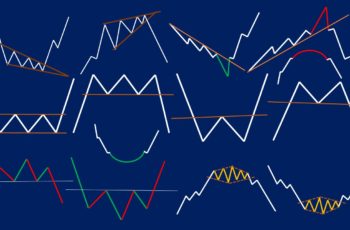

A triangle pattern is a continuation chart structure in which its support and resistance lines converge as it develops.

At least four reversal points are necessary to form a triangle. However, generally, six points make this pattern which Elliott Wave Theory defines as well.

The triangle’s height is known as the base, and the point that the two trendlines intersect is known as the apex. And generally, the price breaks the pattern somewhere between 60% to 75% from the base to the apex point.

There are four types of triangles: symmetrical, ascending, descending, and broadening triangles. In the following, this article discusses each of them separately. Moreover, it gives examples too.

Generally, triangles are continuation patterns. By generally we mean that there is no rigid rule for triangles to be continuation patterns. There are exceptions, and they can be reversal patterns. This article discusses them as well.

Symmetrical Triangle Pattern

A symmetrical triangle is a continuation pattern. In a downtrend, it suggests the continuation of the downtrend, and in an uptrend, the continuation of the uptrend.

However, being a continuation is a general tendency not certain. So, be careful. It can be a reversal pattern too.

In a symmetrical triangle, the support and resistance line of the pattern converges. Or in other words, the resistance line slopes downward, and the support line slopes upward.

Examples

Microsoft stock made a bullish symmetrical triangle that started in September and lasted over four months.

As you the price broke upward the triangle very sharply, pulling back and continue rising.

The triangle lasted a long and it paid off by rising from $225 (from the breaking point) up to the $347 price level (from the 300 level above is not shown in the chart but it reached that point).

Here is a bearish symmetrical triangle example.

The GBPUSD pair made a triangle and its development took about four months. And when it fell, it continued falling for months.

The base of the pattern started after a triple bottom formation and ended with a small triple top pattern. It indicates the benefit of studying inside the pattern.

It is not perfectly symmetrical. However, the upper line of the pattern slopes downward a little bit.

Ascending Triangle Pattern

The ascending triangle is one of the triangles in which the resistance line of the pattern is flat (or almost flat), and its support line rises. This pattern is also known as the rising triangle.

An ascending triangle pattern implies that bulls are more series about pushing the price higher. That is why the support line is rising.

This pattern completes only if the price closes above the resistance line (upper line) of the triangle. So, consider buying only above the upper line.

The breakout of the resistance line should be accompanied by more and taller green candles. In other words, you should see a noticeably higher volume at the breakup point.

If ascending triangle appears in a downtrend, there is a chance of reversal, however, it is low.

Examples

The USDJPY daily chart made an ascending triangle in the first two months of 2022. It started with a hanging man and signaled to rise by a bullish harami pattern inside the pattern. This example illustrates the importance of incorporating candlestick patterns with chart patterns.

After breaking the upper line of the pattern the next candles were green which is a sign of high volume and bulls’ potent.

Let us look at another example.

The daily chart of the USDJPY forex pair started rising in late March by forming an inverse head and shoulders. During the uptrend, it completed two triangles. The first one is ascending triangle (labeled 1) and the second triangle (labeled 2) is symmetrical which turned out to be a reversal pattern.

The price broke the upper line of the ascending triangle. However, it did not continue as expected. And it is ok to be wrong sometimes and even lose some trades.

The second triangle stresses waiting for the breakout before placing an order. Even though, most of the time a symmetrical triangle is a continuation but it can be a reversal too.

Descending Triangle Pattern

The descending triangle generally appears in a downtrend. However, it can form anywhere. It is just more likely to develop in a downtrend.

The descending triangle is the mirror image of the ascending triangle, in which the support line of the pattern is falling while its resistance line is flat.

And it indicates that bears are in control.

The descending triangle pattern completes only if one or two candles are closed below the resistance line of this structure. So, sell only below the resistance line.

You may ask, what is the difference between ascending and descending triangles?

Here are some differences:

- Both are correction patterns. However, the ascending triangle appears more in an uptrend and the descending triangle in a downtrend.

- Some call ascending triangles bullish and descending bearish triangles.

- Ascending triangles sometimes can be bullish reversal patterns and the descending triangle bearish reversals.

Examples

In mid-March 2020, in the daily chart, the USDCAD signaled a new downtrend by a long-legged doji.

In early April, it started forming a descending triangle. It was successful.

The following chart shows an example of a descending triangle that appeared in an uptrend.

In the below weekly chart, the USDJPY made two triangles. The first one is symmetrical, and the second is a descending triangle.

Both triangles predicted corrected the continuation of the uptrend. And this trend ended with forming a head and shoulders top.

Here is a chart containing all three triangles. And it does not need more explaination.

General Features of Triangles

Triangles are different. However, they all share some general features.

And they are:

- All of them are generally reversal patterns. However, rarely, each of them can be a reversal.

- The longer it takes to develop, the more likely to be a potent pattern.

- As the pattern continues development, the volume decreases (it is the opposite in an expanding triangle) and increases when the price breaks the structure. If you use other indicators, such as RSI and MACD, it will move toward the middle of the indicator chart, which is an indication of consolidation.

- Enter the market only when one or two candles close above the resistance line of the pattern in an uptrend and below the support line in a downtrend.

- Your take profit should be at least twice your risk. Or adjust your stop loss as new continuation patterns form.

- Triangle patterns form in forex charts more often than in the stock market.

- Breaking triangles upward requires more volume or taller candles than in bearish triangles.

Difference Between Symmetrical Triangles and Pennants

Visually, symmetrical triangles and pennants look the same, and both are continuation patterns.

However, there are two differences too.

First, a triangle takes a longer time to develop, while the pennant forms in the middle of a sharp trend which takes less time.

Second, a symmetrical triangle sometimes can be a reversal pattern, while a pennant is always a correction pattern.

Final Words

Generally, triangles are continuation patterns.

However, they can be reversal structures as well. So, wait for a breakout before placing your order.

Moreover, combine candlestick charting techniques with chart patterns such as triangles and wedge patterns.