Forex brokers are intermediary financial companies that connect currency traders to the currency market. If you want to trade financial assets, you need to open an account in a forex broker, stockbroker, binary options broker, etc.

A broker provides its customers with live data and software to analyze the market. A broker itself buys data from another company which is called data providers. Swiss Quote is one of the most famous data providers.

A broker also may buy its trading platform (software) from other companies. MetaTrader 4 is the most famous software for trading forex, developed by MetaQoutes.

Types of Forex Broker

Forex brokers are different based on your connection to the interbank network. I will explain below more in the following.

ECN Forex Broker

ECN stands for Electronic Communication Network. It is an internet-based Forex or stockbroker that directly connects its clients to the interbank network or directly communicates to the real market. It means that you buy from real sellers and sell to real buyers in the market by sending your orders straight to the real market.

An ECN broker generates revenue by charging spread, commission, and overnight fees.

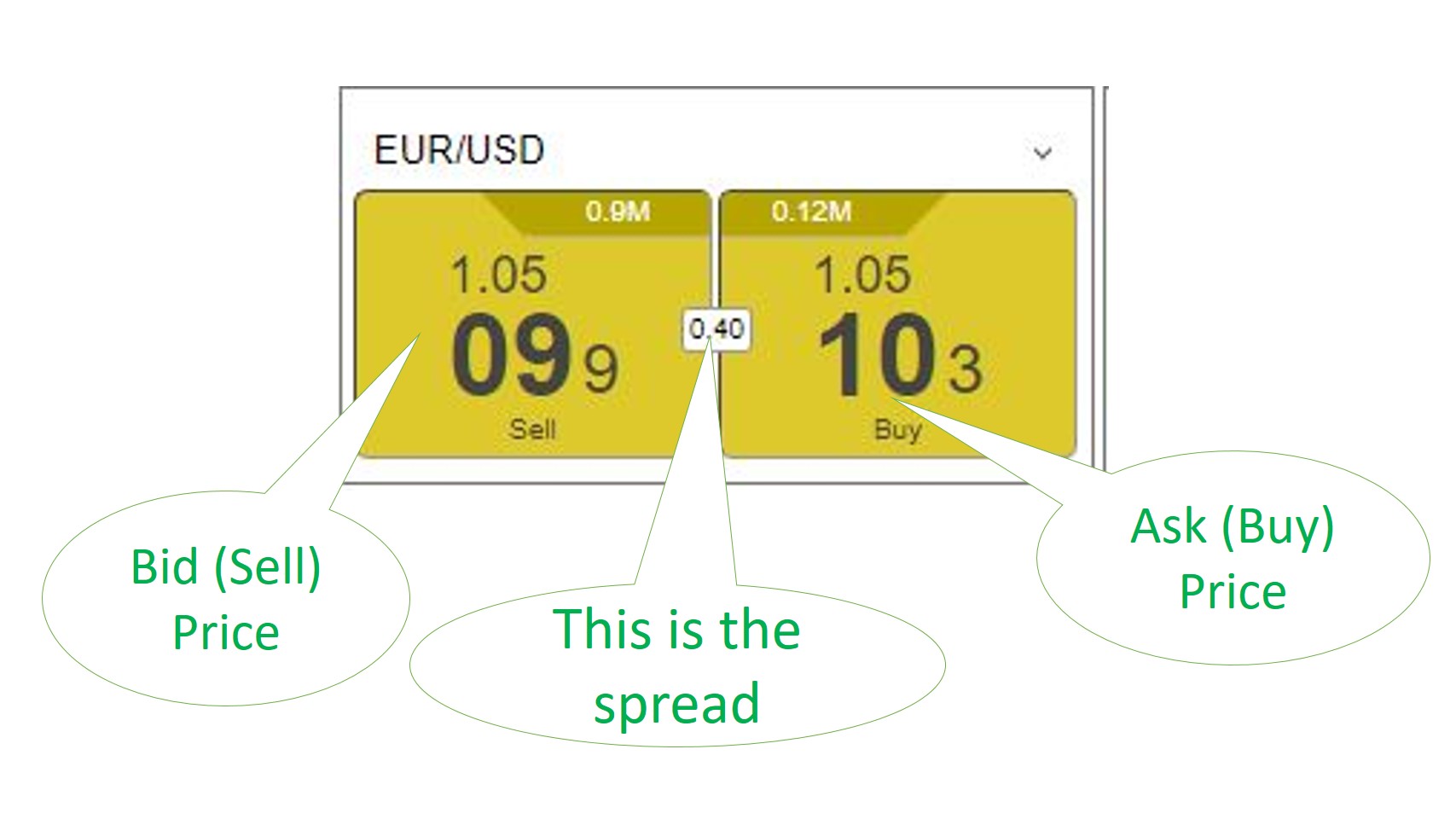

- Spread: spread is the difference between ask and bid prices;

- Commission: an ECN broker charges a commission every time you place a trade; and

- Swap: swap is the overnight fee that a broker charges. It is the difference in interest rates between countries.

An ECN broker has shared interests with its clients. If its clients win, the broker also wins by charging spread and commission. If the client loses, the client may get discouraged and stop trading, which is a loss for the broker. In other words, Shared Interests between you and an ECN broker exist, which means both of you may win or lose together.

An ECN forex broker’s spreads are narrower during rush hours and wider during non-rush hours. It happens because your broker does not control the spread.

ECN Forex brokers are connected to many banks directly that provide bid and ask prices. Your ECN Forex broker selects the lowest bid price and highest ask price to narrow down the spread. For example: suppose that you want to buy USDJPY, and there are three banks, A, B, and C.

- Bank A quotes (110.01-109.95);

- Bank B quotes (110.00-109.94); and

- Bank C quotes (110.02-109.99).

