Reversal patterns help investors to buy low and sell high. To do so, they should recognize price chart formations that predict these lows and highs.

Chart formations that show possible highs and lows are known as reversal patterns. Those that form at the top are bearish, and those at the bottom are known as bullish reversal chart patterns.

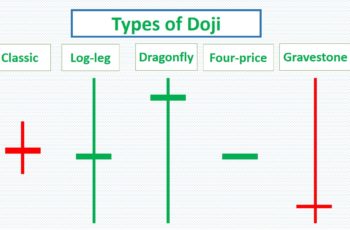

This article elaborates top 10 reliable western/traditional chart patterns, not candlestick reversals. In western technical analysis techniques, investors don’t look at candles. Instead, they focus on the overall picture of charts containing several candles and candlestick patterns to analyze one to a few candles.

So, let’s explain them.

Head and Shoulders

Head and shoulders are among the most powerful formations.

This pattern resembles the head and shoulders of a person.

From the trend perspective, a trend changes when the new highs and lows change to the opposite. And this pattern exactly confirms it.

For example: If a trend is up, the chart makes new higher highs and higher lows. When the price starts making new lower highs and lower lows, the direction changes from an uptrend to a downtrend.

Head and shoulders form at the top and bottom. The one that forms at the bottom is known as the inverse head and shoulders.

Here is what theoretically a “head and shoulders top” looks like.

And what a “head and shoulders bottom” looks like.

Related article: Head and Shoulders Pattern: Types, How to Trade & Examples

Double Tops Bottoms

Double tops and bottoms are among the most popular chart structures. They form more frequently than most other reversal patterns.

Double tops form at the end of an uptrend and are bearish reversal patterns.

Theoretically, a perfect double top looks like this.

Double bottoms form at the end of a downtrend and are bullish reversal formations.

And a double bottom looks like this.

Related articles:

Triple Tops and Bottoms

Triple top and triple bottom patterns are reversal structures.

However, they do not form as often as double tops and bottoms.

The triple top has three tops/highs, and the triple bottom has three bottoms or lows. That is what its name comes from.

Triple formations take longer, and when the price breaks above or at bottom of the pattern, it is more reliable.

This is how an ideal triple top forms.

And this is how an ideal triple bottom forms.

Related articles:

V-Shaped Patterns

V-shaped patterns are powerful structures. But they are probably the most underrated patterns.

Moreover, they form more frequently than most other formations and take less time to develop.

If combined with other reversals, candlesticks, or chart patterns, they become more reliable than most other formations.

Here is an ideal theoretical picture of a v-shaped at the top.

And here is an ideal theoretical image of a v-shaped at the bottom.

Related article: V-Shaped Patterns: How to Trade, and Examples

Wedges as Reversal Patterns

Generally, wedges are continuation patterns.

However, when a rising wedge appears after an extended uptrend, it is a bearish reversal formation, and a falling wedge after an extended downtrend is a bullish reversal formation.

A rising reversal wedge looks like this.

And a falling reversal wedge looks like this.

Related articles:

- Wedge Pattern: Rising & Falling Wedges, Plus Examples

- Broadening Wedge Pattern: Types, Strategies & Examples

Triangles as Reversal Patterns

Generally, triangles are continuation patterns.

However, after an extreme trend, a triangle can be a reversal.

And among triangles, a descending triangle after a long uptrend and an ascending triangle after a long downtrend are more likely to be reversals.

A descending triangle as a reversal formation looks like this.

And an ascending triangle as a reversal structure looks like this.

Related article: Triangle Pattern: Types, Trading Guide & Examples

Rounding Tops and Bottoms

Rounding tops and bottoms take a long time to develop. They often form on the weekly charts.

Rounding formations if appear at the top or bottom, develop gradually. And they often suggest fundamental problems in the whole market. That is why they are found on index charts more frequently than individual financial assets.

Theoretically, rounding the top as a reversal looks like the following.

And a rounding bottom like this.

Related articles:

Diamond Patterns

A diamond pattern is a combination of a broadening wedge/triangle and a general symmetrical triangle.

They can appear at the top or bottom. A diamond at the top is a bearish reversal pattern and at the bottom a bullish reversal.

Ideally and theoretically, a diamond pattern looks like the below image.

And a diamond at the bottom like this.

Related article: Diamond Chart Pattern Explained [Example Included]

How to Trade Reversal Patterns?

Reversal patterns are great tools to use for chart analysis.

However, use them strategically.

Here are things to consider while finding any of the above reversal patterns.

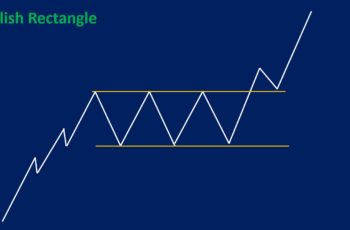

- Wait for a breakout. Reversal charts are complete only if the price breaks the top or bottom of the formation. Otherwise, it can be another structure. For example, a triple top or double top can be a rectangle if you do not wait for a breakout.

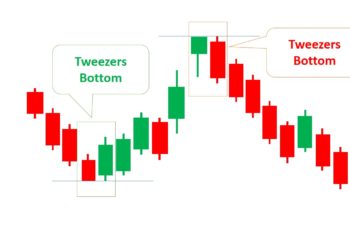

- Study inside the pattern. There are patterns inside a pattern. And they help you time better your entry. Moreover, do not forget to look at candles around pivot points.

- Add an indicator. A technical indicator helps you see minimize your emotional decision and to manage your risk. It can be an extra tool and beneficial for your analysis.

- Blend fundamentals. Fundamentals confirm or disagree with your analysis. The more confirmation you gather the more likely you are to be right.

Here is image showing all of them.