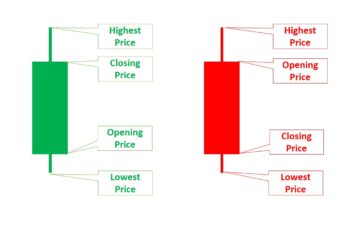

The “three black crows” is a bearish candlestick pattern having three red (black crow) candles immediately after reversal from an uptrend to a downtrend. These candles must open within the previous body or near the closing price.

The “three black crows” mean the three red candles that generate after a trend reversal from an uptrend to a downtrend. Earlier, when investors were using paper drawing candles, they were filling bearish candles with black and bullish candles with white. And crows are black. That is why they chose this name.

The three black crows pattern resembles three crows sitting on a tree branch. This way, you can remember it longer.

The “three white soldiers” is the opposite pattern of the “three black crows” which is a bullish pattern. We have a separate article for this. Click HERE to read it.

How to Trade Three Black Crows Patterns?

This pattern is bearish. And shorting in the stock market during normal economic conditions is risky because it could be late due to having three candles. Thus, trade this pattern with caution in the stock market.

However, in the forex market, shorting is very common. Shorting a forex pair means selling the base currency and buying the quote currency.

Followings are factors to consider when you discover a “three black crows candlestick” pattern.

- The opening price of succeeding candles near the low of the preceding candle or after a small gap leads to strength (it is ok if the opening price succeeding candle is within the preceding candle). So, if candles open at the closing price of the previous candlestick, the pattern is more reliable than opening within the body range of the preceding candle.

- Ideally, the candles should have long bodies and tiny or no shadows.

- When the market moves sideways, this pattern is not reliable as it is when the market makes new larger waves. So, do not trade it sideways.

- A safer approach is to trade it with a larger downtrend.

- It is better to sell based on this pattern when there is an unhealthy downtrend. An unhealthy downtrend is a trend that falls but frequently changes the direction and color of candles. In this situation, it is very likely to be mistaken with the rising three methods.

- Always blend your analysis with other technical tools and techniques. Moreover, fundamental analysis can make you less emotional and confirm your technical analysis.

- If a “three black crows pattern” convinced you, don’t forget to put a stop loss above the pattern.

The more supporting signals (confirmations) exist on the chart, the more will be your success rate.

Examples of Three Black Crows Candlestick Pattern

Here are examples from forex and the stock market.

Example #1

In the below chart, Alibaba made a “three black crows pattern” that happened to be the start of a new downtrend.

The above pattern changed the direction due to multiple reasons. First, it was generated below a resistance area that previously another candle with long tails failed to break. Second, the first candle of this pattern together with the preceding candle made a tweezers top pattern, which is a bearish pattern itself. Finally, the RSI started moving downside after when a resistance area was made.

Based on the above reasons, the end of the three black crows candlestick pattern was a good entry point. Finally, a stop loss should be placed above the pattern.

Example #2

This example is from the GBPUSD forex pair.

In the above chart, the EURUSD chart made a “three black crows candlestick pattern” under a strong resistance area. In fact, it was the second top of a “double top” pattern.

Because it formed under a resistance line, it had made a double top, and the RSI indicator showed relatively an overbought condition. That is why the price dropped.

Example #3

The daily chart of USDCHF completed a “three black crows pattern” in May.

In the above chart, candles preceding this pattern showed the weakness of bulls by making long shadows, such as doji, shooting star, and hanging man. All of these candles are reversal structures at the top.

Moreover, the RSI showed an overbought condition.

In the forex market, it is better to go down to lower time frames to see what patterns form there. It can help a lot understand the trend better.

Differences Between Upside-Gap Two Crows and Three Black Crows Patterns

Both are reversal structures, both have three candles, and both have crows.

However, the first candle in the “upside-gap two crows pattern” is green, followed by a gap. While all three candles of the “three black crows” candles are red.

Here is an image comparing them.

Bottom Line

Three black crows is a bearish reversal pattern, but caution is required because it has three candles. And it could be late in the stock market, specifically when overall the market is in a normal condition.

Meanwhile, this pattern is more helpful in trading forex. And, shorting in forex is common.