A double top pattern is a bearish reversal chart structure having two tops (peaks) almost at the same level. I say almost because a perfect structure often does happen. There are tiny differences, and these differences do not reject pattern recognition.

A double top pattern forms after an uptrend. Next, the price retraces a little bit forming the first top and defining the support line. Then, the price rises to the first top level. Finally, the price reverses completing the second top and falls lower than the resistance line.

The bottom between the two tops acts as a support line. And this pattern is only complete if the price breaks the support line.

A double top structure is reliable and forms more frequently than other reversal patterns such as head and shoulders, and triple top. Moreover, it is easily recognizable because it looks like the letter M.

How to Trade Double Top Pattern?

A double top completes only if the price closes below the support line of the pattern. Before that, a formation that makes two peaks is more likely to be a correction than a reversal.

For example, the below chart is not a double top.

And this is not a double top either.

A trend is more likely to continue than to reverse. That is why you have to wait for confirmation. And confirmations can be other technical tools or fundamentals.

Anyway, consider the following factors when finding a double top.

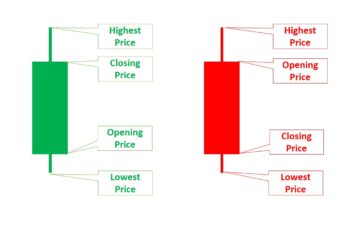

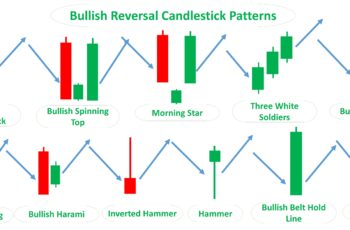

Study Inside the Double Top Pattern and Blend with Other Technical Tools

Inside a pattern, there are chart and candlestick patterns. They can confirm your analysis or may disagree. In both cases, studying inside patterns is helpful.

Other tools such as Moving Averages, MACD, and Fibonacci Tools can be extremely helpful. When multiple techniques confirm that you are right or wrong, your judgment then will be more objective than subjective.

Size Does Matter in a Double Top Pattern

The period that a structure develops does matter.

A structure that took, for example, two months, is more powerful than a structure that developed in days.

Placing Order

Placing an order on time leads to a higher success ratio.

So, an order should not be influenced by emotions.

There are two ways to trade a double top pattern.

The first place is shorting after the closure of a candle below the support line. However, this method is very risky. You should sell only if you have enough confirmations and the reversal is sharp, generally broken by a tall candle.

The second method to sell a double top pattern is to wait for a pullback. It is the safest way to trade. A pullback as a correction pattern and breaking down the support line of consolidation confirms the reversal. Trading with the trend is what makes traders professional.

Stop Loss Order

There is no guarantee to be right in the market.

So, put a stop order above the second top.

You also may put your stop loss above the pullback if it is a large bearish continuation pattern.

Taking Profit Order

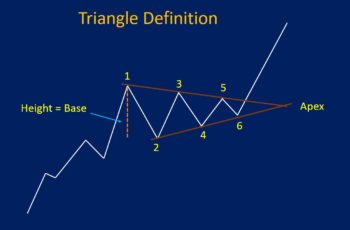

The minimum amount of take profit should be equal to the height of the double-top formation from breaking the support line level. For example, if the height of the pattern is 100 points, the minimum take profit level will be 100 points below the resistance line.

Remember it is the minimum. And we do not encourage. Because putting a take profit order equal to the height of the pattern means that your risk and reward ratio is 1. Risking the same amount for the same reward is not a good strategy.

Another method is adjusting the stop-loss order as the trend continues falling and closing your order when a bullish reversal pattern forms. As the price continues falling, it will make corrections over time. And adjusting the stop loss above these structures lets your profit go while cutting your loss.

Combine Technical Analysis with Fundamentals to Trade Double Top

Macro data such as GDP, interest rate, trade balance, and unemployment rate play huge roles in the financial market. So, following them is necessary.

If you are not lazy read reports on macroeconomic indicators. And if you are lazy, at least follow events on the economic calendar.

Fundamental analysis tells you how long should own an asset or if it is late or not late to enter or exit.

Double Top Pattern Examples

Here are three examples of double top pattern.

Example #1

In early September, in the hourly chart, Alibaba Group Holdings Ltd made a nice double top pattern.

After breaking the support line of the structure, it made a pullback and then continued falling.

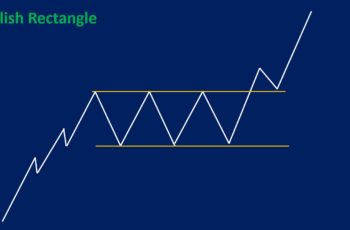

Since, the prior uptrend, before the double top pattern, was not long enough, the best place to enter that market was to wait for a pullback. This pattern could be a continuation pattern, such rectangle, and a bullish flag. However, it turned out to be a double top.

The minimum take profit level could be $160. However, it is not a good strategy to risk $10 for a possible $10 profit. So, the best option was to adjust your stop loss to pullback, a, b, and c levels over time.

Example #2

Alibaba chart on 25 October completed a double top pattern similar to a horn top pattern. And was confirmed by the momentum indicator at the bottom of the chart that it is probably an overbought position.

The price started falling after a bearish engulfing pattern at the second top of the formation.

Next, after breaking the support line, a tiny pullback (a series of small green candles) formed which shows how series bears are in bringing down the price.

Then, the price continued falling till a v-shaped pattern appeared followed by a bullish engulfing pattern. This place was probably a good place to take a profit. However, the profit was small but should be ok because no one can take advantage of every move in the market.

Finally, the downtrend continued, made a broadening wedge pattern, and continued collapsing due to unexpected earnings.

Example #3

eBay daily chart, finished in mid-December 2015.

The price crossed the support line of the structure and then continued falling.

Entering after the pullback was a good idea. However, very soon bears struggled before going down.

The first stop loss could be above the right top and adjusted later.

Finally, the momentum indicator showed an overbought condition followed by a v-shaped reversal structure. And it could be a place to take a profit.

Find Real Double Top Patterns in the Following Charting Tool

To draw a structure, click on the pencil icon. And insert the one you need.

Moreover, you can let the software find double top patterns for you. However, it only looks for perfect formations.

To insert a double top, click on {f(x)} >> Pattern Recognition >> Double Top Pattern.