Gap trading should never be underrated because gaps are among the most powerful patterns. Gaps are also known as windows in Japan.

What Is a Gap?

A gap is a price range in a financial asset chart in which trading does not occur. And it is a continuation candlestick pattern that suggests the continuation of the current price trend.

It is only a gap if there is a space between shadows. In other words, if there is no space between the shadows of two candles, there is no gap, irrespective of how different the closing price of the first and the opening price of the second candle is.

Gaps are bullish and bearish. A bullish gap completes when the first candle’s high does not touch the low of the second candle. It is a bearish gap if the low of the first candle does not touch the high of the second candle.

Gaps form in the daily and above charts of the stock market due to trading activities after and pre-market hours. After hours are the time that the market is closed, but trading continues. And pre-market hours occur before the market officially opens.

Side note (1): gaps generally do not form in the Forex market in lower than weekly charts, less than daily charts in stock, and all time-frames in crypto markets. But appear on daily and above charts in the stock market due to after and pre-market hours.

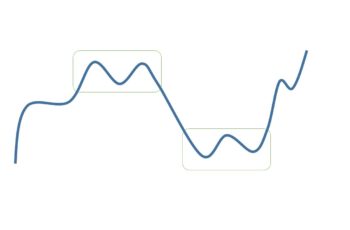

The above chart belongs to the Tesla stock. It shows several gaps in a single chart.

Now, look at the below chart.

The above chart belongs to the EURUSD currency pair. It is a daily chart in which technically, you do not see any gap.

Side note (2): Even though gaps are strong patterns, there are no guarantees. To decrease your risk and increase your analysis to be correct, always blend it with other technical and fundamental techniques.

Types of Gaps

Gaps appear in different forms. So, they are more helpful in telling us various stories, meanwhile, having almost the same implication.

And gap trading becomes easy if we consider their types in our analysis.

Here are some of them

Tasuki Gaps

Tasuki gaps contain three candles, in which a gap is between the first and the second candle.

The upside Tasuki gap is a bullish continuation pattern. In this pattern, the first candle is bullish followed by a gap, another bullish candle, and a bearish candle. After the third candle, it is common for the price to have a rest and continue sideways for a few more sessions. The upside Tasuki gap is confirmed when a large green candle closes above the resistance line of these candles after the gap. And this gap now plays the role of a major support line.

The downside Tasuki gap is a bearish continuation structure. It also (like the upside Tasuki gap) starts with a red or a green candle followed by a gap, another red candle, and a green candle. After the red candle, the chance of going lateral is very likely. And the downside Tasuki gap is confirmed when a large red candle closes below the resistance line of candles after the gap. And this gap becomes a major resistance line.

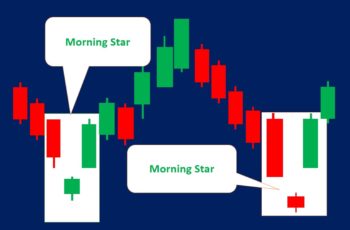

The following chart shows an upside and a downside Tasuki gap.

In late April (in the above chart) in the Apple stock chart, an upside gap formed. However, the continuation of the uptrend was questioned by two shooting stars followed by a spinning top.

The trend reversed in early May and after a few days, a downside Tasuki gap occurred which is the pattern that suggests the continuation of the downtrend.

The downtrend continued till early June which stopped by a short shadow hammer. The bottom of the hammer became the new resistance line. And a new uptrend was confirmed a few days later by an upside Tasuki gap.

The above chart also shows that blending other candlestick patterns help a lot and diminishes your risk. As always more confirmation is better than one or two.

Gapping Plays

There are two types of gaping plays, high-price, and low-price gaping plays.

A high-price gaping play is a bullish continuation candlestick pattern. This pattern starts after a sharp uptrend, followed by a series of small candles that be green and red. It is similar to a bullish flag or a bullish pennant pattern in that price breaks the resistance line by a gap. A high-price gapping play completes when a candle breaks the resistance line of the series of candles. And this gap becomes a major support line.

A low-price gapping play is the opposite of a high-price gapping play, a bearish continuation candlestick pattern. It starts after a sharp downtrend, followed by a series of small candles that be bullish and bearish.

A low-price gapping play is similar to a bearish flag or a bullish pennant pattern in that price breaks the support line by a gap. After breaking the support line, the gap becomes a major resistance line.

Let’s go for an example.

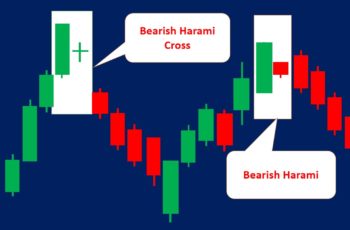

The following chart shows two gapping plays, high-price and low-price gapping plays.

Traders use gaps to adjust their stop-losses more often than placing a new trade. They place a new trade if a gap is confirmed by other patterns and the risk-reward ratio is good. For example, they may not open a new trade if the gap is in the middle of a trade, instead, they will adjust the open stop-loss or take-profit orders.

The above chart perfectly suggests adjusting opened stop-loss or your take-profit order. In both situations, the trend continued after the formation and were amazing resistance and support areas.

Gap Trading Strategies

There is no specific strategy in gap trading.

However, some factors influence your gap analysis. So, consider them in your analysis.

Here are some of them.

Size of a Gap

The size of a gap does matter.

Small gaps have insignificant importance because the price of a stock does go up and down. When it moves it may make small gaps intentionally, which is meaningless. Moreover, look if these small gaps form inside chart patterns such as triangle and rectangle patterns. If it is true, then the importance of the gap diminishes.

However, significant events such as earning calls and economic data such as unexpected GDP numbers make huge gaps and are potent and reliable.

So, as the size of the gap increases, does its significance.

In Gap Trading, It Is the Gap That Is Important

Gaps could have many names. It is the gap itself that is important not their names. As long as there is a gap, and the gap isn’t filled, it is valid and plays the role of support or a resistance line.

Gaps Are Potent Support and Resistance Areas

A rising gap acts as a support area and falling as a resistance area. That is why they are mostly used for adjustment of the stop-loss not initiating a new trade.

Gaps become invalid if filled. In other words, if the price closes out of the price range of a gap, it becomes invalid. In simpler words, once a candle closes under a rising gap or above a falling gap, these areas become invalid. And potentially, the trend could change if a gap is filled.

Technically, the whole price range of a gap acts as a support or resistance area, which means, unless filled, it is still a valid support or resistance area.

Look at the chart of Apple above. Except for the first gap, all other gaps played the role of a potent resistance line. Technically, the whole gap plays the role of support or resistance area. However, in the above chart, the top gaps in all successful gaps became support areas. If a candle closes within a gap, it has not breached the support area role of a gap.

Because the whole gap acts as a support or resistance line, a trader should blend gap analysis with other analysis techniques. For example, a technical indicator such as MACD or looking for economic data on the economic calendar can help to confirm or reject the analysis.

Gaps are more reliable support and resistance areas due to the strength behind the movers. A rising gap requires too much pressure from buying side and falling from the selling side. Without any pressure, there is less likely to see a window. That is why they are reliable and potent.

Blend Gap Trading With Other Technical and Fundamental Techniques

All technical traders agree that more confirmation leads to a higher success ratio and lower risk ratio.

So, don’t forget to look for other patterns around a gap and track economic data.

Bottom Line

Gaps are not only strong continuation patterns but also strong support and resistance lines.

Use them for placing a new trade or adjusting your current position.

Even though if they are potent, your analysis becomes more reliable if blended with other technical techniques.

Bilal khan

good work I gained huge knowledge thanks ZAFARI