What Is Fiscal Policy?

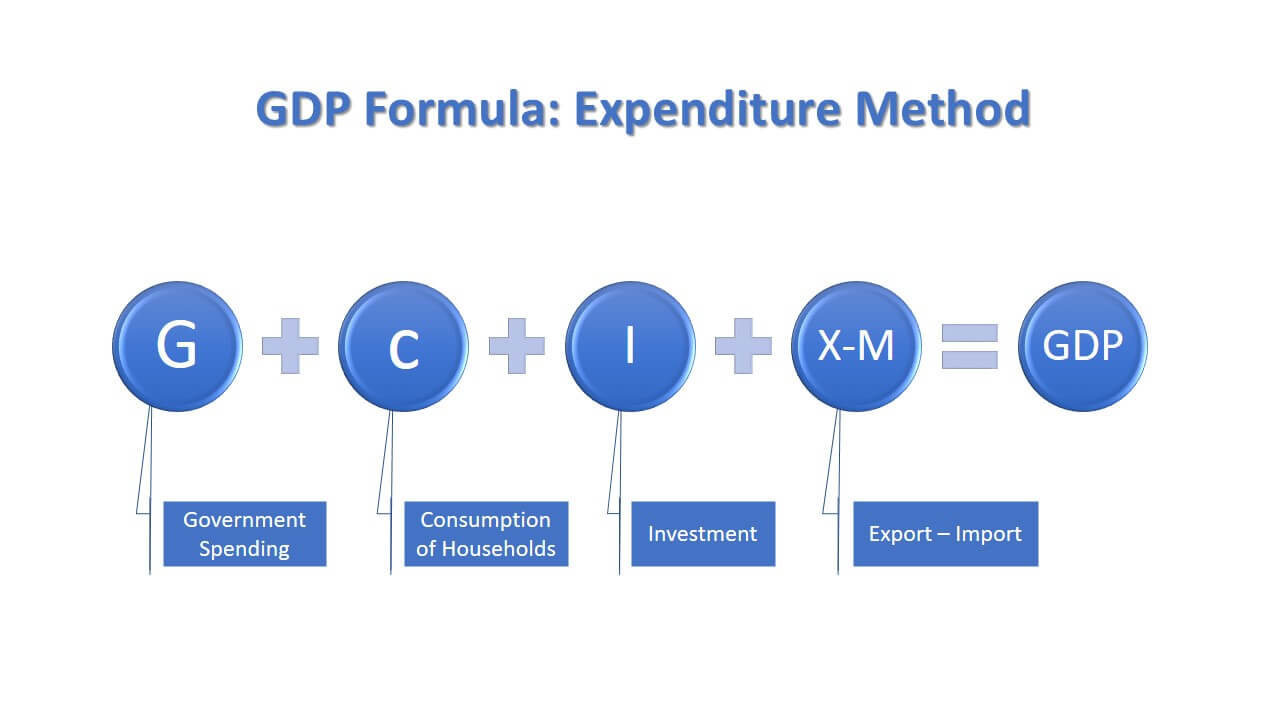

Fiscal policy refers to the revenue and expenditure programs of the government to impact economic conditions (generally macro economy).

When the economy is slow or fast, the government intervenes to stimulate or slow down the economy. The government intervenes by changing public expenditures and incomes. You read later in this article, how the government intervenes. Now, keep reading.

In a free market, the government does not intervene to cure the economy. And the government was not intervening in the economy in a free market until John Maynard Keynes suggested intervention in the case of malfunction of the economy. He said, why should wait for the economy to fix itself in the long run when the government can do it sooner? He suggested running debt by the government to increase demand and fix the economy faster.

The leader of a country (president or prime minister) and the congress (parliament) set the fiscal policy. For example, in the U.S.A., the white house and congress set the fiscal policy, and in Australia, the prime minister’s office and the parliament set the fiscal policy.

The revenues and expenditures of a government relative to its GDP indicate its inclination toward capitalism or socialism. A bigger size of expenditure by the government shows a more socialist approach. Contrarily, the smaller the size of the expenditure by the government expresses a more capitalist approach.

As mentioned earlier, the government intervenes in the economy by changing its revenues and expenditures. So, what are they?

What Are Government Revenues?

The government needs revenue to run. Its sources are taxes, fees, and so on.

The government allocates its revenues to various sectors to maximize social benefits.

Government revenues come from different sources, depending on fiscal policy.

