Support and resistance lines are among the first words that a new trader here. Traders use these lines to spot trading opportunities.

This article explains what these lines are, and how to trade them, provides an example, and elaborates if they work?

What are Support and Resistance Lines?

Support and resistance lines are drawn on the chart that connects two or more pivotal points in a direction or sideways.

Generally, there are two types, horizontal and trend support and resistance levels.

Horizontal Support Level and Resistance Level

The horizontal support line connects two or more bottom points in a chart when there is no trend, and the market price fluctuates above this line.

And a resistance line connects two or more top points of a price chart, in which the price fluctuates below the line, and there is no an uptrend or a downtrend.

The support and resistance level traders claim, this strategy works, specifically for round numbers. Round numbers are 10, 20, 50, 100, and so on. Traders pay more attention to these numbers, considering them major support and resistance lines. In other words, round numbers act as milestones, and traders wait to rest and plan at these prices.

Support and Resistance Trendlines

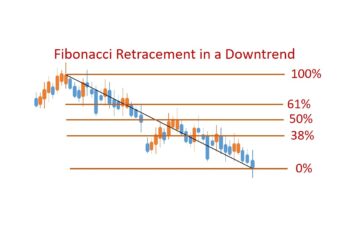

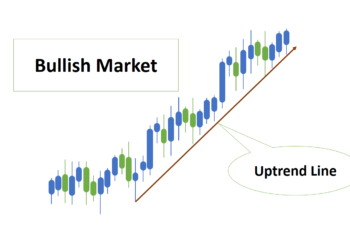

Trend support and resistance lines connect two or more pivotal prices when there is a direction. By direction, I mean that there is an uptrend or a downtrend.

Both, in a downtrend and an uptrend, the support line connects two or more prices where the price goes up and comes back to this line. And, the resistance line connects two or more prices that the price chart goes down and comes back up to this line.

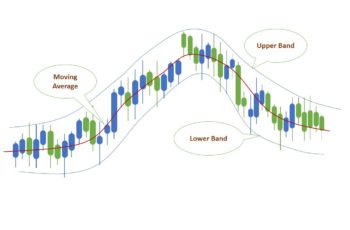

Drawing support trendline and resistance trendline is an amazing strategy for pattern recognition. It helps you be in the market and draw correction patterns. Additionally, most of the time, specifically in the forex market, there is no trend. And the market is going sideways or making a consolidation pattern.

Read more: What Is Trend in Finance? How to Determine a Trend?

How to Trade Support and Resistance Lines?

Support and resistance lines traders believe that price fluctuates between these lines again and again. For example, the current support line on the chart is also support or a resistance line in the past.

To begin with, you have to draw support and resistance areas correctly.

To be more precise, it is better to connect at least three price points at the bottom of the chart price for the support line and at the top to draw a resistance line.

The same is true for both trending and horizontal support and resistance levels.

Some traders prefer to name these lines support area and resistance area. They like these names because a line is too thin, and the market can not touch and reverse the exact price points.

Price does not always fluctuate between these two lines. It breaks them consistently.

Once the price breaks the support line, it becomes a resistance line, and if the price breaks the resistance line, it becomes a support line.

The common notion is that when the price touches the support line, it is time to buy. And, when the price hits the resistance line, it is time to sell.

Moreover, once the price breaks the support line and a chart pattern or an indicator confirms it, it triggers a sell signal. Furthermore, if the price breaks the resistance line, and a chart pattern or an indicator confirms the breakout, it triggers a buy signal.

Notice, if you are interested in this strategy, confirm trend reversals between support and resistance lines all the time. In addition, you should also confirm the price breakout of these lines by a chart pattern or an indicator. You do this because prices do frequently cross and create new support or a resistance line.

Examples of Support Line and Resistance Line

Here I have given two examples from support and resistance lines, horizontal and trending.

Example as Horizontal Support Line and Resistance Line

The below chart is from the forex market and EURUSD pair. I have put texts on the chart to help explain easier.

In the above chart, there are four horizontal lines. Each of them acts as a support line and earlier or later as a resistance line.

The first horizontal line acts as a support level in point B, and it will or has acted as support or resistance levels/areas in the past.

The second line plays the role of support line in point A, and as a resistance level in points H and J. I had mentioned that a support line can become a resistance line and vice versa. It is true here.

The third line in point D acted as a resistance level and became a support line in points G and I. Again, the support line shifted its role to the resistance line.

Finally, the fourth line was a resistance line in points C and E and became a support line in point F.

This example illustrates that a horizontal line can shift its role from support to resistance line and vice versa. If you go back, this line probably has been both a support and resistance line many times.

Examples When There is a Direction

I have provided two examples of support and resistance lines in a trending direction.

The first example is a chart from the AUDJPY forex pair.

In the above chart, the line that connects points 1, 3, 6, and 8 is a support line. Moreover, the line that connects points 2, 4, 5, and 7 is the resistance line, and this line becomes a support line in point 9.

The second example is from the EURUSD pair.

In the above chart, there are support and resistance lines, and the support line becomes a resistance line at point 6.

Notice that a support line becoming a resistance line when market is trending is not very common. This feature is more common when the market goes sideways.

Do Support and Resistance Lines Work?

Are support and resistance lines reliable? Some traders don’t trust horizontal support and resistance lines or areas.

The answer to this question is YES and NO.

A trader can get benefit from it if he does not overuse it. Specifically, for short-term traders, this technique can lead to frequent losses, because spotting entry and exit points is very difficult. On the other hand, If a trader draws these lines less often, and specifically puts these lines on round numbers, he can benefit.

Overuse of these lines makes traders emotional and keeps them away from their strategies. You can put horizontal lines in any part of the chart, and you see somewhere in a chart that these lines seem to be support or resistance lines.

We draw support and resistance lines on our chart, very less often. However, we do use trendlines extensively for drawing support and resistance lines for patterns.

Anyway, trading is not easy. You have to practice and test different types of strategies to find the one that suits your personality.

Do it now. Go to your chart and drop randomly horizontal lines and go back to see if it happened or not.

Read more: What is a Trend in Finance? How to Determine a Trend?

Bottom Line

The support and resistance lines are among the first things that a new trader hears, and his couch teaches him.

You can benefit from support and resistance levels if you apply them less often. However, if you put too much support and resistance line, psychologically, it can hurt you and your trading career.

Although numerous traders recommend this strategy, we do not use them too much except for pattern recognition and breakout.

Let me disclaim that nothing you read on this website is guaranteed. Everything you read here is just for educational purposes or personal opinions only. You need to practice, knowledge and patience to become a successful investor, such as Bill Ackman and Warren Buffett.