A diamond chart pattern can be both a reversal and a continuation pattern that occurs at the middle or end of a trend.

However, it forms more often as a reversal pattern than a consolidation.

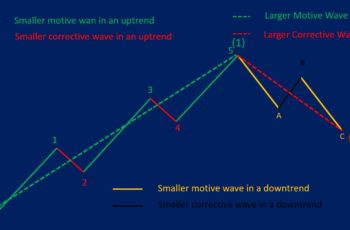

Visually, a diamond chart pattern looks like a diamond. First, it starts narrower, and its support line is falling while the resistance line is rising. Up to now, it resembles a broadening triangle. Next, both trendlines change direction in which the support line rises and the resistance line falls. Up to now, it looks like a broadening symmetrical triangle is attached to the regular triangle. Finally, the pattern completes if the price breaks in the opposite direction of the prior trend.

This is a diamond formation the top.

And this a diamond at the bottom

A diamond pattern looks like a complex head and shoulders pattern in which its lower line touches the support line of a bullish v-shaped pattern.

How to Trade Diamond Chart Patterns?

Often a diamond formation is not clear in structure. So, trading this pattern requires caution. Moreover, diamond chart patterns rarely occur.

In the beginning, you may see a broadening wedge pattern or a broadening triangle. Later, you may also see a v-shaped pattern. And finally, the diamond will complete itself.

If the formation is long enough, it is easier to find a good time to enter. However, it is difficult to enter when its width is small.

So, maybe it is a good idea to ignore the pattern if its width is small and trade after breakout if its width is long.

The best place to go long/short is after the breakout. And your take-profit should be at least twice the size of your risk or adjust as new formations appear.

Example of Diamond Chart Pattern

Finding a perfect diamond pattern is tough. However, I managed to find you a perfect one.

The daily chart of GBPUSD made a diamond chart pattern inside a symmetrical triangle.

Moreover, you see that in the middle of the diamond it looks like a v-shaped pattern. And the whole diamond is an inverse head and shoulders.

Visually, based on the chart, the stop-loss should be below the formation. And your take-order could be twice or even three times your risk.