And some of these sources are:

1. Taxes

Income tax, corporate tax, real estate tax, sales tax, and social security tax are the most popular taxes and the largest portion of government revenues.

2. Tariffs on Imported Goods

Governments impose tariffs on goods bought from other countries.

3. Fees For Services

Fees on services are revenue for the government. It receives money for the services that the government provides. Ex: fee on the issuance of a driving license.

4. Sales of Government Assets

The government may sell its assets, such as land and mine.

5. Interest Receipts

Interest received from borrowers lent by governmental firms. Generally, banks and foreign countries borrow from a government.

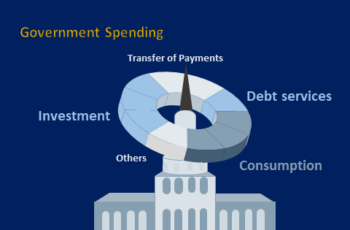

What Are Government Expenses?

Government expenditure refers to the total spending by the government during a time for social, economic, and political purposes.

Government expenditure is also called government outlays, government expenses, and government spending.

The expenditure policy (the second half of fiscal policy) goals could be GDP growth, prosperity, reducing poverty, increasing the incumbent party’s image, raising the standard of living, and so on. Or goals of expenditure can be social, economic, and political.

Some of the government expenditures are:

1. Common Consumption

Common consumption refers to payments such as payments as salaries to government employees and rents.

2. Investments

Investment expenditure by the government refers to infrastructures built by the government, such as roads, hospitals, and schools.

3. Social Security Payments

Social security payments refers to money paid to retirees and other beneficiaries like disabled people.

4. Military Spending

Military spending, also called defense expenditure, refers to expenses for security purposes domestically and internationally.

5. Interest Payments

Interest payment refers to payments on governmental bonds amassed in the past years.

6. Unemployment Insurance

It is the payment to insured employees who lost their jobs.

7. Subsidies

It is the amount of money paid to businesses to keep the costs of specific products or services low to encourage people to purchase more.

3 Types of Fiscal Policies

The government steps in when the economy is not healthy.

And it responds accordingly.

The government uses its tools, revenue collections, and expenditures to cure the economy. Depending on the problem, it may expand or contract the economy.

Here are what those fiscal policies are.

1. Expansionary Fiscal Policy

The government takes expansionary fiscal policy when the economy is underperforming, also known as easing or loose fiscal policy. For example, when the unemployment rate is high and the GDP growth rate is lower than targets, the government takes expansionary policy.

When the unemployment rate is high or the GDP growth rate is lower than the target, the government takes an expansionary fiscal policy by increasing government spending. The policy might be giving free money to citizens, building roads, repairing public infrastructures and building hospitals, etc.

An increase in spending by the government creates jobs. And jobs enable consumers to increase consumption, encouraging investors to invest and employ more.

For example, in the 2020 covid-19 recession, the USA introduced trillions of dollars in stimulus and relief packages. The aim was to encourage citizens to stay home, prevent a decline in consumption, and prevent massive bankruptcies.

Another example is from the 2008 recession. The US government introduced an over 800 billion dollar bill to increase spending by repairing roads, buying securities, etc.

2. Contractionary Fiscal Policy

Contractionary fiscal policy is the opposite of expansionary policy.

When the economy is “runny too fast” or overheating, when the inflation is higher than the target, for example, the government can cool down. In this situation, the government can increase taxes or cut spending.

A higher tax lowers the disposable income of citizens and businesses followed by lower demand and fixing the economy. And a cut in spending directly decreases demand and cools down the overheating economy.

The contractionary fiscal policy is effective but dangerous. For example, in 2010 the UK government wanted to rebalance the economy by cutting spending. However, inflation fell, but unemployment rose to 8%.

3. Neutral Fiscal Policy

In a neutral fiscal policy, the government allows the market to fix itself. In other words, public expenditure and taxes do not impact the total demand in the economy.

A neutral fiscal policy may fix the economic problem, however, it takes time. And there is not any guarantee of what the outcome will be.

It is very hard to keep a neutral policy in the long run because it requires a balanced budget or the revenues exceed expenses. A balanced budget means the total revenues and expenses of the government are equal.

Bottom Line

Fiscal policy refers to the government’s policy on its revenues and expenses. The major revenues of the government come from taxes and the major expense go to common consumption.

There are types of fiscal policies: expansionary, contractionary, and neutral. In an expansionary policy, the government tries to stimulate the economy. The contractionary policy wants to cool down the economy. And in a neutral policy, the government lets the economy itself fix its problems.