The “three white soldiers” is a bullish reversal candlestick pattern. It has three candles with bodies and tiny or no shadows.

This pattern appears at the bottom of a trend or end of a bullish correction pattern. In candlestick patterns, a continuation pattern is also considered a trend.

Ideally, candles in the “three white soldiers pattern” should open within the body, the closing price of the preceding candle, or with a gap.

If one of the candles is a doji or has a tiny body, do not consider it a “three white soldiers candlestick pattern” because it shows a sign of weakness.

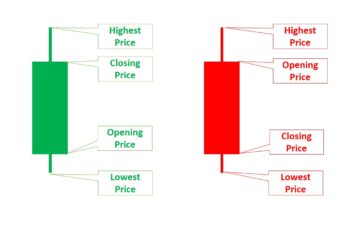

In the past, investors were not filling bullish candles and letting them be white. That is why they chose this name. Today, investors often choose green for bullish and red for bearish candles.

The opposite of this pattern is the “three black crows” which is a bearish pattern.

Here is an image depicting both of them.

How to Trade Three White Soldiers?

Trading this pattern is difficult due to being easily mistaken with falling three methods. The “falling three methods” is a bearish continuation pattern which is an opposite trend pattern.

This pattern is not very reliable. So be careful.

However, the following factors help you to trade it better:

- Taller candles are better. They indicate the strength of bulls. However, if they are too tall, wait for a correction because a pullback is more likely in those situations.

- During sideways, this pattern is not reliable. Make sure that it appears after a downtrend or at the end of a correction. Additionally, do not trade it in an unhealthy uptrend (an uptrend that continuously goes ups and downs and the color of candles switches frequently).

- A safe approach to trading this pattern is to trade if there is a larger uptrend.

- Always blend the “three white soldiers” with other technical analysis techniques such as wave theory, technical indicators, and chart patterns. For example, the appearance of this pattern at the end of the fifth impulsive wave is more valuable.

- Check the economic calendar and fundamental data to decrease your emotions and increase your chance of success.

- If you have sufficient supporting signals, place your trade or close your open short position, and don’t forget to put a stop loss under the pattern.

More confirmations lead to a higher success rate. Thus, try to study the chart in more depth.

Examples of Three White Soldiers

In this article, I have brought you three examples. Two of them are from the Meta chart, and the last one is from GBPUSD.

Example #1

In the following chart, the first three white soldiers succeeded a gap-down, a green inverted hammer, and a red hammer.

Due to the gap-down, going long after the first one seemed very risky.

However, because of a hammer and an inverted hammer, it was promising too. In these situations, it is better to wait for stronger confirmations. And a confirmation signal developed two days later by a gap-up. The best time to enter with a low risk/reward ratio was probably after the gap-up because it cleared the doubt about the bearish strength of the gap-down. Finally, the stop-loss should be put under the pattern at 298.

The second three white soldiers formed after a gap-down too but filled quickly. When a gap is filled the trend changes. So, after the gap was filled buying had less risk.

Example #2

On 16 March, the Meta stock completed a three white soldiers candlestick pattern.

I did very well.

The above pattern appeared above a strong support line. Moreover, the RSI indicator shows a correction period. If they are not convincing, a gap-up after the pattern should destroy the uncertainty.

Example #3

Here is an example from GBPUSD. This example is more complicated, and I talk somehow more than in previous examples.

Three green candles (explained on the chart) should not be considered as three white soldiers because they were too small compared to the prior red candle.

The first “three white soldiers” started strong after touching the 0.786 retracement level, which is the golden level. Moreover, this pattern began so strong that its first candle engulfed almost 7 prior candles. Furthermore, previously two doji candles hesitated to go down, another sign of reversal.

The second pattern started after a flag which is a bullish correction pattern. As a correction pattern is expected after a rally, it was a good sign for the continuation of the uptrend.

The third three white soldiers appeared at a critical moment. It was nearly at the end of an uptrend. Moreover, it formed at the end of a correction pattern that its top (around 1.30000) failed to break the resistance area, which is a warning. However, the third candle of this pattern was a tall green candle, a sign of strength behind bulls. Anyway, if you trade in these circumstances, you probably end with a loss, and it is OK to make some losses.

From a risk/reward ratio perspective, except for the first pattern, others were not good entry points. The first pattern appeared after a golden retracement level and the unhealthy uptrend had not started yet. On the other hand, the two other patterns had no supporting signals at all.

Bottom Line

The “three white soldiers candlestick pattern” is the opposite of the “three black crows” in terms of where it appears and the fact that the first is bullish and the latter a bearish reversal candlestick pattern.

This pattern is not very reliable due to being similar to the falling three methods (a bearish continuation pattern) and signaling lately.

However, it is a good pattern if traded with a high time frame uptrend.