The purchasing power of money is the power of one unit of a currency that can buy products and services.

You can say that value of a currency is the purchasing power of that currency.

The purchasing power of money increases when there is a low supply of money by the government, central bank, and commercial banks. It decreases when the supply of money increases.

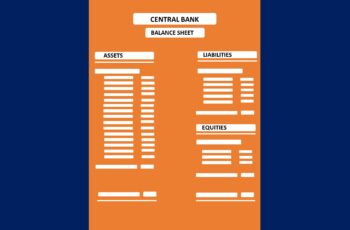

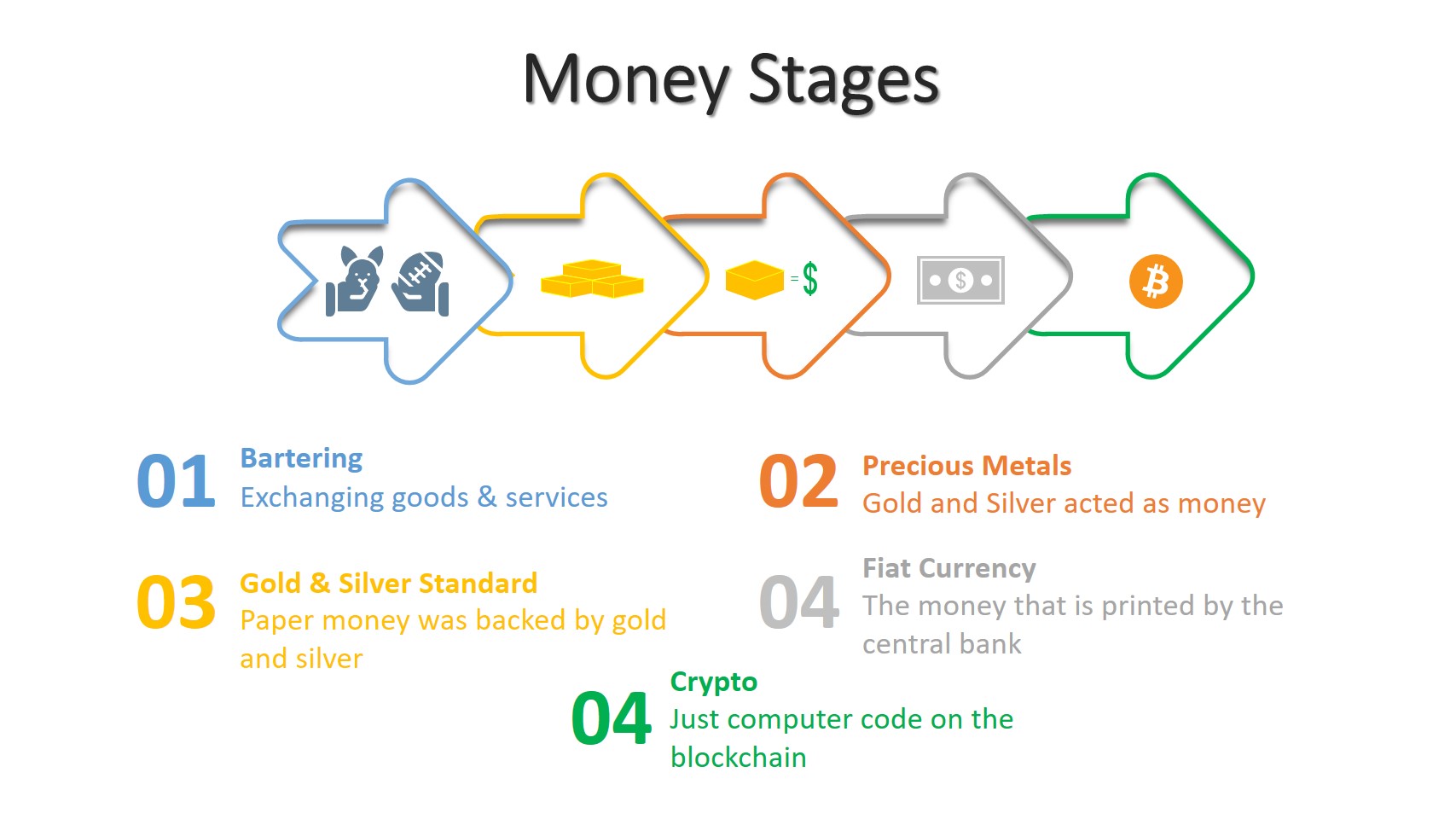

The currency that I mean here is the fiat that central banks print. I do not mean gold and cryptos or other forms of money.

Governments and investors use the purchasing power of money to compare money’s ability with past years.

Forex traders analyze them to gauge the fair value of currencies and make trading decisions.

Factors that Affect Purchasing Power

The purchasing power of currencies also fluctuates, as do other things.

1. Money Supply & Inflation

The money supply and inflation are always interconnected. An increase in the money supply directly pushes inflation higher. And the opposite is correct as well. A decrease in the money supply brings down the inflation rate.

Suppose that the price of one egg is $1. If the price of egg drops and you could buy paying one dollar for two eggs, the purchasing power dollar has doubled, and on the contrary, if you need to pay two dollars to buy one egg, the purchasing power of money has decreased to half.

When a currency loses its purchasing power, it means that inflation is positive. On the other hand, when it gains the power to buy more than in the past, it shows negative inflation (or there is deflation).

