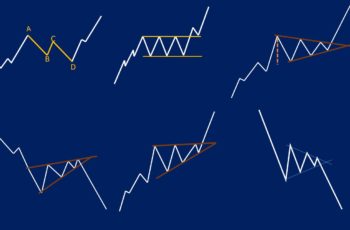

ABCD pattern is a large reversal price chart structure that can be both bearish and bullish. This pattern is the same as the corrective wave in the Elliott Wave Theory. Those who do not follow Elliott Waves study this pattern separately.

ABCD pattern is also known as Measured Move and Swing Measurement. In the past, investors called it Measured Move, and mostly now they call it the ABCD pattern.

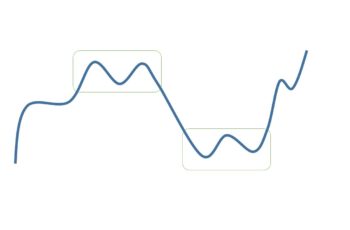

Here is how the bullish ABCD pattern forms.

- The first leg starts from the bottom of a downtrend (point A) and then rises but does not reach or exceed the beginning of the downtrend (point B). This is the AB leg.

- Next, the price falls but does not reach the A level (point C). Generally, it falls to 50% – 61% of the AB height. This is the BC leg or correction.

- Finally, the price rises and exceeds the B level reaching point C. And it is the last point that makes the CD leg.

In this pattern, generally, the leg AB = CD. However, it is not a must to be exactly the same. A slight difference should be ignored.

An ABCD pattern completes only if the price is reversed from point C.

On the other hand, the bearish ABCD pattern is the opposite way of the bullish version.

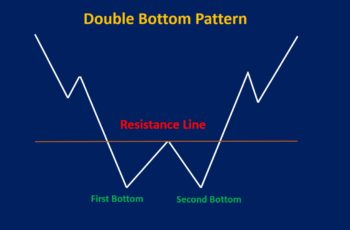

Here is an image that shows its structure.

Trading Strategy of the ABCD Pattern

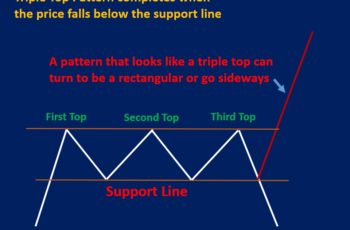

From the Elliott Wave Theory perspective, the entire ABCD pattern is a correction that starts after a spike.

So, to make sure that it is a correction, the slope of the formation should not be as steep as the prior trend.

In other words, without consideration of the positivity and negativity of slopes, the correction wave should have less slope than the spike.

So, make sure that it is an ABCD pattern. Just AB = CD does not mean that it is an ABCD pattern. It should reverse from point C.

Then, when you are sure this pattern exists, look for confirmations such as technical indicators and chart structures.

Finally, based on smaller patterns and confirmation place your trade. Candlestick patterns around point C are very helpful. So, look at them.

Put a stop loss below point C in a bullish ABCD and above the C level in a bearish ABCD pattern.

Your take-profit should be at least from the C to the A level or adjust as new formations appear.

ABCD Pattern Examples

This article provides you with four examples, two from each version.

Example #1

The daily chart of AUDJPY made an ABCD pattern from early September to early November 2020.

A shooting star candlestick stops the uptrend which is point A. Then, it falls and is stopped by an inverted hammer, marked as B. Next, the price starts rising to reach C where two candles make a bearish harami pattern. Finally from point C, the price drops to point D where the chart makes a bullish engulfing pattern.

The new uptrend started from point C and continued rising. In the middle, it made a flag in the daily chart, and this flag is another bullish ACBCD pattern in the 4-hourly chart.

An aggressive trader may buy after the completion of the bullish engulfing. And a conservative trade may wait longer for the price to cross the resistance line of the pattern and wait for a confirmation. In both cases, this pattern was a good opportunity.

Example #2

A bearish ABCD pattern appeared in the daily chart of gold from mid-July to mid-October of 2015.

The above pattern started with a symmetrical triangle and ended at point D with a long-legged doji.

From the last point (D) the price dropped below the A level, made a rounding bottom, and changed direction.

The above pattern is a clear example and does not need more explanation.