What is Sector Rotation?

Sector rotation refers to the sequences of money flow in the stock market. In other words, sector rotation shows what industry’s stock performs better in various business cycle stages.

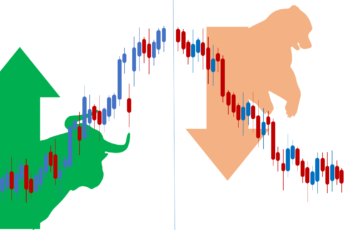

The stock market like the economy has cycles. And they are accumulation (bottom), mark-up (bull market), distribution (peak), and mark-down (bear market) phases.

On the other hand, the business cycle (also known as the economic cycle) refers to the four stages of expansion, peak, recession, and trough in the economy.

These two cycles generally go hand in hand. However, often, the stock market leads the business cycle. It means that the stock market starts rising and falling first, and the economy follows. That is why the stock market is considered a leading economic indicator.

For example, in the 2020 Covid recession (light blue area), the stock market led the economy both in the downtrend and uptrend. The stock market started falling on 19 Feb 2020, but the recession started on 28 Feb 2020. On the upside, the stock market began to rise on 23 March 2020, but the economy did on 01 May 2020.

With that being said, a reversal from an uptrend to a downtrend doesn’t need necessarily lead to economic recession.

The following chart shows the four last recessions in the USA and five downtrends in the stock market.

In the above chart:

- The first bear market did not lead to an economic recession.

- The second, fourth, and fifth stock markets led the economy in uptrends and downtrends.

- The third stock downtrend led in the downtrend but did not in the uptrend.

What Sectors Are in the Stock Market

Diversification is one of the main reasons to understand sectors. Consider each sector as a basket and your investment in companies as your eggs. So, it makes sense to understand sectors and put your investment in many sectors than one.

There are 11 stock market sectors in Global Industry Classification Standard. The three largest sectors are technology, health care, and financial sectors while the smallest sectors are utility, real estate, and material.

The “State Street Global Advisor”, or SSGA is one of the most well-known companies that manage ETFs of 11 S&P sectors in the USA market. The following chart represents those 11 sectors with their ETF tickets.

Please note that the above are not only ETFs in the market. There are many such as Vangardthe and Invesco.

However, we prefer to track SSGA ETFs.

| No. | Sector ETFs | Symbols | SP500 Market Weight* |

|---|---|---|---|

| 1 | Financial Select Sector | XLF | 12.35% |

| 2 | Technology Select Sector | XLK | 28.11% |

| 3 | Materials Select Sector | XLB | 2.46% |

| 4 | Consumer Discretionary Select Sector | XLY | 10.64% |

| 5 | Industrial Select Sector | XLI | 8.37% |

| 6 | Real Estate Select Sector | XLRE | 2.43% |

| 7 | Consumer Staples Select Sector | XLP | 6.79% |

| 8 | Energy Select Sector | XLE | 4.02% |

| 9 | Communication Services Select Sector | XLC | 8.56% |

| 10 | Health Care Select Sector | XLV | 13.65% |

| 11 | Utilities Select Sector | XLU | 2.62% |

As of June-23-2023, source: Fidelity.com

Worth mentioning that the above table represents the US market. If you are interested in other markets such as India, the sector rotation almost works the same way. This article explains the sector rotation and can be educational for studying any market.

Note: the market weight changes based on the performance of sectors.

Sector Rotation Group

Investors have categorized sectors into two groups and some into three groups. But, this article considers two groups, cyclical and defensive sectors.

The cyclical group contains those sectors that do well when the economy is doing well. They are more volatile, riskier, and potentially can have a good return on investment. Conversely, they perform weak when the economy is weak. Generally, these sectors include materials, tech, information tech, financial, consumer discretionary, industrial, and real estate.

The defensive group includes those industries that consumers demand regardless of how the economy performs. This group is less volatile, less risky, and has a lower return on investment capabilities. They are consumer staples, energy, communication services, healthcare, and utilities.

