The business cycle is also known as the economic cycle, and the credit cycle refers to the four stages that occur in a free-market economy. The cycle starts with recovery, followed by a peak, recession, and trough.

Stages (phases) of the Business Cycle

As the cycle implies, a business cycle goes through ups and downs to complete itself. Each pivot point in the cycle represents the start of a new stage and the end of the earlier one.

Generally, there are 4 stages in a business cycle.

1. Recovery Stage

The first stage is recovery. It is also known as expansion, boom, and growth is the first stage or phase of the economic cycle.

The recovery starts with easing policy (lower interest rates) to boost investments. A low-interest rate reduces the financing costs of businesses and consumers followed by economic growth.

In simple words, everything starts to get better.

Features of recovery stage are:

- GDP is growing;

- Wages and salaries are increasing;

- The stock market is finishing higher and higher;

- The unemployment rate is declining;

- Interest Rates are usually low;

- Credit purchases are rising;

- The housing market is rising;

- Investments are increasing;

- Sales are growing; and

- Government spending is growing.

2. Peak Stage

The second stage is the peak. At this stage, the economic growth capacity is probably full.

Even though, everything looks great but is vulnerable. Some investors and analysts question and start talking about bubbles.

Features of peak stage are:

- GDP is the highest;

- The unemployment rate is low;

- The stock market is at its peak;

- The interest rate is higher;

- Consumer confidence is high;

- Production confidence is high;

- Companies are making huge profits;

- Sales are very high; and

- Government spending is low.

3. Recession Stage

The third stage in a business cycle is the recession, also known as the contraction, crisis, and bust stage.

It refers to an economic situation when the economic activities significantly decline that lasts months. Some economic theories define a recession when two consecutive quarters of GDP growth are negative. However, two consecutive negative growth is not enough. There should be a decline in the unemployment rate and a fall in investment.

This stage is the opposite of recovery, and everything is getting worse.

Features of recession stage are:

- GDP growth rate is declining;

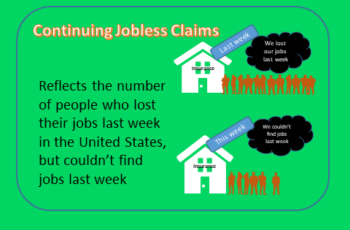

- Jobless claims and unemployment rates are rising;

- The Stock market is falling very fast;

- Consumer and production confidence is lowering;

- A lot of companies and people are going bankrupt;

- Discounts by stores are rising to sell more and empty inventories;

- Investment is falling;

- Sales are declining; and

- The central bank is lowering the interest rate.

4. Trough Stage

The fourth and last stage in the business cycle is the trough, also known as the bottom. It refers to the economic situation when the economic activity is the lowest since the start of the recovery stage of the economic cycle.

Features of trough stage are:

- The government is taking economic action to boost the economy;

- Governments cut taxes;

- The central bank is increasing the money supply to stimulate the economy;

- The Stock market is at the bottom;

- Government and central bank bailing out bankrupted companies;

- The unemployment rate is very high; and

- Sales of luxury goods and services are the lowest in the past years.

Example of Business Cycle

The United States economy peaked in October of 2007.

Then, the recession started and lasted till March 2009. And Dow Jones, one of the most watched stock indexes, fell about 53%.

Next, the trough was around March 2009.

Finally, the expansion or recovery started and continued till Feb 2020. This expansion grew 350% before the covid-19 recession started.

Here is how the GDP in the USA changed over time during the business cycle.

source: tradingeconomics.com

What Causes a Business Cycle?

The Business cycle can start from any event such as political changes, natural disasters, the housing market, credit crisis, disease, etc.

No one can predict the exact causes until it starts.

Investors that predict the market correctly make huge profits, especially during a recession.

Bottom Line

This cycle is happening in the free market again and again.

No one knows how long each of these stages will last.

Monetary policy is probably the main cause of all four economic stages or phases.