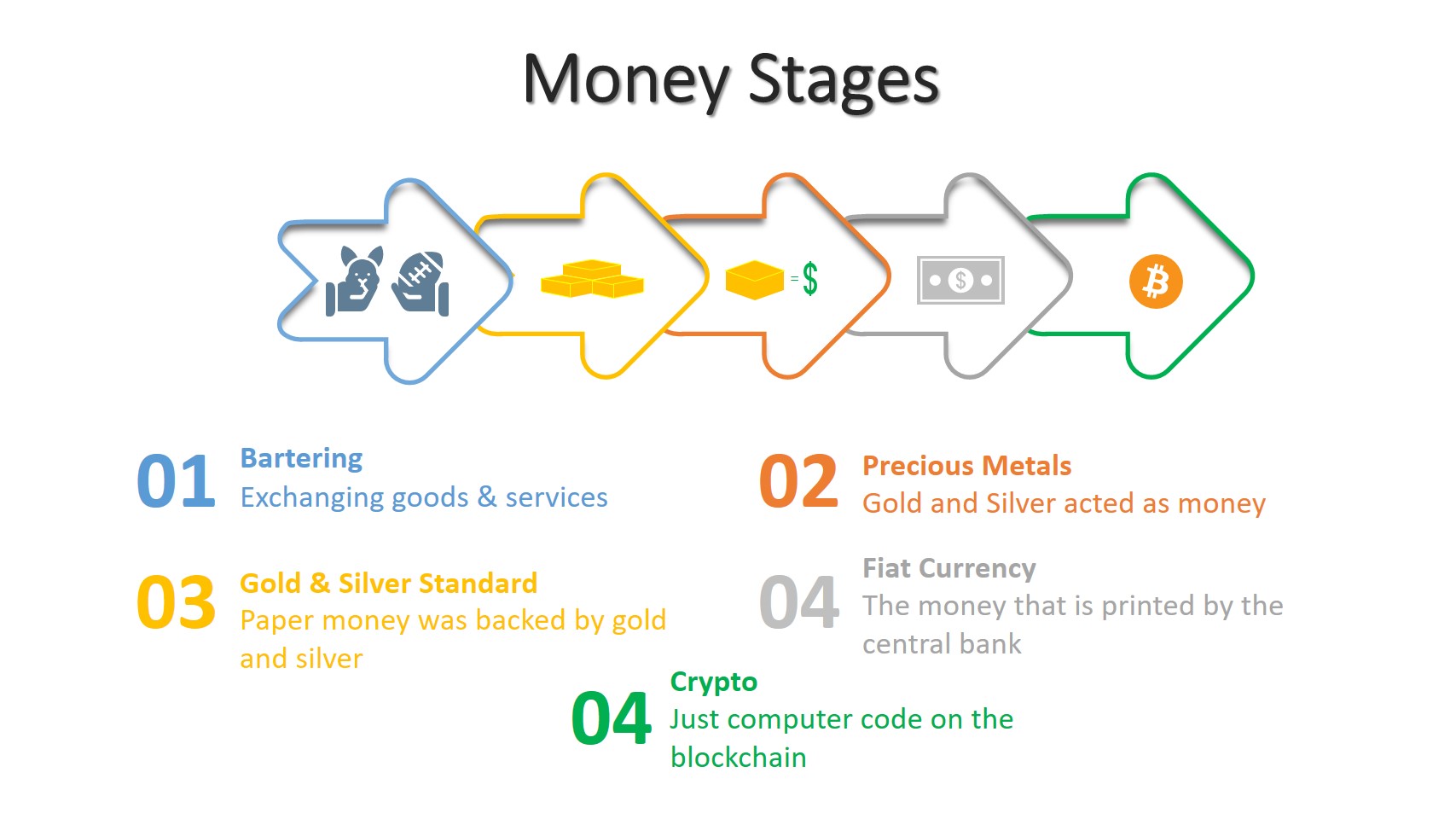

Monetary policy refers to the money supply plan adopted by the central bank to influence economic activities.

The general monetary policy aims are macroeconomic stability such as inflation, currency stability, and employment.

A government needs to adjust constantly its policies because no policy is perfect, and the economy is evolving. Additionally, competitors and market forces in the free market often create imbalance. That is why monetary authorities should step in to solve the problems.

Generally, there are two types of monetary policy, expansionary and contractionary.

Tools of Monetary Policy

Central banks have authority powers and tools to implement their policies to fix economic problems.

