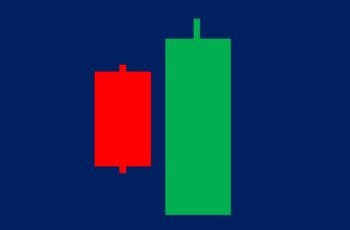

Counterattack candlestick patterns are reversal structures involving two candles in the opposite color but close at the same price. They are also known as counterattack lines. There are bullish and bearish counterattack candlestick patterns.

A bullish counterattack candlestick pattern forms at the bottom. In this pattern, the first candle is red and the second green. The second candle opens after a gap-down but closes at the closing price of the first candle. This pattern says that during after-hours or premarket hours, the stock made a gap however, the market driver was wrong. (At the end of this article, I have compared it with the piercing pattern)

A bearish counterattack pattern occurs at the bottom. In this pattern, the first candle is green, but the second candle is red. The red candle opens after a gap-up but closes down near the closing price of the first (green) candle. This pattern tells that the bulls’ attack was so fierce that made a gap-up, but they were wrong, and finally, the bears took control. (At the end of this article, I have compared it with the dark cloud cover)

How to Trade Counterattack Candlestick Patterns?

Counterattack candlesticks are not as potent as engulfing, piercing, and dark cloud cover patterns. So, they need more supporting signals.

Here are signals that you should be looking for:

- There should be an uptrend before bearish and a downtrend before the bullish counterattack candlesticks. Or, they should for at the end of a correction pattern.

- Taller candles represent powers. So, taller is better.

- Look for technical supporting signals that confirm the pattern.

- Check the economic calendar, and blend technical analysis with fundamental analysis.

- If you are convinced, put your stop loss at the opening price of the second candle. And, close your open position, if you have one.

More signals translate to more success. There should be something that confirms the counterattack candlestick pattern.

Examples

In the following, I have brought two examples of bullish and bearish versions.

Bullish Counterattack Candlestick Pattern Example

On 19 July 2021, the Snap stock generated a bullish counterattack candlestick pattern. The constituent candles were not tall and had small shadows, but could reverse the trend.

On 19 July 2021, the Snap stock generated a bullish counterattack candlestick pattern. The constituent candles were not tall and had small shadows, but could reverse the trend.

On the day the pattern finished, there was only one supporting signal, the 0.618 retracement level. However, the next day the session opened after a gap-up, creating a strong confirmation.

The above pattern looks like a risky reversal candlestick pattern. That is why in those situations, you should never forget to put a stop loss under the pattern.

Bearish Counterattack Candlestick Pattern Example

The Nio stock made a bearish counterattack candlestick pattern on 10 July 2019.

Apparently, after this pattern, the Nio was making a bullish correction pattern by moving down very slowly. Even the short uptrend before the pattern had made three small gap-ups.

Sometimes it happens. It did drag the price down.

Selling in that situation is very risky. However, if you sell, definitely put a stop loss at the top of the pattern.

Difference Between Bullish Counterattack Candlestick Pattern and Piercing Pattern

The bullish counterattack candlestick pattern and piercing pattern are both bullish reversal structures.

However, the followings are different:

- They both open after a gap down. But, the piercing pattern closes within range of the first candle, and the counterattack candlestick closes near the closing price of the first candle.

- The piercing pattern is stronger than the bullish counterattack candlestick pattern.

Here is an image comparing them.

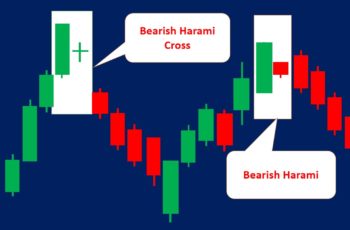

Difference Between Bearish Counterattack Candlestick Pattern and Dark Cloud Cover

Both bearish counterattack candlestick pattern and dark cloud cover are bearish reversal structures.

However, the differences are the followings:

- Both opens after a gap-up. However, the dark cloud covers close around the middle of the first (green) candle, and the bearish counterattack candle closes at the closing price first candle.

- Dark cloud cover is more potent than a bearish counterattack candlestick pattern.

Here is image comparing them.

Bottom Line

Counterattack candlestick patterns are reversal structures but less potent than engulfing candlestick pattern. Thus, need more confirmation.