Now, your ECN broker will quote you (USDJPY: 110.00 – 109.99) to minimize your cost. If you buy USDJPY, your broker communicates to Bank B (the lowest price), and if you sell it, your broker will communicate to Bank C (the highest price).

Market Maker Forex Broker

Market Maker is also known as a Dealing Desk broker. It is a type of forex broker that does not direct your orders to the interbank exchange. In other words, a Market Maker does not connect you to the real market.

A Market Maker only buys data from a data provider and trading platform (software), such as MT4, developed by MetaQoutes.

When a trader places a trade, the Market Maker acts somehow to take the opposite position. For example: when you buy, the broker sells, and when you sell, the broker buys.

Since most traders lose money trading financial assets, a Market Maker broker makes money.

Because an MM does not direct to the interbank network, a Conflict of Interest exists between traders and a Market Maker broker. Conflict of Interest here means that if you as a trader win, your broker loses, and if you lose, your broker makes money.

A Market Maker does not make money only by losses of its customers but also in the following ways:

- Swap: Unless you have opened an Islamic Account, a Market Maker broker charges you a swap, the difference between interest rates of two countries plus a markup. If you open an Islamic Account, your broker will not charge you a swap because in Islam, receiving interest is Haram. Some brokers offer Islamic accounts, and some do not. If you are interested in opening an Islamic Account, check your broker’s website.

- Spread: Spread is the difference between ask and bid prices. Usually, a Market Maker has more control over STP and ECN brokers. Some Market Makers even provide fixed spreads.

Note (1): most Market Makers do not charge commissions, but its spread is higher than the ECN account.

Note (2): spreads of Islamic Accounts are higher than Standard Accounts in most brokers.

STP Forex Broker

STP stands for Straight Through Processing. This type of forex broker mixes ECN and Market Maker brokers’ functions. It means that an STP broker has the choice to direct orders to Interbank Exchange or take a position against the trader.

This type of broker makes the most money because it can filter traders. It will direct the order of winning traders and take a position against the losing traders.

An STP broker makes money like an ECN broker by charging spread, commission, and swap.