In “relatively stable” and stable economies, primary tools are interest rates, market operation, required reserved ratio (RRR), collateral policy, and credit quotas.

Interest Rate

The overnight interest rate is the most powerful tool of the central bank.

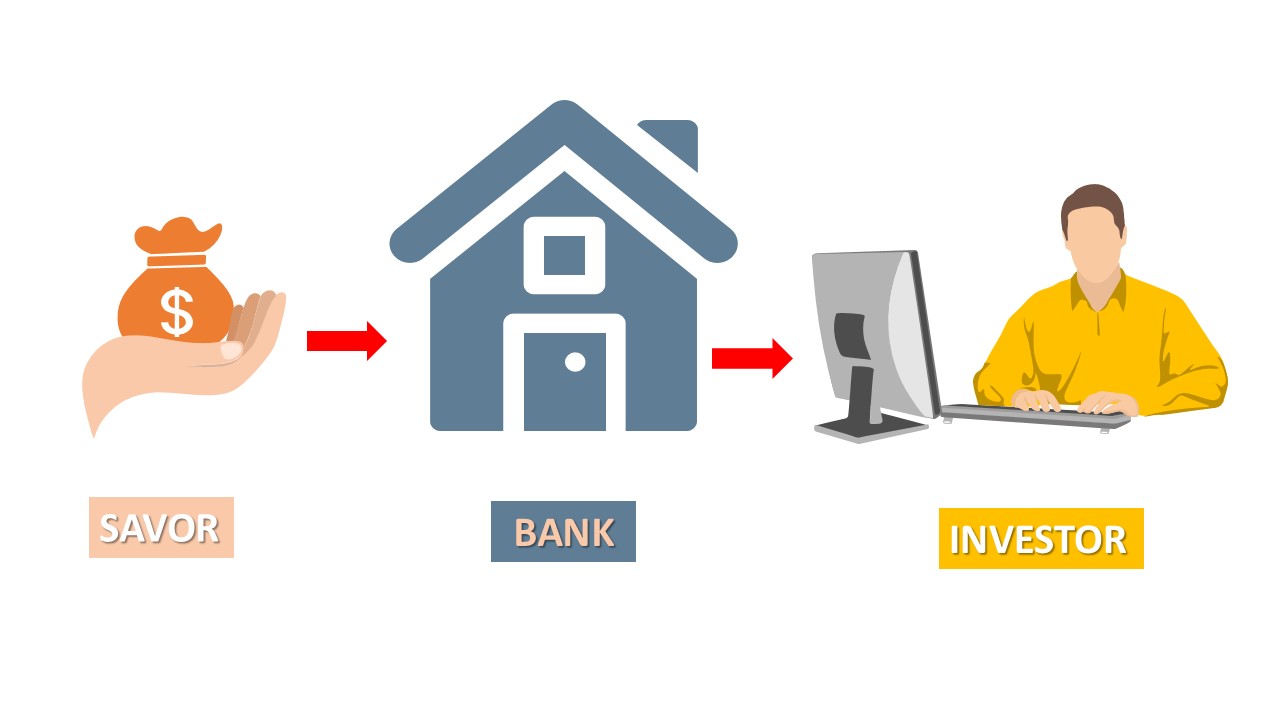

It is the interest that commercial banks receive for their deposits in the central bank. When the central bank changes its interest rate, other banks follow by raising or cutting the interest rate that charges their customers.

A higher interest by the central bank (Ex: Fed in the USA and Bank of England in the UK) increase borrowing cost and decrease the money supply. A fall in the money supply lowers the inflation rate and investment.

Contrarily, a lower interest rate decreases borrowing cost and increase the money supply.

Discount Rate

It is the rate of interest that central banks charge other banks for lending them for short terms.

Required Reserve Ratio (RRR)

The required reserve ratio (RRR) is the percentage of deposits by customers that a commercial bank should keep in cash.

A higher RRR enables banks to loan more and causes an increase in the money supply. On the other hand, a lower RRR forces banks to loan less and decreases the money supply.

Market Operation

The central bank may enter the market as a participant, known as market operation.

Market operation is effective when the exchange rate is not in the target range.

The central bank sells foreign currencies when the domestic currency exchange rate is lower than the target and buys if the exchange rate is higher than the target. Moreover, it can buy debt securities to increase the money supply, and sell to decrease it.

Credit Quota Policy

Credit quota is a policy by the center that defines for every bank the amount of money that can lend.

This policy is not very common. However, the State Bank of Vietnam still uses it.

Collateral Policy

Collateral is a guarantee that the lender will receive if the borrower fails to pay the loan.