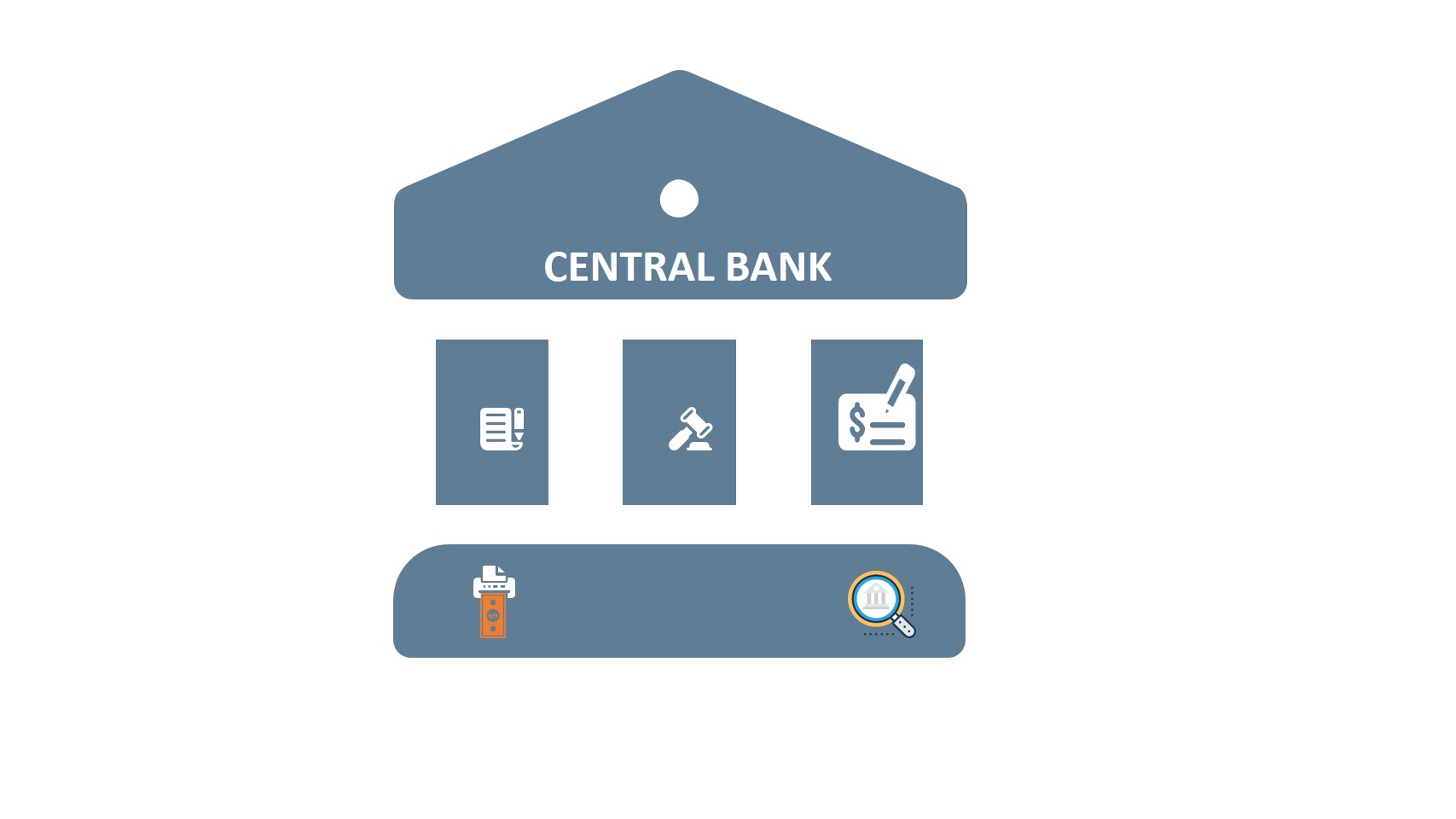

The government somehow can manage it by regulating money supply and demand by setting interest rates, changing holding reserves requirements, issuing bonds, etc.

The authorities can decide the money supply because they have almost full control over the amount of money in circulation. It doesn’t have full control over money demand, because people individually decide if to keep cash, how much, or even not at all.

However, due to international trade and relationships, it can not completely control the way it wishes. Trading partners will react. For example, if China weakens the exchange of the Yuan, the United States may react by increasing the tariffs on Chinese products to protect its domestic companies.

2. Exchange Rate

The exchange rate is the relative value of one currency against another currency.

For example, the USDJPY represents the relative value of the United States Dollar against the Japanese Yen.

When a currency loses value against another, its purchasing power declines, and vice versa.

Every country trades with other nations. So, a currency’s value in the international market directly impacts its purchasing power.

How to Calculate Purchasing Power of Money?

The calculation of purchasing power helps you understand how much more expensive or cheaper today is relative to another year in the past.

To calculate purchasing power, you need CPI data for two years.

Simply, divide the CPI number of the earlier year by this year. You will get how much you needed to pay in the earlier year for goods and services that you pay one dollar today.

To find in percentage terms, subtract the derived number from 1.

Example:

The CPI number in early February 2018 was 250. Four years later, in Feb of 2022, it was 285.

Let us calculate how much more expensive Feb of 2022 was than Feb of 2018.

Solution:

250/285=0.877

The above result means that $1 in 2022 can buy the same amount that $0.877 could buy in 2018.

1-0.877=0.123=12.3%

The above result means that in the Feb of 2022, goods and services are 12.3% more expensive than Feb 2018.

There is an easier way in the U.S. to calculate purchasing power. Visit the CPI inflation calculator on the U.S. Bureau of Labor Statistics website, and do it.