What Is a Central Bank?

A central bank is the regulator of the banking system, responsible for printing money and monetary policy in a country or a union. Additionally, it is the lender of the last resort, which means, it is the central bank that provides loans to financial institutions nearing collapse.

The main objectives of most central banks are domestic currency stability, inflation control, high employment, and economic growth. It is contrary to other banks that their goals are to profit.

Central banks are independent of governments. It means that central banks make monetary policies without interference from government officials.

Examples of central banks are the European Central Bank, the Federal Reserve in the USA, the Bank of Japan, the Bank of England, the Bank of Canada, the Reserve Bank of Australia, and the Reserve Bank of India.

Central banks regulate the banking system, setting rules on how financial institutions provide services to individuals and businesses. These institutions are commercial banks, credit unions, and insurance companies. The central bank also regulates the stock market in some countries, such as the central bank of Singapore and Bahrain.

What Does a Central Bank Do?

What a central bank does changes the direction of the economy because it directly impacts the macro economy, such as exchange rate, investments, employment, and trust in the economy. So, it is essential to formulate the functions of a central bank in a way that maximizes the well-being of citizens.

What it does varies from country to country, however, the following are the most common jobs of a central bank.

1. Bank of the Government

The central bank acts as the bank of the government. In many nations, it collects government payments such as tariffs and taxes.

Additionally, it also provides loans to the government and buys government bonds.

2. Advisor to the Government

The central bank conducts research and advises the government in the area of the stock market, fiscal policy, economic policy, and so on.

3. Printing Money

Printing money is the most important function of the central bank. It is the only institution in a country/union to print money. Printing money doesn’t mean banknotes alone, it also includes creating credits in its balance sheet. A central bank is allowed to print as much as it wants. However, it prints the optimum amount of money that maximizes the economic welfare of citizens.

There are unions such as the European Union and East Caribbean that have one central bank for the union, and another national one for each member. However, it is the central bank of the union that prints money, and its main job is to keep inflation under control.

4. Custodian of Precious Metals Reserve

In some countries, keeping precious metals such as gold and silver is another responsibility of the central bank.

Every central bank in the world except the Bank of Canada keeps gold as a reserve for unexpected economic situations. If needed, it will exchange the gold for foreign exchange or national currency to control the money supply.

5. Keeping Forex Reserve

The central bank keeps forex beside precious metals as a reserve. It uses foreign currency to manipulate the daily price of a national currency relative to other currencies.

Forex reserve is also essential for trust in the economy and the currency exchange stability. A higher amount of forex reserve means the economy can handle an economic issue effectively. And it builds trust in the strength of the domestic currency.

6. Money Regulation & Supervision of Commercial Banks

The central bank regulates and oversees other commercial banks. It probes other banks to keep them in line with regulations.

Licensing monetary institutions is also the job of the central bank. Anyway, there should be limits on who can enter banks or money exchanges and who can not. It helps the financial system keep scammers and nasty behaviors out of the financial system.

7. Money Supply Management

The central bank set the interest rate to manage the money supply. It will raise the interest rate when a reduction in money supply (known as contractionary money policy) is critical in the economy to curb the inflation rate. Conversely, it will cut the interest rate when it wants to stimulate the economy.

It also set the minimum required reserve ratio by commercial banks. The reserve ratio is needed for the unexpected rush of people to withdraw money. If people take back too much money, there will not be enough money in the bank, and commercial banks may go bankrupt.

The bankruptcy of a bank hurts the financial system and other banks. If one bank goes bankrupt, customers of other banks may fear and rush to withdraw their money. Bank bankruptcy creates chaos and will last for a very long period. So, the central bank must regulate other banks and set a minimum reserve requirement ratio.

The central bank may also enter the open market to buy or sell foreign currencies to influence the exchange rate. The exchange rate affects exports and imports directly, and other economic indicators indirectly, such as investment and employment.

8. Building Trust in the Financial System

Central banks create trust in the financial system. They build trust by ensuring citizens that commercial banks are regulated and controlled. In case a depository institution goes bankrupt, the central bank will take care of the money deposits of customers. Or, it will bailout failed commercial banks. This way, it ensures people that their deposits are safe.

9. Burning Old Banknotes

Over time the paper money eradicates to the extent that it is better to burn them. The central bank orders commercial banks to collect old notes and exchange them with new banknotes. Finally, it put them on fire.