Here is the summary of sector rotation group.

| No. | Cyclical Sectors | Defensive Sectors |

|---|---|---|

| 1 | Financial | Consumer Staples |

| 2 | Tech | Communication Services** |

| 3 | Materials | Healthcare |

| 4 | Consumer Discretionary | Utilities |

| 5 | Industrial | |

| 6 | Real Estate** | |

| 7 | Energy |

Sector Rotation Sequences

Generally, a sector starts rising after one and before another specific industry. However, it is not a strict rule, and it can change.

Here is an image that shows what industry performs better in specific stock market stages. In the following, this article explains each of them separately.

Please remember that sector rotation does not perform like physical laws and can vary based on social, political, and economic conditions.

How to Analyze Sector Rotation?

As mentioned earlier, there are 11 sectors in the stock market which all are part of an index. An index itself is an average. And that average in this article is the SP500 index.

To keep it short this article pinpoints essential things to do while doing your analysis.

Each sector moves with SP500 because it is part of it. A sector in the stock market includes related companies in the SP500. So, it is logical to move with SP.

Because a sector moves with SP, there should be critical points to look for which may not be identified easily.

Here is a chart showing all of them together. It is hard to read.

Generally, all sectors move in the same direction. However, the portion of funds allocated to each of them varies.

Please note that the ETFs we track to analyze the market contain the largest companies listed in the SP500 in the USA. On Srading.com, we suppose that you are trading American stocks. If you are trading/investing in other countries, please google to find relevant ETFs.

Because ETFs mimic the largest companies in a sector, they might represent the whole market. There are many companies that are not listed in the SP500 Index but are listed on exchanges.

Because it is hard to analyze all 11 sectors in one chart, we add a sector and the SP500 in a sector chart to analyze this industry with the benchmark. This way, we have only two graphs which are easier to understand and more helpful.

So, how to understand a sector performs relative to the SP500?

Here are some steps to remember, and explain them with our following hypothesis chart.

The first thing to remember is to not add all sectors in the chart, because it makes the analysis harder than being helpful.

Second, select the starting date (base year/date) and an important date, such as the end or beginning of a recession. In this method, the SP500 and the selected sector start from 0% growth or decline, helping us compare relative to the base date.

Third, from the starting date on, if a sector graph moves above the SP500, it has performed better than the average (index). Conversely, if it moves below the SP, it has performed worse than the average.

Fourth, during a time, the graph that moves steeper upward, it has performed better in that period. And vice versa.

And Fifth, over time, a sector and the SP lines may diverge. In this case, the graph that is above performs better.

If you are interested to track daily performance in a table, visit Fidelity Research and Quote

Cyclical Sectors

Cyclical sectors refer to those industries that perform well in a bull market.

Consumers and investors need the confidence to purchase and invest in these sectors. In other words, their performance depends on the economic activities and move together.

Visually, you may not find some of the arguments in this article evident because of following sectors are part of the SP500 index. And more importantly, past performance does not guarantee future outcomes.

This article explains these sectors starting with the financial and ending with the energy sectors. However, in the real market, it might not follow the sequences elaborated in this article.

1. The Financial Sector

A company in the financial sector offers financial services such as banks, investment firms, and insurance businesses.

Some well-known examples are UBS (a Swiss investment bank), JPMorgan Chase, and Bank of America.

Doing business in the financial sector is hard because it is very competitive and requires a lot of experience and skills. Moreover, this industry is very volatile.

This sector in the stock market performs well before the recession ends. The reason behind its performance is interest rates. During recessions, central banks stimulate the economy by cutting the interest rate. A lower interest rate benefits this sector, enabling them to provide loans more and make more profits.

The above chart shows that the financial sector started falling in early 2007 and broke down the SP500. Before that time, the financial sector performed better than the Index that benefited from lending to house buyers.

