What Is the Stock Market?

The stock market is a physical or virtual place where traders buy and sell securities. It is also known as the equity market and share market.

When people talk about the stock market, they mean where traders trade shares of publicly traded companies. A public company is a corporation listed on a stock exchange that its stocks are available to be sold or bought by the general public. The most well-known public companies are Apple, Microsoft, Tesla, Amazon, etc.

Generally, the ownership of a company consists of millions or billions, and one unit of them is one stock. An investor can buy as many as he can afford or be willing to risk.

The maximum number of stocks a company legally can issue are authorized shares. All issued shares held by insiders and outsiders are outstanding shares. And the number of stocks available for trade are floating shares.

What Is a Stock Exchange?

A stock exchange is a marketplace established by an entity where buyers and sellers can trade securities.

A company goes public by being listed on a stock exchange. And the stock exchange provides a ticker or trading symbol for recognizing it in the market. For example, BABA is the ticker for Alibaba and MSFT is the ticker for Microsoft.

Stock exchanges make money by charging market participants and companies for their services. Additionally, they make money by providing live data to companies such as Google Finance and Bing Finance and selling software and technologies needed for quotations and other things. For example, in 2021, the Intercontinental Exchange, owner of the NYSE made $4.10 billion in net profit and the NASDAQ Inc, the owner of the NASDAQ exchange, made $1.19 billion in net profit.

The 5 largest stock exchanges in the world are the New York Stock Exchange (NYSE), National Association of Securities Dealers Automated Quotations (NASDAQ), Shanghai Stock Exchange (SSE), Tokyo Stock Exchange (TSE), and Shenzhen Stock Exchange (SZSE).

What Is the Primary Stock Market?

The primary market is the segment of the equity market, where investors buy and sell new securities. These securities can be shares or bonds.

The IPO and issuing of new shares are examples of primary markets.

The main job of the primary market is to raise funds. In this market, financial corporations and high net worth people are involved. Retail investors do not have any place here.

Furthermore, in the primary markets big institutions may trade in between that is not available to the public.

The price of a security in the primary market is set after negotiation and research which may take months. Time and negotiation are needed because a huge sum of money is involved in this market.

What Is the Secondary Stock Market?

The secondary market is where everyone can buy and sell securities. In other words, a secondary market is a place where existing securities are traded.

When people talk about the stock market, they mean the secondary market. After the IPO, the stocks enter the secondary market.

Examples of secondary markets are NYSE and NASDAQ.

In the secondary market, you have two options to trade stocks. First, you can trade immediately, known as the spot market. Second, you can place a trade for future delivery known as the future market.

Unlike the primary market, where participants negotiate and set the price, in the secondary market, it is the supply and demand that set the price.

How Does the Stock Market Work?

Like any market, the stock market players are buyers and sellers.

Every investor makes his analysis and decision, buy or sell. There are millions of stocks traded every day. The daily trading volume, for example on NYSE, is nearly $20 billion.

If the trading volume from the buyer side surpasses the seller side, the stock price rises. And, if the selling volume is more than buying side, the stock price falls.

In the past, when computers and IT did not exist, investors were trading on the trading floor. A trading floor is a physical place where investors gather to buy and sell securities. However, today most trades take place online from anywhere in the world because everything necessary is available online.

The physical market is not dead yet. Investors gather to communicate with each other to share information, specifically fund managers. They also have offices around the stock exchanges to serve their customers.

Why the Stock Market Is Important For the Economy?

The stock market is one of the most essential tools of a free market. And it is due to the stock market we have computers, mobiles, and electric cars.

The stock market is not a must for a company to grow. For example, Huawei, one of the biggest companies in the world, is still private.

However, most large companies are public companies that evolved due to the stock market.

Here are some reasons that a free economy needs the stock market:

- The stock market promotes innovations: The stock market promotes innovation by enabling inventors to raise funds for new technologies and ventures. Professionals from various industries gather and analyze the potential growth of businesses years ahead and price them. That is why companies such as Amazon made losses for years but continued to operate. Today Amazon is one of the largest companies in the world.

- The stock market put in work unused capital: Some people don’t like to deposit their money in the banks because of low-interest rates and inflation that eats the value of their money. The best alternative is the stock market, where the money growth potential is higher, and people invest in it.

- The stock market helps grow the economy: Companies listed on the stock exchanges produce goods and services more efficiently, leading to more prosperity and economic growth.

- The stock market helps to higher employment: Due to the potential that the stock market brings to an economy, entrepreneurs found new companies and expand their existing companies. All of them lead to the creation of new jobs, and a fall in unemployment.

What Do People Mean When the Stock Market Rises and Fall?

When people say that the stock market rose or fell, they mean stock market indexes rose or fell.