For example, a borrower may provide his home as collateral. If he fails to pay the loan, the lender can sell it to receive his money.

And central banks decide which assets qualify to be collateral.

Types of Monetary Policy

There are two types of monetary policy: expansionary and contractionary.

Expansionary Monetary Policy

Expansionary Monetary Policy means an increase in the money supply to increase economic activities.

A central bank increases the money supply by combining multiple or using one of its tools. It can cut the interest rate, lower Required Reserve Ratio (RRR), or buy foreign exchanges from the domestic market.

How does it work?

The expansionary policy lowers the financing costs of businesses and investors and enables them to increase their borrowings. And lowering financing costs increase economic activities.

Objectives of Expansionary Monetary Policy

Economic problems can be many, and an expansionary policy can solve them.

And some of them are the followings:

- Increase economic growth: Central banks take expansionary monetary policy to increase the money supply to make it cheaper by lowering the interest rate and the required reserve ratio (RRR) or buying foreign currencies. Central banks hope that the decisions lead to economic growth by boosting consumption and more investment.

- Reduce the unemployment rate: The central bank can help unemployment reduction by making available money to companies. The central bank may directly buy companies’ bonds or help get a loan from commercial banks by lowering interest rates. Low-interest rates encourage firms to borrow more, invest more, and finally will hire more.

- Increase inflation: One of the primary jobs of the central bank is to manage the inflation rate. Generally, in developed countries, the central banks target about a two percent inflation rate. Economists believe that a 2% inflation rate helps the economy to become stable. If the inflation rate is below the targeted rate, the central bank increases the money supply. Pouring money into the economy will diminish its value relative to other assets and raise the inflation rate.

- Boost Exports: The job of the central bank is not only to control money supply and demand but also to help exports and the economy. The central bank can help boost exports by weakening the exchange rate of a national currency relative to foreign currencies. If the value of a national currency is lower than the trading partners of a country, the cost of goods and services produced is lower than trading partners. The government can weaken the exchange rate by simply printing money or buying foreign currencies.

