A head and shoulders pattern is a reversal chart structure. Investors put this name on it because they resemble the human body from the shoulders above.

The head and shoulders that form at the top of the trend are a bearish reversal chart pattern. And the one that forms at the bottom, known as inverse head and shoulders, is a bullish reversal pattern.

This article explains these patterns separately, explains how to trade them, and provides examples. Moreover, at the end of this article, there is an online charting tool that enables you to practice what you learned.

Head and Shoulders Top

The “head and shoulders pattern” at the top of a trend has three peaks in which the middle peak is higher than the two others.

The line that connects the start and end of the middle peak is the neckline. And the neckline acts as a support line for the pattern that can be horizontal or tilted.

You find this pattern when the right shoulder fails to continue rising. Until then, you do not know if it is head and shoulder or something else.

Often not always, from the peak of the head to the peak of the right shoulder, it looks like a bearish flag. And this feature makes it more reliable.

Head and Shoulders Bottom

It is the mirror image of the head and shoulders top, also known as inverse head and shoulders.

The “head and shoulders bottom” form at the bottom of a trend and has three lows, and the second low is lower than the lows of outer lows.

In this pattern, from the low of the second low to the third low, it often looks like a bullish flag.

How to Trade Head and Shoulders Pattern?

Generally, a perfect “head and shoulders” do not form. That is why careful analysis is required.

This article explains factors to be aware of it while discovering this formation.

Placing a Trade

There are three places to place your trade.

1. Ordering Immediately After the Right Shoulder

Aggressive traders may sell after the peak of the head and shoulders top and buy after the low of the inverse head and shoulders.

Entering this place is risky because the new trend is not yet confirmed.

However, if the right shoulder is a continuation pattern, a flag or a potent candlestick pattern, for example, is a good option to place a trade.

2. Ordering After Breaking the Neckline

The second place to enter the market is after breaking the neckline. It is the most recommended way.

However, it is important to notice the price action from the right shoulder to the neckline.

If the move is sluggish, it is better to wait, and if the move is fast, it is better to trade.

3. Ordering After a Pullback

Waiting for a pullback after breaking the neckline is the safest option because the trend will change by any definition.

However, a pullback may not happen. In those circumstances, look inside the pattern in a lower time frame.

Putting a Stop Loss

I always recommend putting a stop loss. Everyone does not see the chart the same way, and many factors impact the price. So, it is better to accept a small loss than pray for reversal later, in case of being wrong.

Put a stop loss above the right shoulder in the head and shoulders top and at the bottom of the inverse version. If you do not put a stop-loss, you will act emotionally.

Moreover, you might be wrong in recognizing the pattern, and it could become a continuation pattern.

Putting a Take Profit

Put a take-profit order if you do not adjust your stop loss over time.

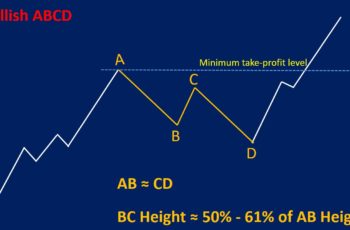

A minimum take-profit objective in a head and shoulders pattern from the neckline can be the same size as the distance from the top of the head to the neckline.

However, adjusting the stop-loss as new formations appear is a better option. In this method you let your profit increase, and you also limit your loss or the price hit the stop-loss level with a profit.

Size of the Pattern and Volatility

Generally, the head and shoulders at the top in the stock and commodities take less time to form and are more volatile. However, in the forex market, there is no difference between the top and bottom formations.

Additionally, more volume or large candles are required at the bottom to break the pattern than at the top.

Lastly, larger “head and shoulders patterns” lead to more reliability.

Blending With Fundamental Analysis

Technical analysis is one part of understanding the market. And the fundamental is another part.

Professional investors always follow economic news and the economic calendar. They help you be aware of what is going on in the world. And more importantly, they minimize your emotional decisions.

Analyzing Inside the Pattern

Go to a lower time frame to study what pattern appears there. It is significant to look at what is happening in the short period if you use long-term time frames.

Moreover, look for candlestick patterns. And use a technical indicator too.

Head and Shoulders Pattern Examples

This article provides you with four examples for better understanding: two examples of head and shoulders tops and two bottoms.

Example #1: Head and Shoulders Bottom

The USDCHF made a beautiful inverse head and shoulders from early December 2020 to late February 2021. And its neckline is a horizontal line. (look at below chart)

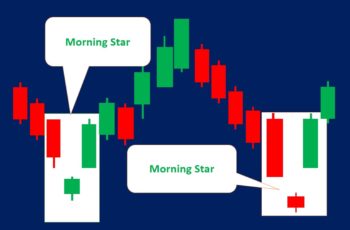

The right half of this pattern is a bullish flag. So, buying after breaking the neckline involves less risk. Moreover, at the end of the right shoulder, there is a doji, a reversal signal in these circumstances.

The first stop-loss will be at the bottom of the right shoulder. And next sop-losses could be adjusted to points B and D.

Since the fifth wave (according to Elliott Wave Theory) was completed on the first of April, and the momentum indicator at the bottom does not agree with the uptrend, it is the best place to close your long position.

Example #2: Head and Shoulders Bottom

In early August, the Meta chart completed an inverse head and shoulders.

The right shoulder contains a doji and a green candle that can be either a doji or a hammer. In both cases, the green candle is a bullish sign.

This pattern was completed when a large green candle broke its neckline and continued rising.

The first stop-loss could be under the right shoulder and adjusted to around the $116 price level. And could take a profit when the momentum indicator continued declining.

Example #3: Head and Shoulders Top

In early June, in the hourly chart, Amazon stock made a head and shoulders top. At the start of this formation, the momentum indicator at the bottom signaled the end of the uptrend.

The right shoulder was completed after the formation of a bearish harami pattern.

Then, the price continued falling containing two gaps.

Those who adjust their stop-loss sign of the trending ending appeared by rising momentum. And the best place to take a profit is marked (TP).

Example #4: Head and Shoulders Top

In the following hourly chart, Crude Oil made a head and shoulders top pattern after a huge uptrend.

It was a short-lived formation and a good one.

The best place to short was after breaking the neckline because there is no other confirmation to enter sooner.

The first stop-loss could be at A and the second at B.

The price continued falling after point B and came back quickly. In this case, the price hit the stop-loss with a profit.

Check What You Learned In the Following Charting Tool

Insert drawing tools by clicking on the pencil icon to study the chart.

Moreover, you can click on {f(x)} >> pattern recognition >> head and shoulders pattern and let itself find for you. However, the built-in tool that finds patterns only looks for perfect formations, not its varieties.