Forex trade history report provides information about your past trading activities.

In other words, the Forex trade history report is your profit and loss account/report.

A Forex trade history helps a trader understand his trading strategy efficiency and find what works better. It is a tool for evaluation of his methods and analysis and comparison with past performance.

Moreover, a trade history report helps form the basis for making strategy adjustments and make better trading decisions.

MetaTrader 4 and 5 are similar to each other. I chose MT5. After reading this article, you will understand both reports generated by MT5 and MT4 because the terms are the same.

If you are new to Forex trading, I recommend you read our article on how to use MetaTrader 4 and the differences between MetaTrader 4 and 5.

Downloading Forex Trade History Report

To find your Trade History Report, go to the Toolbox (MT4) and Terminal (MT5) window and click on the “History” tab. This tab has the list of your trades with details but lacks some statistics that help to analyze your performance. That is why you need to download a more detailed report.

Next, to download your trade history, right-click on the window of Toolbox (MT4) or Terminal (MT4). In the middle of this menu list, you see (1) All History, (2) Last 3 Months, (3) Last Month, and (4) Customize Period. The Customize Period option allows you to select the start and end of a period.

Lastly, right-click again on the “history” tab window of Toolbox (MT5) and Terminal (MT4), click Report in MT5 and Save as Report/Save as Detailed Report in MT4, and save as Excel or HTML file. I suggest you save it as an HTML file.

Click HERE to download a report sheet in the HTML file that this article uses for explanation.

Reading the Forex Trade History Report

The Trade History Report has six sections: statement detail, Positions table, Orders table, Deals table, Open Positions table, and statistical reports.

Statement Detail

The statement at the top starts with the following:

- Name of the report: Trade History Report (at the top);

- Name: is the name of the account holder;

- Account: provides info about account ID, base currency, the server of the broker, type of account( demo or real), and if the hedge is allowed or not;

- Company: is your broker’s official name; and

- Date: is the time of report creation.

Positions Table

The Positions table contains all closed trades. This article explains this table in more detail than other tables because they have the same parameters except for some exclusive columns that other tables have.

Let us start from the left to the right.

- Time: It is the time of the position that opened.

- Position: Every time you place a trade, your broker’s server automatically generates a ticket for accounting and further references such as reports and claims. In some brokers, this table is known as a ticket.

- Symbol: represents ticks of assets you traded, such as currency pairs and symbols of other assets’ CFDs. Symbols of currency pairs among brokers are identical. However, CFDs may vary.

- Type: type represents orders type such as buy and sell.

- Volume: It is the value of your position calculated in lot.

