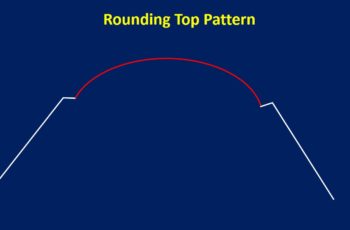

The dumpling top pattern is a bearish candlestick reversal structure. And the frypan bottom is a bullish candlestick reversal structure.

The dumpling top forms at the top of a trend. After a series of red and green candles, a falling gap occurs, confirming the reversal of the direction.

The frypan bottom is the opposite of the dumpling top pattern. It occurs at the bottom of the trend, and a rising gap confirms the trend reversal.

Example of Dumpling Top Pattern

Here is an example of a dumpling top pattern that had many supporting signals.

The first confirmation appeared in late March as a hanging man, which is a reversal pattern.

Second, a long-legged doji formed immediately following the hanging man. A doji is a sign of indecision. However, when it appears at the top or bottom, it warns about a possible reversal.

Third, another butterfly doji appeared two sessions later after the first doji. It is also a signal that bears may lose control.

Fourth, two candles before the gap formed a bearish harami pattern, which adds to our supporting signals.

Finally, a falling gap with other previous candles made a dumpling top pattern. And then, the price continued falling.

Example of Frypan Bottom Pattern

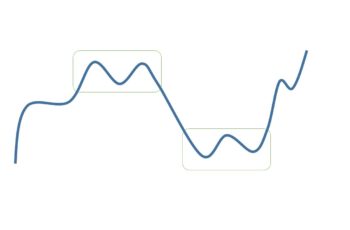

In the following chart, Microsoft made two frypan bottoms and one dumpling top.

In late October, an inverted hammer with a previous red candle made a bullish harami pattern, challenging the small falling gap. Next, a red hammer appeared, which is a bullish reversal pattern. It is a challenge for the previous falling gap and a confirmation for the frypan bottom pattern. Finally, a rising gap completed the frypan bottom pattern.

The second frypan bottom appeared after a spinning top and a green candle. Finally, a rising gap followed by a tall green candle clears the doubt of a future uptrend.

How to Trade Dumpling Top and Frypan Bottom?

These two patterns have some special features that traders need to remember.

The gap itself is a significant trend reversal confirmation. However, more signal is better.

Some of those can be from the following things:

- Candles before the gap can tell a lot. Generally, there should be multiple spinning tops and doji, which are a sign of losing control by the current holders. Look for weakening trend confirmation there.

- A larger gap indicates the power behind reversing forces. Thus, larger gaps are better.

- Look for other technical and fundamental clues to see if they confirm the reversal or not. Specifically, a leading technical indicator helps a lot by showing if the price is in an overbought condition or not.

If you are assured, place your trade. Nevertheless, put a stop-loss at the bottom of the dumpling top and the bottom of the frypan bottom.

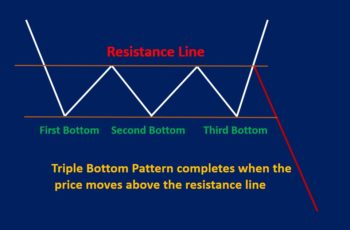

Differences Between Dumpling Top Pattern and Upside-Gap Two Crows

Both are bullish reversal structures.

However:

- The “upside-gap two crows” appears on the left side of the top, and the dumpling top pattern is on the right.

- The gap in the “upside-gap two crows” is a rising gap, but the dumpling top gap is a falling gap.

Here is an image showing both of them.

Final Words

Dumpling top and frypan bottom patterns are multiple candlestick reversal structures.

They are powerful. However, you need confirmation to trade with less risk.