Inflation is a general price increase of goods and services in a time interval, monthly, quarterly, and annually. And it is measured in a rate known as the inflation rate.

To understand inflation, look at nominal GDP and real GDP. If nominal GDP is higher than real GDP, there is a price increase in an economy.

Price increases resemble taxes from many perspectives. It redistributes wealth from savors of money to spenders and investors in society the way that tax does. It also decreases the purchasing power of your income, as the tax does. In other terms, it cuts the real income of the people.

What Are Origins of Inflation?

Inflation can originate from the demand-side or supply-side, known as demand-pull and supply-push inflations. In other words, high demand and shortage of supply are price increase culprits.

As the world economy evolves, sources of demand increase or supply shortage also may change over time. So, there are no specific things to say that cause a rise in demand and a fall in supply.

1. Demand-pull Inflation

The price increase that starts from the demand increase is called demand-pull inflation. It happens when the total demand outperforms the total supply in an economy.

Demand increase expresses that buyers are willing to pay a higher price to purchase a limited supply.

Because buyers are willing to pay higher, the supplier will increase the price. It starts from a demand increase, followed by a price increase by the supplier.

Some factors of demand-pull inflation are the followings:

- Government spending: Government spending increase demand for products and services, followed by price increases.

- Household consumption: Household consumption often increases if income rises. The income of households rises when there is confidence in the economy, low-interest rates, and so on.

- New export markets: Finding a new export market limits the supply of goods for the internal market and pushes the price of domestically produced goods higher. This case is verifiable specifically for small countries that depend on the export of a few products.

2. Supply-push Inflation

Supply-push inflation refers to the economic situation when supply outpaces demand.

Many factors affect supply increase, and some of them are as follows:

- Technological improvement: Technological improvement cut production cost enabling producers to produce more and cutting the price simultaneously. As the price decrease, consumers demand more goods and services.

- Finding new resources: Finding new resources enables producers to produce more and cut the price due to a cut in production cost and availability of raw materials. Ex: discovering a new oil field that costs less to extract oil, then the oil producers increase production and cut the price, which results in a demand increase by consumers.

- Tax cut: Corporate tax cuts and income tax cuts both affect demand positively. The corporate tax cut enables companies to lower prices, which results in higher demand, pushing the price even further. An income tax cut will increase the disposable income of consumers, leading to higher demand. Higher demand will increase the price of goods and services.

3. Built-in Inflation

Built-in inflation is the targeted one by the government. Authorities believe that around 2% price increase is necessary to keep the economy healthy and persuade investments.

Businesses tend to increase prices as much as they can to increase profits, pushing prices higher.

What Causes Inflation?

No one knows the exact causes of inflation.

But, it does not appear automatically.

It is a result of other factors such as the oversupply of money, a political crisis, and a shortage of resources.

1. Oversupply of Money

Oversupply of money causes inflation as anything that is too much worthless. Too much money supply decreases its purchasing power due to too much money in the market. In this situation, everyone is competing to purchase goods and services, which results in a price increase.

The process of money oversupply is simple. Let’s presume that the government increased its employees’ salaries by 100%. Also, assume that the government is paying this salary by printing money.

Now, a large portion of the population can afford to purchase twice more as in the past. In the short run, society does not feel this phenomenon. Government employees are happy, and they go to the market to purchase more goods and services, which means demand for goods and services increases. We know that a demand increase results in a price increase, and a price increase means inflation.

Producers feel higher demand which encourages them to increase production.

Due to price increases, other people feel price increases, which results in higher price expectations by these people. They also try to buy goods and services to protect themselves from further inflation that decreases the purchasing power of their money.

Very high inflation frightens producers too because they need to purchase raw materials and buy services. The price increase in raw materials discourages producers raise production or even may stop producing if the inflation is too high.

As a result, the money supply at the beginning for the short-run result in economic growth but, a higher demand pushes the price higher, and panic among other people in the society accelerates further inflation which is bad for the long run.

There are a lot of real examples that printed (supplied) too much money increased prices and even hyperinflation. Hyperinflation refers to the situation when the price could increase overnight.

2. Political Crisis

Political crisis causes inflation and even hyperinflation in a country. It creates distrust. Trust is one of the most crucial elements for economic growth and stability.

In a political crisis, producers stop producing. It takes place after a supply reduction and accompanies by a price increase. In political trouble, investment is risky because no one knows what happens tomorrow.

People also rush to the market to purchase to protect themselves from further price increases because they expect a worse situation in the future that stimulates price increases even further.

