A triple top pattern is a reversal chart structure having three tops and forms at the top of a trend. And It is reliable and a bearish pattern.

A triple top is similar to head and shoulders. And the difference is that the second top (head) in the head and shoulders pattern is higher than the other two, while in the triple top pattern they are about at the same level.

The line that connects the low after the first and the second tops acts as a support line.

A triple top pattern completes only if a candlestick closes below the support line. Otherwise, it can be rectangle, a continuation pattern, or continue sideways.

So, make sure that the price breaks the support line.

How to Trade Triple Top Pattern?

Most often a rectangular may fool traders that a triple top is developing.

So, caution is needed.

This article explains some of those things to consider when you look for a triple top pattern.

Study Inside the Triple Top Pattern

Study candles inside the structure. And go to lower time frames to see what happens.

Candles and lower time frames, if confirmed, your chance of being right increases. If not, look for more signals.

Blend Your Analysis With Fundamentals

Fundamentals give you clues on how long a trend can last.

Moreover, they are a great confirmation of the technical analysis. If fundamentals do not agree with technical, doubt your analysis, and continue studying the chart, news, and economic events.

Do not forget to check the economic calendar, specifically if you are trading forex.

When Should You Sell Triple Top?

When to sell is essential and it defines how successful a trader is.

There are three places to short in a triple top pattern. And I explain from the riskiest to the least risky one.

3. Selling After the Third Top

Selling after the third top is the most aggressive method to short.

You should not go short after the third top if strong reversal signals are not there.

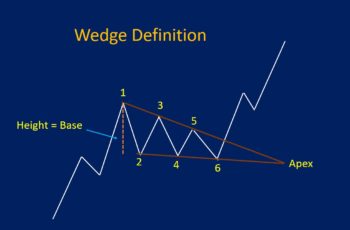

For example, if from the start of the third top to the end, it is a rising wedge, and confirmed by candlestick patterns and news, it is safer to sell. Otherwise, the chance of being right is lower than being wrong because it can be a consolidation pattern.

Remember that selling at the reversal point of the third top, the triple top pattern is not yet completed. Protect your capital.

2. Selling After Breaking the Support Line

Selling after breaking the support line of the pattern also carries risks.

If a tall red candle (with heavy volume) breaks the support line, it is meaningful to sell. On the other hand, if the price approaches this line from the third top slowly, it is better to wait. And doubt about being correct on the pattern recognition.

3. Waiting For a Pullback

Waiting for a pullback is the safest method to trade a reversal formation. And it is the same for the triple top pattern.

A pullback after breaking the support line confirms a reversal from up to down by any definition. A downtrend means lower highs and lower lows. And breaking the support line makes the trend build lower highs and lower lows.

However, a pullback may not occur. So, a detailed analysis is necessary.

And most importantly, unless the reversal is extremely strong, a pullback often occurs.

Stop Loss Level

Stop loss is necessary to cut losses.

Put a stop loss at the top of the third top and adjust as the price continues falling.

Profit Taking Level

Depending on the trading strategy, you may choose a take profit level, or adjust your stop loss and wait for another bullish reversal pattern.

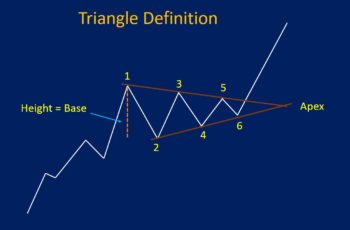

The minimum distance to the target is equal to the height of the pattern from the selling point. Just measure its height, and select the take profit level below the support line equal to this height in distance. For example, if the height of the triple top is 100 points, put your take profit 100 points below the support line of the pattern.

Another option is to adjust your stop-loss level. As the trend continues falling, new bearish correction patterns form. Adjust your stop loss above these corrections.

Triple Top Pattern Examples

Example #1

From the middle of May to the middle of June 2003, the EURUSD made a small triple top pattern. The third top started falling with a “three black crows” candlestick pattern. (look at the below chart)

Moreover, the reversal of the trend was signaled before the completion of the pattern by the momentum indicator at the bottom of the chart.

The triple top formation itself, the three black crows, and the momentum indicator were confirmations of a new trend.

Since, the price fell quickly from the third top, shorting below the trendline was a good idea.

And take profit could hit if ordered beforehand, or could adjust as it developed.

Example #2

In the following chart, the USDCAD forex pair made a nice triple top.

It continued falling about 1000 pips.

The entry point could be after breaking the support line of the pattern because it was a sharp drop and a tall red candle confirmed the reversal.

The first stop loss could be at the top of the pattern. And if adjusted, this trade could make 700 to 1000 pips if waited till the momentum indicator showed an overbought situation and a V-Shape pattern formed.

Check What You Learned In a Live Chart

Insert drawing tools by clicking on the pencil icon to draw patterns.

Moreover, you can click on {f(x)} >> Pattern Recognition at the bottom of the list >> Triple Top Pattern. However, the following chart only looks for ideal patterns and may miss many patterns.