A “rising three methods” is a bullish continuation candlestick pattern containing four or more candles.

In this pattern, the first candle is a long green candle. Then multiple small candles (most of them red) go sideways or go down in a shallow steep. Finally, the last candle is a long green candlestick as well.

Defining technically, the “rising three methods” has three candles between the first and last candle. However, it is ok if there are two, four, or more candles, as long as they stay within the range prices of the first and last candles.

Often rising three methods patterns are similar to flag patterns. But not always.

A rising three methods candles indicate that bulls have rested and will start going up soon. A rest or pullback is necessary for the market to discount some pricing factors.

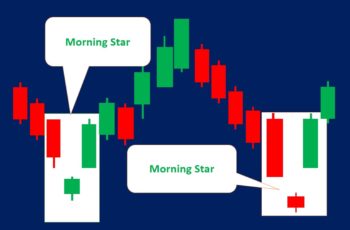

The bearish counterpart of the rising three methods is the falling three methods candlestick pattern. It is a bearish continuation pattern that mirrors the bullish version.

Here is an image showing both of them.

How to Trade Rising Three Methods?

Before trading the rising three methods, make sure the pattern is finalized.

It takes at least four sessions to develop. So don’t think of some candles as this pattern unless the chart clearly shows it.

By the way, there are six things to consider when you find a rising three methods:

- It should appear in an uptrend. Or, it takes shape at least after a powerful reversal pattern such as piercing and a hammer.

- Taller first and last green candles indicate the power behind bulls. So taller is better.

- Smaller and more candles between the first and last candles mean a long rest. And, after a long rest, bulls will be more potent. So small and more candles in between are better.

- Blend this pattern with indicators such as MACD to make sure that this pattern is not in an overbought condition. Moreover, blend it with other technical techniques because more supporting signals lead to a higher success rate.

- Check the economic calendar and news if there is a critical event. And consider the health of the economy, industry, and the company, if you are trading stock. For forex traders, tracking economic activities and industry is enough.

- If you are assured, place your trade if it forms nearly at the start of the trend. If you are already long, change your stop-loss under the pattern.

Because the “rising three methods” is a continuation pattern, there will be less confirmation than reversal patterns. And it is ok. However, more is better.

Examples of the Rising Three Methods

In the following, you see three examples. The first example is from the stock market. The second example is from the forex. And the last example shows a failed pattern that did not have the qualities of a satisfactory rising three methods.

Example #1

On six January 2020, the Meta stock finished a rising three methods.

The above pattern owns qualities of a well-defined rising three methods candlestick pattern.

First, it appeared in an uptrend, which is necessary.

Second, the first and the last candles were tall.

Third, the candles between the first and second and the last candles were short enough to indicate a good rest.

And lastly, there was a gap, one of the great supporting levels.

Based on the above reasons, buying at the end of this pattern was great.

If you buy in a similar condition, put your stop loss at the bottom of the pattern. And, if you have an open long position, modify the stop-loss position and put it under the pattern.

Example #2

In the following chart, the USDJPY daily chart made two “rising three methods candlestick patterns. And it started in the middle of June by completing a double bottom reversal chart pattern.

The first pattern from the left had three supporting signals. The first signal was the double bottom, which is a reversal pattern. The second was the tall green candle, which shows the strength of the bulls. And lastly, the candles between the first and last green candles are small-bodied and doji sessions. Due to these reasons, buying was an opportunity.

Example #3

The EURUSD daily chart made a “rising three methods” that was not successful.

This pattern failed because it did not have convincing qualities, even though two sessions earlier there was a tweezers bottom.

The chart shows this pattern:

- Formed during an unhealthy downtrend.

- The red candles in the middle were not small enough and didn’t move sideways either.

- There were no potent confirmations, such as a window (gap).

Based on the above argument, buying was not a good idea. There should be sufficient pieces of evidence to put your capital at risk, which was not there.

Bottom Line

The “rising three methods” is a bullish continuation candlestick pattern that should appear in an uptrend, and there should be enough supporting signals to place a new trade.

It is also a pattern in that you can move your open long position stop-loss to its bottom. This way, you make money and prevent losses in case the trend reverses fiercely.