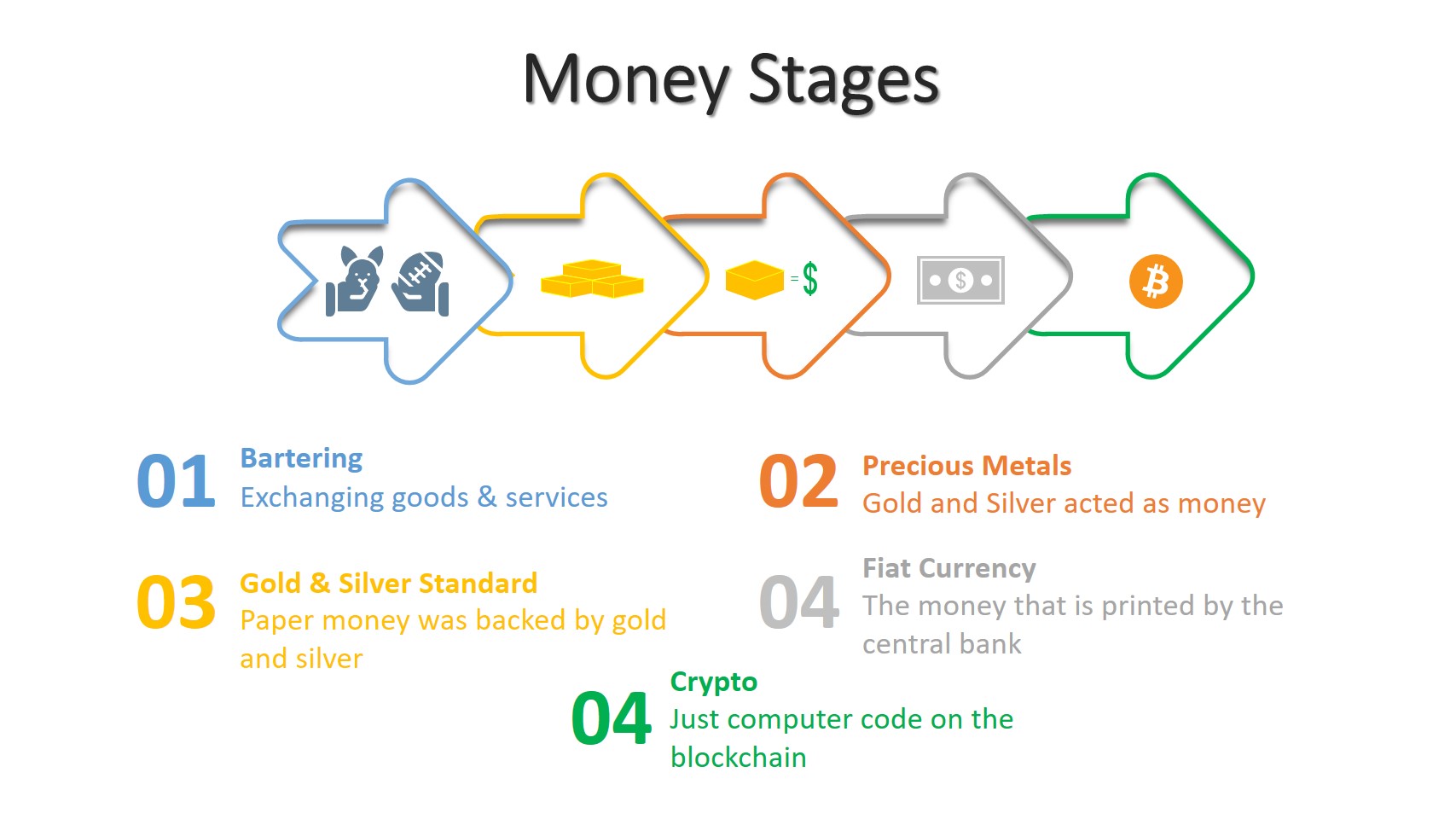

10. Another Unofficial Function of Central Banks: Demotion of Gold

Central banks try to throw gold out of money circulation or the financial system.

Gold is money. It has been in the past 6000 years.

The central bank and government hate gold because if people use it widely, the economy will become decentralized, and the government will lose control. Government cannot control a decentralized money system as much as it can a centralized money system.

Commercial banks also hate gold. It is costly to accept gold as deposits because it requires more facility and security. Instead, banks offer credits in currency to customers. Using paper money or credit is much easier than gold.

How Does A Central Bank Influence the Economy?

A central bank is one of the most influential institutions in a country. It can impact every industry, company, and individual by changing its monetary policy.

It influences the economy using its tools and policy. Its tools are interest rate, RRR, market operation, etc.

Read more: What Is Monetary Policy? Types, Tools, Objectives & Examples

Example of How a Central Bank Influences the Economy

Assume a central bank wants to boost investment to help the Gross Domestic Product (GDP) growth and the unemployment rate fall.

It cuts the interest rate for these purposes.

Because of a cut in the interest rate, borrowing cost declines. It declines because commercial banks follow the central bank in interest rates.

Cheap money entices individuals to borrow for consumption and investment, increasing the demand side of the economy. According to economics, an increase in consumption increases investments followed by a rise in employment and growth of the GDP. Moreover, investors increase their borrowings and investment due to cheap money that helps the economy further.

Differences Between a Central and a Commercial Bank

Both are banks. And both deal with money.

However, they are different in many ways.

Here are some of the differences between a central bank and a commercial bank:

| Number | Central Bank | Commercial Bank |

|---|---|---|

| 1 | It is a monetary authority that plans and decides monetary policy | A commercial bank is obedient to the central bank’s rules and adjusts its policy with the central bank’s policy |

| 2 | It has the exclusive right to money printing and minting coins | A commercial bank does not have printing power |

| 3 | A central bank’s objectives are macroeconomic stability, such as currency exchange rate and inflation control | Commercial banks’ objectives are purely making money. |

| 4 | It mainly deals with internal and international financial institutions | A commercial bank deals with individuals and companies by accepting deposits and giving loans to them. |

| 5 | It is the leader of the monetary system in a country | Commercial banks are followers. For example, commercial banks follow central banks in changing the interest rate. |

| 6 | Public actors own or control central banks, and the private sector can not own or control them | The private sector can own commercial banks |