After the recession ended, the financial sector started rising but fell below the SP500 Index. The reason that the financial sector fell below was the technology sector because a huge part of the SP500 is technology companies.

2. The Technology Sector

The information technology sector includes companies that produce high-tech hardware and software products.

Some well-known companies in this sector are Microsoft, Apple, TSMC, and Alphabet corporations.

These companies are often growth companies. They invest in future products and have big R&D budgets.

This sector includes the cyclical group because confidence and a growing are required to increase spending in research and development. Moreover, investing in these companies carry a higher risk due to unknown outcomes because the outcome of R&D does not always tend to be positive.

As a result, this sector performs well after the recession is over.

From the Dot Com recession to late 2007, the SP500 performed better because investors’ trust had not recovered yet. And when the recession ended, the technology company started rising faster than the SP500 index

3. The Material Sector

The material sector ($XLB) includes companies that produce, distribute or sell raw materials used for other companies to manufacture finished goods.

Examples of the material sector companies are construction material, metal, mining, paper, and forest products, producers.

The stock price of a company in this sector depends on the raw material price it produces. For example, if iron increases, it increases the profit of companies that mine iron, leading to rising in their stocks.

Because higher demand for raw materials occurs in a bull market, it is logical to expect a rising stock price in this sector during a bull market.

After the recession in 2021 ended, the material started performing stronger rising to 100% from the end of the recession. However, it fell much faster than the SP500 index, shown by the steepness of its graph.

Following the 2008 recovery, the material began performing better than SP500 again. However, it was more volatile than the average (index) and is expected to be.

4. The Consumer Discretionary

Consumer discretionary or cyclical products are those products that owning is not necessary. Examples are cars, luxury goods, and entertainment services.

Generally, consumer cyclical are expensive, and buying them requires confidence in the economy. So, they do well when the interest rate is low.

Examples of companies in the discretionary sector are Tesla, Starbucks, Toyota, Amazon, and Nike.

By moving above the index from 2001 to 2007, the consumer discretionary sector performed better SP500. And it repeated after the 2008 recession ended.

However, during recessions, it was doing worse than the SP500. For example, in 2020, consumer discretionary dropped much more than the average in terms of percentage.

5. The Industrial Sector

The industrial sector encompasses those companies that aid other businesses or produce machinery for manufacturers and service providers. In other words, a company in the industrial sector sells its products or services to another company that directly sells to end users. For example, a shipping company from the industrial sector provides services to a retail store which is another business, and the retail store sells directly to you and me.

Companies in this sector are construction companies, machinery manufacturers, defense contractors, airplane makers, and shipping/delivery companies.

Some of the best well-known companies in the industrial sector are DHL, FedEx, Boeing, Lockheed Martin, and 3M.

The stock price of these companies depends on other companies. So, there should be a healthy economy (or bull market) for their stocks to perform well.

As a result, the industrial sector performs better in the middle of a bull market but follows the material sector.

As shown in the above graph, the industrial sector performed better than the average during normal economic conditions.

However, in 2008 and 2020 recessions fell faster and more than the average.

6. The Real Estate Sector

The real estate sector includes companies that buy and sell lands and buildings or are developers.

Examples of real estate companies are CBRE Group and Simon Property Group.

The real estate sector falls in the cyclical group. This sector performs well when the economy is in good shape. People tend to buy homes when they feel secure economically.

On the other hand, when the economy performs unpleasantly, many homeowners who purchased using loans will lose their properties and new buyers will drop in number. As a result, this sector performs badly during a recession and early recovery.

Important: some investors think of the Real Estate sector as sensitive or defensive because it does not clearly moves like the above five-mentioned sectors.

In the above chart, because the SPDR Real Estate ETF (XLRE) had no data available earlier than 2016, I inserted the Vanguard Real Estate Index Fund ETF (VNQ). There is no big difference. They almost perform identically.

