What Are Chart Patterns?

Chart patterns or structures are shapes that appear in the chart by market price action. They help traders to predict the next possible direction or trend.

A chart pattern forms with a combination of several big or tiny ups and downs.

Chart patterns or structures occur on every chart in the financial market such as forex, stock, cryptos, etc. Thus, every trader needs to learn them and practice them.

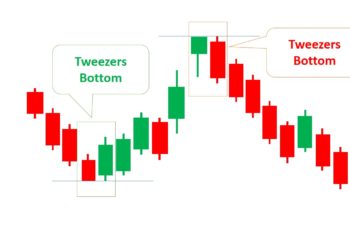

Notice that in this article we are not talking about candlestick patterns here, although they are on charts. Candlestick patterns are a combination of one or a few candles, while chart patterns are a combination of small upward and downward movements. Additionally, we do not cover everything about chart patterns in this article, because it will be too long, maybe 100k words or more. This article is just an introduction

Patterns or structures are the primary tools of technical analysis that predict possible price actions in the future.

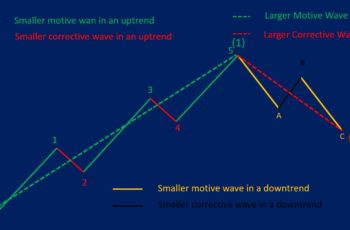

Chart patterns are essential in any technical analysis techniques, including Elliott Wave analysis and Support and Resistance Lines analysis. So, you must learn and experience chart pattern formations.

Fundamental analysts also use chart patterns because speculators always speculate in the market, and fundamental analysts cannot predict speculators’ actions. Thus, they need to learn technical analysis and chart patterns as well.

Structures or patterns form due to common human trading behaviors. People get used to behaving in a certain way, and these behaviors produce chart patterns.

For example, traders react to a news announcement by buying or selling an underlying financial asset. The reaction of all participants in the market pulls down and pushes up the asset price forming a structure. If the price broke this structure upward, bulls are stronger, and if it broke downward, bears are stronger.

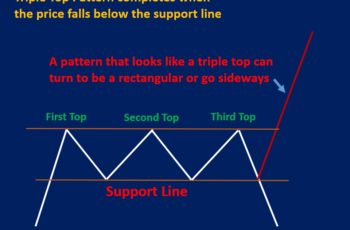

Numerous patterns appear on the chart. And not all of them are reliable. A pattern to be reliable should repeat itself over and over again.

It is crucial to learn and experience trading chart patterns because most of the time a market is not trending. It is consolidating.

Read more: Fundamental Analysis of Stocks

Types of Chart Patterns

Generally, there are two categories of patterns: (1) reversal and correction patterns, and (2) bullish and bearish chart patterns. In many places, a pattern can be a reversal, correction, and bullish/bearish at the same time.

Read more: What is a Trend in Finance? How to Determine a Trend?

Reversal and Correction Patterns

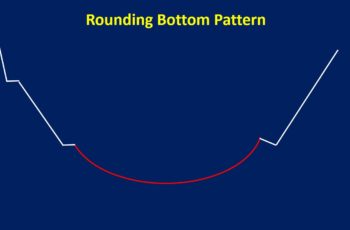

A reversal pattern appears when a trend is over. It tells you that the market direction is possibly going to reverse. If a reversal pattern forms at the top of a trend, it suggests a future downtrend. On the other hand, if a reversal chart pattern appears at the bottom of a chart, it suggests a future uptrend.

The double top and double bottom reversal patterns are examples of reversal patterns. A double top occurs a the top of a trend and double bottom at the bottom of a trend.

A correction pattern appears in a bigger trend. It suggests that the trend is going to continue. Correction pattern is also called continuation pattern and consolidation pattern. Because most of the time a financial asset price is making corrections, you need to identify them.

A Correction Pattern Is Either Bullish or Bearish

A bullish pattern is a structure that suggests a future uptrend or continuation of an uptrend. On the other hand, a bearish pattern suggests a future downtrend or a continuation of a downtrend.

Most of the bullish and bearish patterns are correction structures. A correction pattern can either be bullish or bearish.

Bullish Patterns

A bullish pattern that occurs in an uptrend, suggests that the current direction will continue.

Examples of bullish patterns that occur in an uptrend are flag and wedge bullish patterns. These patterns predict the continuation of the direction upward. And, bullish patterns at the bottom (it is also called reversal pattern at the bottom) of the chart also form but, they are less strong compared to bullish patterns in an uptrend.

Bearish Patterns

A bearish pattern that occurs in a downtrend suggests the continuation of the downtrend movement price. In addition, a bearish pattern can occur at the top of a trend and suggest a future downtrend. Bearish patterns at the top are also called reversal pattern.

Examples of bearish patterns that occur in a downtrend are bearish flags and wedge patterns. They suggest the market will continue falling. After breaking down the pattern, it is confirmed and completed.

Read more: What Are Bull and Bear Markets? (Plus Examples)

How to Trade a Chart Pattern?

Every chart pattern is different, and different rules apply to them. This article only illustrates the most essential things a trader should remember for trading a chart pattern.

To begin trading a pattern, you need to identify and draw it correctly.

Identification of a pattern requires knowledge and practice. Play with charts and try to find as many patterns as possible. It helps your mind to recognize upcoming patterns easier, and more of them.

A chart pattern is temporary. The price breaks the pattern and later starts making another chart pattern. Once the price breaks the pattern, depending on the direction of the breakout, it is time to sell or buy the underlying asset. And maybe close your position if you have an open one.

The most important action for a trader is to not place a trade before a breakout of the chart. If you place a trade before the price breaks the pattern, the risk will increase, because no one knows in what direction the price will break the structure.

Additionally, it is essential to put a stop loss in the correct place and don’t move before another structure is completed.

Read more: Support and Resistance Lines (How to Trade and Example)

Summary

A pattern is a structure or shape that several candlesticks or a graph make on the chart. And, it predicts possible future price movements.

Patterns that suggest the end of a trend and the start of a new trend are called reversal chart patterns. A pattern that corrects market price is a correction pattern.

Patterns that suggest the continuation of an uptrend or a future uptrend, are bullish. On the other hand, those that predict the continuation of a downtrend or a future downtrend, are bearish patterns.

A trader first should identify a pattern and after the breakout of the pattern and confirmation should place his trade.