An index is the weighted average stock prices of its components. They use weighted average because the market capitalization of companies varies and should reflect the true value change in the stock market.

Indexes are used as a barometer to mirror economic activities. Generally, a rising stock market means a rising economy, lowering the unemployment rate, rising prosperity, and so on.

The Dow Jones and NASDAQ are examples of indexes in the United States, Nifty in India, Nikkei in Japan, and FTSE in the UK.

How to Trade In the Stock Market?

Before entering the stock market, make sure you understand all risks and rewards associated with it. You may find financial freedom but also may lose all of your capital.

Some brokers warn on their website in Disclaimer Page that over 80% of traders lose. So, invest only the amount that you can lose.

To trade stocks you need a broker account. A broker is a financial institution that connects traders to the stock exchange.

The stock broker provides software capable of analysis to its customers, known as the trading platform. After depositing some money into your broker account, you can start trading. When you order stock, the broker immediately does it on your behalf in the real market.

A trader makes profits by buying low and selling high during volatilities. But, it is not easy. Thousands of independent views move the price of stock ups and downs. Sellers want to sell high, and buyers want to buy low. To be on the right side requires experience and knowledge.

The number of things that affect the stock market is countless. Economic activities, natural disasters, international relations, and even the opinion of people such as the CEO of investment banks and heads of central banks can impact the stock price. So, it is impossible to track everything that changes prices in the stock market.

Some pieces of knowledge you need to succeed in stock trading are technical analysis, fundamental analysis, inter-market analysis, following the news, and emotional management. The last one is crucial for success. Emotional management is the hardest part which you only learn by experiencing firsthand.

Why Should and Should Not Invest In the Stock Market?

Everyone does not become a professional investor, as everyone does not become a professional athlete. Before investing in the stock market or giving someone else to invest on your behalf, learn as much as you can.

If you decided to invest yourself, open a demo account to practice. A demo is a virtual account that mimics and enables you to experience investing with virtual money. Professional investors recommend being disciplined, educated, and hardworking to start investing. Moreover, they recommend having capital and risk only the amount you can lose. The money you risk, should not affect your financial life and your family members. The stock market is not kind. Only invest if you are confident and can lose.

For people who can not invest themselves, there is another option to give their money to funds such as index funds, mutual funds, and hedge funds. Be aware that these funds also may lose your capital. They have their terms and condition. Make sure to research them and understand their contract terms and conditions.

Who Regulates the Stock Market?

A regulatory authority (forcing body) is needed in every country to establish security and trust and ensure compliance with them.

Regulatory authorities of the stock market have different names in various countries.

In the US, the Securities and Exchange Commission (SEC), in India, the Securities and Exchange Board of India (SEBI), and in Singapore, the Monetary Authority of Singapore (MAS) regulate the stock market.

How Does a Company Get Listed In a Stock Exchange?

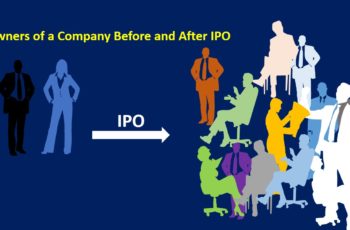

Initially, friends and family members own a company. As long as the public can not trade its stock, it is a private company.

A private company that wants to grow, expand, or has any other reason may want to go public. This company contacts stock exchanges such as NYSE and NASDAQ for advice, pricing, and negotiation. It takes about four months to process and check owners’ reports and claims.

Before going public, a private company should meet some standards required by SEC and the stock exchange.

After meeting the required standards, a private company goes public in an event called Initial Public Offering (IPO).

And after this event, regular investors can trade its stocks.

After going public, a company is bounded to new laws to protect its investors. For example, a public company must report the financial positions of the company quarterly, and the management team should not involve in insider trading.

Who Are Stock Market Participants?

Market participants are retail and institutional investors.

Retailer investors are people who trade in the stock. And analyze and make the decision alone, what stock to buy and what company’s stock to buy. Generally, retail investors buy and sell on consistent bases. They want to make a profit from daily or weekly volatilities.

On the other hand, institutional investors are financial institutions and other companies that buy and sell stocks. Institutional investors are large funds such as hedge funds, mutual funds, index funds, banks, and large companies. These companies are big players that manage billions and even trillions. For example, in January 2022, Black Rock hit a record of managing $10 trillion. Unlike retail investors, a team of professionals manages a financial company and holds for months and years. These companies trade for themselves or on behalf of their customers.

What Are Penny Stocks?

Stocks of small companies are penny stocks. The market capitalization is small and is generally worth less than $5 per share.

The risk of penny stocks compared to others are high. They tend to fluctuate over 10% frequently.

As penny stocks have high risk, they have the potential for high rewards too. For example, if you buy $10,000 worth of stock, and if it rises 50%, you have made $5000, and if it falls, you lose $5000.