From the end of the 2001 recession up to 2011, the Real Estate Sector showed to be cyclical, as shown on the chart.

However, after 2011 Real Estate was not potent as the SP500 index. The main reason could be other industries that are a large portion of the index. As mentioned in the first table, Real Estate only involves 2.43% of the index. So, because of its small weight, its movement may not be as strong as the index.

7. The Energy Sector

A company belongs to the energy sector if it produces, manufactures, or distributes fossil fuels and its equipment.

Some well-known energy companies are Aramco of Saudi, Exxonmobil, Total, and Chevron.

The energy sector begins rising when confidence in the economy is strong and consumers purchasing power has risen. At this stage, people have money to spend and enjoy their lives, for example, vacationing, resulting in the rise of energy stocks. The stock market is at the top during this time, but the economy is still growing.

The Energy sector showed perfectly to be cyclical except during the covid-recession which was a rare phenomenon.

After the 2001 recession ended, the energy sector began performing better than the average (index). And the distance between the index and the energy sector widened till the 2008 recession.

As seen on the chart, during both recessions the energy sector collapsed faster than the index.

Defensive Sectors

Defensive sectors include those companies that do not depend heavily on economic activities. The economy impacts these companies however less than cyclical. In other words, defensive sectors produce or provide essential products and services.

For example, people spend on electricity and water. And people will spend on them irrespective of the economic situation, but maybe a little less.

These sectors often during a recession perform better than the average (index). It shows by being less volatile and moving its graph above the average graph (index).

1. The Consumer Staple Sector

The consumer staple sector includes those products and services that consumers buy daily. Examples of staple products are dishwashing liquid, beverages, and food.

And some well-known companies in this sector are Nestle, Pepsi, and Unilever.

Consumer staples do well at the beginning of a downtrend. During this time, the business cycle starts its downturn. However, the economy is still at its peak. There is still both good and bad news about the economy. Some are optimistic, and some are pessimistic.

From the end of the 2001 recession up to the early 2008 recession, consumer staples performed worse than the average. And during the recession, the staples performed better showing by its graph that fell less than the average.

2. The Communication Service Sector

The communication service sector includes companies that telecommunication, entertainment, interactive media, and media companies.

Some well-known companies in this sector are Verizon, NetFlix, Facebook, and Disney.

During hard times consumers cut their expenses, and the communication service sector is among the first.

However, these companies have some features of technology companies. So, a hard conclusion is difficult and you may not find it visually evident.

Important: some investors consider it a sensitive sector or even cyclical. So, be careful when doing your analysis.

In the above chart, because the SPDR communication service ETF (XLC) did not have enough data, I included the Vanguard Communication Service Index Fund (VOX) too.

3. The Healthcare Sector

Healthcare follows consumer staples, the economy is in a recession, and interest rates are low.

People spend on healthcare no matter the economic situation because it is a priority.

So, it is logical to do well compared to other industries, such as tech and services.

Moreover, the lower interest rate also benefits healthcare stocks because it lowers the cost of raising debt.

Some well-known companies in the healthcare sector are Johnson & Johnson, Pfizer, and the UnitedHealth Group.

On average, health care performed better the SP500 index.

However, the reason why this sector falls in the defensive sector is its good performance during the economic downturn.

4. The Utility Sector

The utility starts doing well. People need electricity and water which they consume. Moreover, the interest rate in this stage falls making the cost of capital cheaper and borrowing attractive for utility companies.

Some well-known companies are Duke Energy and Exelon, and PPL Corporation.

The above chart shows that during the 2008 recession, the utility sector falls less than the SP500 index. And continued its return to be above the average line till 2011.

Read more: Intermarket Analysis for Beginners

Conclusion

Sector rotation analysis helps. However, because these sectors are part of a basket (SP500 Index), their movement sometimes is not clear visually.

Moreover, sector rotation analysis like other types of analysis depends on many factors such as political and economic conditions. So, do not expect it to produce amazing results.