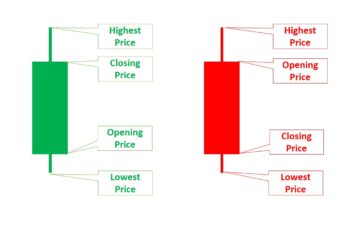

A bullish harami candlestick pattern is a reversal pattern suggesting the future uptrend, so it occurs at the bottom of a chart.

A bullish harami candlestick pattern is a combination of two candlesticks. The first candlestick is bearish (red) and has a large body. The second candlestick is either bullish (green) or bearish, having a small body or a doji that opens and closes within the range price of the first candle.

If the second candle is a doji, it is called a bullish harami cross.

Bullish harami occurs in the stock market frequently. However, because the opening price of the second candle is not the same as the closing price of the first candle, this pattern does not form in Forex and Crypto markets.

A bullish harami pattern is not as strong as a bullish engulfing candlestick pattern. So, more caution is required in trading this pattern.

Side note: Harami meaning is a pregnant woman in the Japanese language. These patterns look like pregnant women in which the first candle looks like a mother and the second candle her child.

The opposite of the bullish harami pattern is the bearish harami. It occurs at the top and suggests a downtrend.

How to Trade Bullish Harami?

A bullish harami is a reversal structure. So, it does require confirmation.

A harami after a rally or fall means that the market is exhausted. And the chance of reversal increases if there are some supporting signals like the followings:

- This pattern must appear after a downtrend. Otherwise, it will not signal a reversal of the direction.

- A taller first candle is better and more powerful. It indicates that the volume is high and more investors are placing trades. Thus, the upcoming direction could be a powerful one.

- The closing price of the second candle near the top of the first candle is more potent in a bullish harami.

- A smaller second candle indicates more reliability. Thus, a bullish harami cross is more powerful than a general harami pattern.

- A harami immediately after a trend reversal signals a consolidation than a reversal.

- Validate the discovered bullish harami with other technical tools and patterns. For example, a leading indicator such as momentum can signal many sessions earlier. If a leading indicator confirms the harami pattern, it is more likely to reverse.

- Blend fundamental analysis with harami patterns, specifically if you use daily or weekly charts. News such as changing executives, CPI data, and earning calls can reverse the direction of a stock.

- Because the bottom of this pattern act as a support line, if you place a trade, put a stop-loss under the pattern.

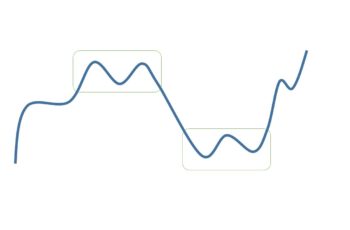

Here is an image that compares weak and strong bullish harami patterns.

Bullish Harami Pattern Examples

Here are examples that worked and the ones that did not.

Example #1

On 08-09 March 2021, a harami pattern formed on the Pinterest chart.

On this chart, the first candle is a long body red candle. The second candle is a hammer, which opens and closes within the first candle.

This harami pattern is a potent one for the following reasons:

- Before the first candle of the harami pattern, there is a long lower tail candle. A long lower tail shows that the market is losing momentum;

- The first candle of this pattern is a tall red candle. A taller candle is stronger than a short candle;

- The second candle of this pattern adds to its power by opening and closing at the near top of the first candle plus being itself a hammer. A hammer candle itself is a bullish pattern;

- The bottom of this pattern is at the resistance area, if not the resistance line;

- On the indicator chart, the momentum, which is a leading indicator suggested an oversold condition. In an oversold condition, the market is expected to reverse or at least make a correction; and

- Stock Index trends’ were up.

Even though there was not any prominent news or event (I googled), there were enough bullish signals. As you see, the market retraced up almost 100% of the previous down move.

Example #2

In late January, in the hourly chart, the Goldman Sachs chart made a bullish harami. Even though the price did not continue rising immediately, it was a powerful warning.

Here are some supporting signals that could help reverse the trend:

- The bullish harami pattern formed at the end of a downtrend after three gap-downs. From a gap (window) patterns perspective, a trend is highly likely to reverse after the third gap. So, these gaps are supporting signals for our pattern.

- The next signal appeared after the last gap, a red candle with a long lower shadow created a resistance area.

- Two sessions before the bullish harami pattern, there are a doji and an inverted hammer. And, both of them after a long downtrend warned of a future uptrend.

- Finally, if the harami did not convince you, a bullish engulfing pattern appeared that engulfed two candles. It is a serious reversal pattern.

As the trend reversed put a stop loss at the bottom of the bullish harami.

Example #3

In early October, Goldman Sachs made a bullish harami that was not the start of a new trend. This pattern clearly reminds us to look for singnals when a pattern appears.

Here are some of the negative signals that invalidate the harami’s prediction:

- The above pattern just looks like a bullish harami. It did not appear at the end of a downtrend or the end of a major correction pattern.

- The RSI indicator does show an overbought condition.

- The red candle of the harami with its preceding candle made a bearish engulfing pattern, which is more potent.

The above example shows that just two candles that look like a “harami pattern” does not mean the trend reverses. We need confirmation.

What Is the Difference Between Bullish Harami and Bullish Engulfing Candlestick Patterns?

Bullish harami candlestick patterns somehow look like bullish engulfing patterns, and both are reversal patterns.

However, they are not the same, and engulfing patterns are more potent.

Generally, there are three differences between a bullish harami and a bullish engulfing pattern.

1. Size of Candles

In a harami pattern, the first candle is taller than the second one. Conversely, in an engulfing pattern, the second candle is larger than the first one.

2. Candles’ Colors

In an engulfing pattern, the two candles should have opposite colors. Here I mean, in a bullish engulfing pattern the first candle is red and the second candle green. And, in a bearish engulfing pattern, the first candle (smaller one) is green, and the second one is red.

On the other hand, in a harami pattern, both candles can have the same color. In a bullish harami, both candles can be green however, the first candle must be green.

3. Strength of Harami and Engulfing patterns

Even though both are reversal patterns, engulfing patterns are more potent.

Bottom Line

The bullish harami candlestick is a reversal structure but less potent than engulfing and piercing pattern.

It is less potent because the second candle is small. And behind a small candle is less power.

To trade it successfully, look for more clues. More clues mean more validators and a higher chance of success.