Example of Expansionary Monetary Policy

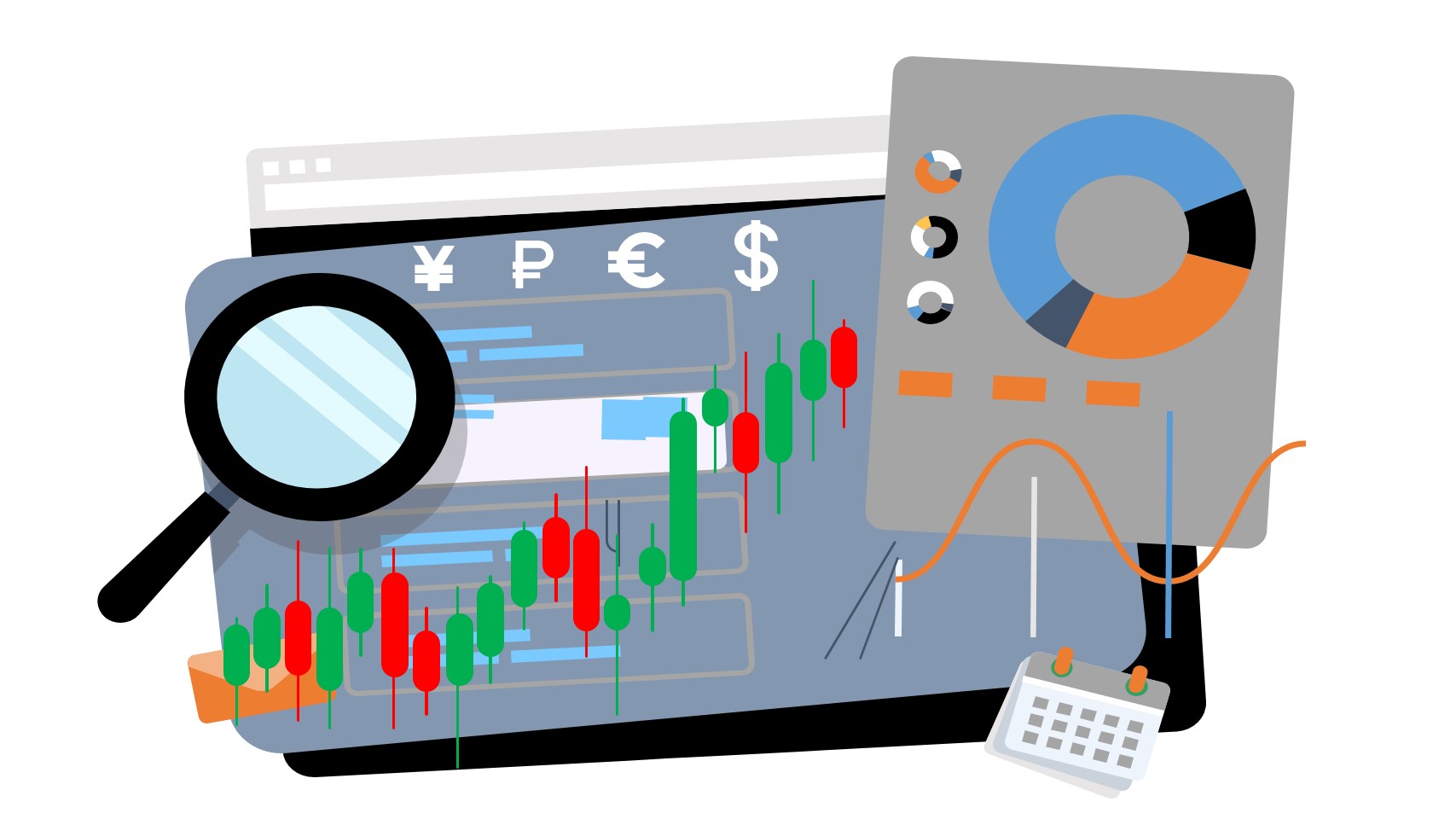

In December of 2007, the 2008 recession started. And the Fed Reserve started cutting the interest rate to encourage borrowing and investment.

Moreover, the Fed bought a huge amount of debt and mortgage-backed securities to inject money into the market.

The following is the chart of interest rates showing it through the years.

source: tradingeconomics.com

Contractionary Monetary Policy

Contractionary Monetary Policy means reducing the money supply in the economy to decrease economic activities. In other words, governments take contractionary monetary policy to cool the overheating economy.

The central bank can raise the interest rates and reserve requirements and enter the open market to cut the money supply.

Central banks also may limit credit provisions to risky projects and people who are not likely to pay back by setting quotas and changing collateral policy.

Objectives of Contractionary Monetary Policy

Investors do not like contractionary monetary policy. However, sometimes it is a must.

Here are some contractionary monetary policy objectives.

- Reducing inflation: A higher inflation rate for savors is problematic. It makes it difficult for them to adjust to the new situation where the prices continue to rise. It is difficult for savors to save enough to buy a house, cars, and other things. There are many ways to control inflation. However, monetary policy tools are more effective in reducing the inflation rate.

- Preventing bubble: An economic bubble is a market condition when prices are too high without justifications. The contractionary monetary policy reduces the money supply making people unable to push prices higher, or creating a bubble. Some economists believe that it is the only money supply that creates a bubble and can avoid it.

- Strengthening national currency: A stable currency is a sign of a healthy economy. No one likes an unstable currency that is not trustable. And a central bank can strengthen a currency by cutting the money supply by raising the interest rate and RRR or selling foreign currencies in the free market.

Example of Contractionary Monetary Policy

The inflation rate in the united states started to rise above the Fed target in early 2021.

source: tradingeconomics.com

To control the inflation rate, the Fed began taking contractionary monetary policy by raising the interest rate in late Feb of 2021.

source: tradingeconomics.com

Moreover, the Fed started shrinking its balance sheet by selling debt securities that had amassed over time.

What Is the Difference Between Fiscal Policy and Monetary Policy?

Both of these policies’ goals are to manage the macro economy.

So, here are the difference in bullet points.

- Fiscal policy is the spending and revenue plan of the government. But the monetary policy is about the money supply in the economy.

- The fiscal policy tool is the budget. And the monetary policy tools are interest rates, RRR, market operation, collateral policy, and credit quota.

- The office of the leader of a country (president or prime minister) and the congress (parliament) decide about the fiscal policy. However, the central bank takes the monetary policy.

- Fiscal policy’s key targets are macroeconomic stability or growth, such as employment, building infrastructure, and a higher GDP growth rate. On the other hand, the fiscal policy’s key targets are to control inflation and the financial market.

- The monetary policy impacts the currency exchange rate. However, the fiscal policy has no or minor impacts on the currency exchange rate.

Bottom Line

Monetary policy is an ever-changing central bank program and is reactive. The central bank responds to the inflation behavior of the goods market and the financial market.

Monetary policy goals are stability in the macro economy, mostly money, and the financial market.