Belt hold candlestick patterns are single candle reversal structures. It is divided into bullish and bearish versions.

A bullish belt hold candlestick pattern is a tall green candle that continues rising after the opening price. It forms at the bottom or end of a bullish correction pattern. Technically, it should not have a low shadow. However, a tiny low shadow is accepted.

A bearish belt hold candlestick pattern is a tall red candle that forms at the top or end of a correction wave/trend. The price continues falling after the start of the candle. Technically, a bearish belt hold candle should not have an upper shadow. However, a tiny upper shadow is accepted.

Since these patterns are single candle structures, they need strong supporting signals to reverse the trend.

This post elaborates on how to trade belt hold patterns and gives some examples.

How to Trade Belt Hold Candlestick Patterns?

Caution is required before placing a trade after a this pattern.

Here are factors to consider when you discover a belt hold pattern:

- There should be a trend (uptrend before bearish and downtrend before a bullish belt hold candle). Or, it should appear at the end of a correction (bullish correction before a bullish hold belt and a bearish correction pattern before a bearish hold belt).

- A taller “belt hold candle” means more strength. So, longer is better.

- Wait till the closure of the candle after a belt hold pattern to confirm the reversal. It is crucial because it is only one candle.

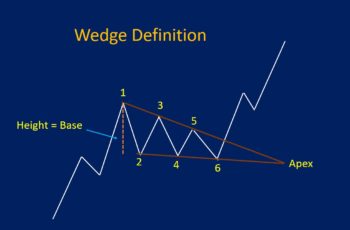

- Combine the hold belt line with other technical analysis tools such as Fibonacci Tools and patterns.

- Check the economic calendar for the confirmation of the belt hold candle. Moreover, don’t forget news and fundamental analysis.

- Put your stop loss at the start of this pattern. Or, close your long position after confirmation of a bearish belt hold candlestick and your short position after the bullish version.

More supporting signals lead to more success rate for the belt hold pattern.

Examples of Belt Hold Candlestick Patterns

There are times that a candlestick pattern works and times that do not. Some patterns’ success rate is higher than others.

And, the success rate of belt hold patterns is lower compared to some others, such as engulfing patterns and stars.

Thus, I have brought you examples that did work and that did not work.

Bullish Belt Hold Candlestick Example

On the 20 December of 2021, the S&P 500 completed a bullish belt hold pattern. It formed after a pullback.

This green belt hold candle is tall. And its height is an indication of serious buyers.

The opening price of the above belt hold pattern is exactly at the 0.618 Fibonacci retracement level. This level is one of the golden levels and is considered very powerful.

As mentioned earlier, it is better to wait for the closing price of the next candle. In this chart, the next candle is a long-legged doji.

Buying after the doji is a good entry point. Under the belt hold candle is a good place to put a stop loss or close long positions.

Bearish Belt Hold Candlestick Example

On 04 August 2005, the S&P 500 completed a bearish belt hold pattern.

Here is the chart.

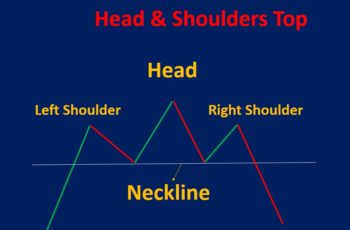

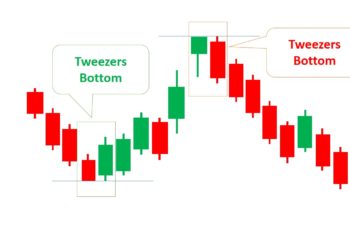

This pattern has a tiny upper shadow, which is accepted. It formed after a “bearish tweezers” which itself predicts the reversal of the trend from upward to downward and created a support line. This support line is a strong wall for bulls and confirms that the belt hold candle pattern is right.

Furthermore, the RSI indicator did not follow the price chart weeks ahead of this pattern. Consider it as another supporting signal.

When the next candle closed as a bearish, it was time to sell or close the long open position, if existed.

Finally, the stop loss should be put above the pattern.

Examples of Failed Belt Hold Candle

On 19 September 2018, Bank of America Corporation made a perfect bullish belt hold pattern. However, it failed.

It was perfect technically because the candle itself opened and started rising closing near the top, which is a perfect “belt hold candle” by definition. Moreover, it formed at the end of a correction wave/trend. Furthermore, the second and third candles earlier made a resistance area.

However, the next candle after the belt hold pattern was red, and the price could not rise. This pattern is an example that traders should wait for confirmation before placing a trade after the belt hold candle.

Final Thoughts

Belt hold candles are reversal candlestick patterns but not potent. You need powerful supporting signals to trade it. And, don’t forget a stop loss.