In addition, a price increase in domestic currency pushes people to exchange their domestic currency for foreign currency, which accelerates domestic currency supply and inflation.

3. Shortage of Resources

A shortage of resources means supply reduction. Supply reduction always goes along with price increases or inflation.

An example of a shortage of resources could be drought or natural resource depletion.

Drought invariably is followed by agriculture production decline. Agriculture products are used heavily in industries, such as juice, meat, dairy industries, etc. Production decline causes inflation because buyers compete for the limited supply, which pushes the price higher and higher.

Natural resources are limited. They can finish or continue, however, with high production costs.

The best example of natural resource depletion could be Nauru Island, a tiny nation in Oceania. Due to its heavily mining activities, Nauru was once one of the wealthiest nations in the world. Mining couldn’t last forever, and now Nauru is one of the poorest nations in the world.

Types of Inflation

The period of a general price increase can be short-term and long-term. Its sources also can be different. It can range from nearly one percent annually to multiple-digit numbers per month. Thus, the types of inflation can vary as well.

Generally, there are six types of inflation in terms of duration (longevity) and rate.

They are the followings:

1. Mild Inflation

Mild inflation, also known as creeping, and moderate inflation, is an average price increase of around two percent.

Economists argue that mild inflation is healthy and necessary for the economy. It is the target of most central banks, including the Fed Reserve of the United States.

During mild inflation government print money but at a lower level. People are not feeling the money supply increase.

There are many rationales the government wants a price increase, and the biggest one is to prevent deflation. Deflation is a condition in which the average price is falling. It has adverse economic consequences and should governments should avoid it.

2. Walking Inflation

It is walking (trotting) inflation when the average price increase is between mild (around two percent) and galloping (around 10%) inflations.

This type of inflation is unhealthy. In this situation, day-to-day goods and services can be unaffordable for ordinary people.

3. Jumping Inflation

It is also called galloping inflation. It is an economic situation when the annual average price increase is around 10%. Galloping inflation is considered unhealthy. The new investment will be zero or very low.

Employees are afraid of the future cost and prices that may make them unable to afford basic needs.

During this period, the government is printing money more than the price increase.

4. Hyperinflation

Hyperinflation refers to the economic condition where the average price increase is over 50% monthly. This phenomenon often occurs as a result of political problems.

Countries that experienced hyperinflation are Turkey, Venezuela, and Germany.

During hyperinflation, the government prints money heavily to finance its spending. As a result, people lose confidence in the money’s value rushing to the market to purchase commodities or foreign financial assets.

5. Chronic Inflation

Chronic Inflation refers to a sustained high price increase for a long time due to a continual money supply. It can last years and decades.

Countries that experienced chronic inflations are Turkey, Argentina, Japan, Venezuela, etc.

6. Stagflation

Stagflation is an economic situation when the unemployment rate is very high, GDP is falling, and at the same time, there is inflation.

Poor fiscal, government, and monetary policies are highly likely to be the main reasons.

How to Calculate the Inflation Rate?

Government agencies or private firms survey and release the inflation rate.

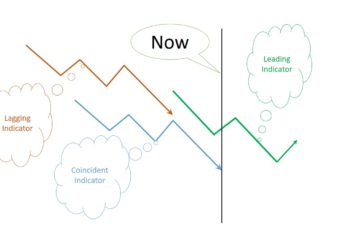

And most popular inflation indicators are:

- GDP Deflator: This indicator measures the rate of price increase of goods and services produced in the country, excluding imported products.

- Consumer Price Index (CPI): This indicator measures the rate of price increase for what a consumer pays for them.

- Purchasing Manager Index (PPI): This indicator measures the rate price increase for producers by surveying purchasing managers. And data are produced by IHS Markit for more than 40 economies.

- Food Inflation: It only counts food prices.

Even though the government or other entities announce inflations, they may not represent your consumption behavior. So, it makes sense to know how inflation is calculated.

To calculate this rate for a period of time, you need to define the base year and the ending year.

The base year is the time you want to compare the ending year with. It could be last year or many years ago.

So,

Inflation rate = {(ending year – base year)}/(base year) * 100

Example:

Suppose that price of your clothes last year (base year) was $100 and this year (ending year), it is $110.

So let us calculate the clothes inflation.

Inflation rate = (110 – 100/100*100 = 0.1*100 = 10%

As a result, your clothes inflation is 10% compared to a year ago. It means that you pay 10% more than last year to buy the same clothes.