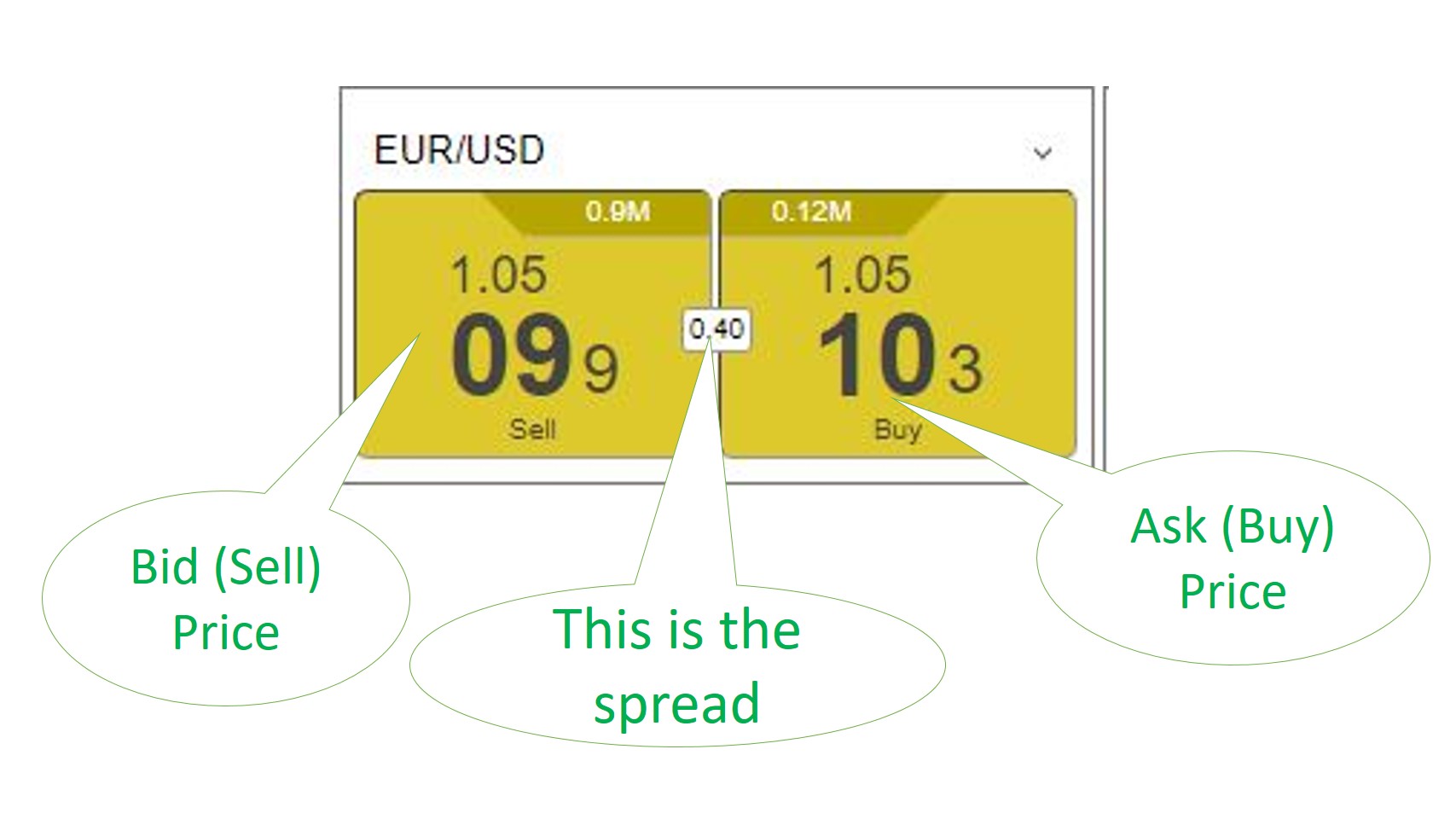

- Price: represents the price you paid.

- S/L: represents the Stop Loss level.

- T/P: represents the Take Profit level.

- Time (2): This is the second time column. It represents the time that your trade was closed.

- Price (2): represents the asset price at the time of closure of your position.

- Commission: represents the amount that your broker charged you as a commission. This column depends on your broker. Some brokers never charge you a commission.

- Swap: represents the amount of money your broker charged you due to keeping your position open overnight.

- Profit: represents if you made a profit or loss.

Orders Table

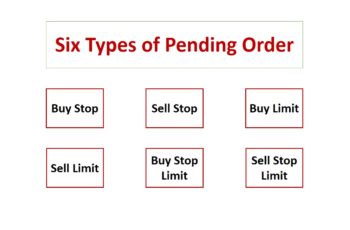

The orders table represents the list of all pending and market execution orders. Moreover, it states if an order is filled or canceled.

Deals Table

The Deals table contains the list of placed orders (excludes canceled orders), including deposits and withdrawals in your accounts. Moreover, it has two more columns, fee and balance columns.

Open Positions Table

The Open Positions table contains the list of open positions.

Statistics Section

The statistics section is the most important part of the Trade History Report. Its elements are calculated based on mathematical techniques that show your performance statistically in a simple language.

Let us begin by explaining the terms in this section:

- Balance: is the sum of equity minus floating profit/loss.

- Free Margin: is the available fund for placing new trades; It is equity minus the open position margin.

- Credit Facility: is the bonus or credit that your brokers have provided you.

- Margin: the amount of funds used for placing the open position. This amount depends on the leverage that you choose.

- Floating P/L: is the amount of unrealized profit or loss due to open positions. It will be zero when you don’t have any open positions.

- Margin Level: the ratio between your equity and the margin (Equity/Margin*100).

- Equity: is the sum of Balance and Floating P/S.

- Balance Graph: shows your trading performance in a graph. The X-axis shows the number of trades, and the Y-axis your account balance over time.

- Net Profit: is the Gross Profit minus your losses.

- Gross Profit: is the sum of all of your winning trades.

- Gross Loss: is the sum of all of your losing trades.

- Profit Factor: the ratio of gross profits to gross losses (Gross Losses/Gross Profit).

- Expected Payoff: is the average profit expected to make for each trade. Mathematically, it is (Net Profit/Number of Trades).

- Recovery Factor: is the ratio of net profit to maximum drawdown. Since, in our report, we had only one loss, the Recover Factor is equal to the Profit Factor.

- Sharpe Ratio: is a tool for evaluating the risk-adjusted return of forex trading techniques and takes into account both the returns and the risk of trades. It is formula is: (Sharpe ratio = (average annual return of investment – risk-free rate) / standard deviation of trade). In this formula: the risk-free rate is the return on government bonds such as treasury bills in the USA, and the standard deviation represents the risk of trades.

- Balance Absolute Drawdown: represents the difference between the initial balance and the minimum balance.

- Total Trade: is the number of trades placed during the time that the report is about.

- Balance Drawdown Maximal: A drawdown is the amount of loss/es from a peak to a low in the balance before changing direction to the upside again. In the Balance Graph, the Balance Drawdown Maximal is the largest drawdown. The Forex Trade History report in the MetaTraders shows you in amount and percentage.

- Short Trades (won %): represents the number of winning short trades and their percentage.

- Profit Trades (% of total): represents the number of winning trade and their percentage.

- Largest profit trade: is your biggest win.

- Average profit trade: represents the average win or your winning trades (Gross Profit/Number of Winning Trades).

- Maximum: represents the number of consecutive wins outside parenthesis and in dollars inside parenthesis.

- Maximal: represents the value of consecutive wins outside and the number of wins inside parenthesis.

- Average: represents the average of consecutive wins.

Read more: Margin in Forex: Every Thing You Need to Know

Note: The loss part is the same as the winning part. So, it does not need explanation.

SHAMSIA

useful information 👍

Zafari

You are most welcome.

And we appreciate your comments