting signals convince you, place your trade and put your stop-loss at the bottom of the trend.

Here is an image comparing weak and strong piercing structures.

More confirmations are better. If you don’t find sufficient signals, trading piercing patterns become difficult. So, take care of your money.

Examples of Piercing Pattern

I have brought you two examples of piercing patterns.

Both worked well.

The first example is from the PayPal chart and the second is from eBay.

I have also provided you with the possible reasons behind those structures.

First Example

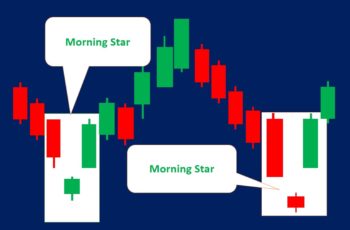

On the second and third of may (in the following chart) the PayPal stock made a piercing pattern. This pattern was successful in predicting a reversal.

Some possible reasons that helped the above piercing pattern to be bottom are the following:

- Both of the candles that made this pattern were large enough. In a reversal structure, larger candles indicate strength.

- The above pattern fell below a major resistance line, however, bears lost control. If any of the reversal patterns break a support or resistance line and then reverse, the chance of reversal increases.

- The MACD indicator in the above chart shows an oversold condition. And the market is expected to reverse in an oversold condition.

- Looking at the broader picture, the piercing pattern has formed at end of the falling zigzag structure, which is one more confirmation of a reversal. A falling zigzag pattern is a bullish continuation pattern. (Look at the below chart)

Our piercing pattern example has four signals. This is not a lot. More confirmations lead to more success rate. However, you don’t have to have tons of signals to reverse a trend. Sometimes one or two are enough to change direction.

Second Example

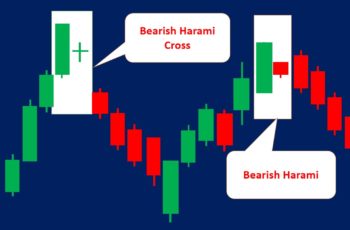

In early April, the eBay stock made a piercing pattern. It formed after a small gap-down which made investors think twice before placing a trade.

Technically, the above pattern was not potent due to its small candles and the prior gap-down.

However, its strength was guaranteed when the next candle after the structure opened and closed after a gap. This example says why we should wait when we don’t have convincing validators.

Additionally, this pattern formed after 50% retracement of the prior wave, a golden level. And golden levels increase the chance of reversal.

Finally, the MACD indicator also expressed reversal by crossing the MACD line by signal line.

Piercing Pattern vs Bullish Engulfing Pattern

If the second candle of a piercing pattern closes above the opening price of the first candle (red), it becomes a bullish engulfing pattern.

Generally, a bullish engulfing structure is more potent than a piercing pattern because it closes higher.

Final Words

A piercing pattern is a reversal structure probably as powerful as a hammer that has a long tail. However, it is less potent than the bullish engulfing pattern.

As a reversal pattern, it does need confirmation. So, do check for it.