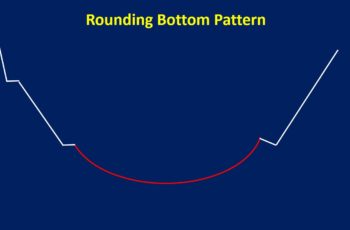

The triple bottom pattern is a bullish reversal formation having three bottoms (lows) almost equal in height.

The line that connects the tops of the pattern is the resistance line. And the formation is complete only if the price breaks the resistance line.

A triple bottom pattern is reliable because it rejects the bears three times and makes them unable to penetrate. When bulls counterattack bears three times, bears will lose hope and surrender.

The mirror image of the triple bottom pattern is the triple top. And at the end of this article, you read the differences.

How to Trade Triple Bottom Pattern?

A single structure does not tell the whole story.

So, in the following, this article explains factors to think of when you find a triple bottom pattern.

Study Inside the Structure and Add a Technical Indicator

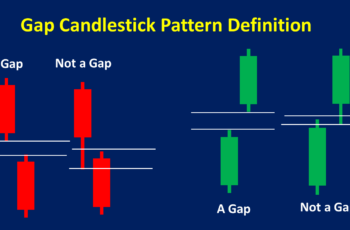

There are patterns inside a pattern. They can be chart patterns and candlestick patterns.

Go to a lower time frame to see if there are formations that signal a reversal of the trend.

Adding a technical indicator that signals overbought and oversold conditions help to time entry and exit points.

The more confirmation you gather, the more will be chance of success.

Follow Fundamentals

Fundamental analysis is another half part of financial analysis. It minimizes your mistakes and confirms or rejects technical analysis. In any case, considering both technical and fundamentals are not without benefit.

If you are an investor or swing trader fundamental analysis is a must because you need to project the future not only today’s price action.

So, do not forget to check the economic calendar and other reports, such as earnings.

Triple Bottom Pattern Entry Point

Like any other chart pattern, you have multiple options to trade a triple bottom. However, the risk level differs.

In the following, this article explains from the riskiest to less risky points to buy after discovering this structure.

1. Buying Immediately After Third Bottom Reversal

Buying immediately after the third bottom reversal is the most aggressive method to trade.

Going long after the third bottom is extremely risky because the pattern has not completed itself. And the chance of being wrong is very high.

However, your reward will be higher than buying later.

So, if you want to buy at the bottom, ensure that there are enough shreds of evidence that the trend will reverse.

For example, if there is a falling wedge pattern, in which the end of the wedge is the end of the third bottom, and breaks with a tall green candle, it makes sense to buy here.

2. Buying After Breaking the Resistance Line

Buying after breaking the resistance line involves risk but its risk is lower than buying immediately after the third bottom and higher than waiting for a pullback.

So, buying here requires caution.

The best time to buy here is when a large candle breaks the resistance line, and the new trend is sharp.

3. Waiting for a Pullback

Buying after a pullback involves the least risk of the two other methods.

A pullback confirms that trend has changed having new higher highs and higher lows.

However, a pullback may not occur

Putting a Stop Loss Order

Stop loss is necessary to control your emotion, of course, if you do not change it emotionally.

Your first stop loss should be below the third bottom. And adjust it as new bullish correction patterns form.

Putting a Take Profit Order

The minimum distance to define the take-profit object is equal to the height of the pattern from the breaking point of the resistance line. However, in this method, the risk-reward ratio will be 1, which means that your risk is $1 for $1 profit, which is not a good ratio.

Another method is to adjust your stop loss level as a new trend makes it till a new trend reversal appears, or hit your stop loss in a profit. In this method, you will manage risk much better and let your profit go.

Triple Bottom Pattern Examples

I brought you two examples, one from a forex pair and another from the stock market.

Example #1

In the first quarter of 2017 in the weekly chart, the GBPUSD completed a triple bottom pattern.

The new trend started from the third bottom of the pattern with a bullish engulfing pattern. And after the engulfing structure, a large red candle acted as a tiny pullback. So, it could be a place to buy, depending on the trading strategy.

After crossing the support line of the structure the price retreated (made a pullback) as a bullish flag, which can be a place to buy. And the trend continued rising with a red bullish hammer.

Since the stop loss is necessary to cut losses, the first could be at the bottom of the triple bottom pattern. The second was under the flag and the adjustment could continue till a double top pattern appeared.

The best time to take a profit was when the price made the double top pattern. And it was confirmed by the momentum indicator by diverging from the uptrend.

Example #2

The Meta daily chart made a triple bottom pattern in late 2016.

The move after reversal was sharp which makes buying after breaking the resistance line enticing. Moreover, the resistance line was broken by a large bullish candle which indicates the strength of the bulls.

And the price continued rising for the next months, making a bullish flag in the middle.

Differences Between Triple Top Pattern and Triple Bottom

Both patterns are reversal structures.

However:

- The triple top is a bearish reversal pattern and the triple bottom is a bullish reversal pattern.

- Generally, in the stock and crypto markets, the triple top pattern takes less time to develop and is more volatile.

- Both are reliable if traded correctly.

Practice What You Learned About the Triple Bottom

Click on the pencil icon to draw structures on the chart.

Moreover, you can go to {f(x)} >> Pattern Recognition >> Triple Bottom Pattern to let the software itself find you. However, it will look only for perfect patterns, not its variations.