Private credit is not new. But it came to public attention recently. This article guides what private credit is and ends with comparing it to private equity.

What Is Private Credit?

Private credit (also known as private lending or direct lending) is a loan by a private lender to a borrower.

In other words, private credit is a non-bank loan not financed by leverage or bank deposits.

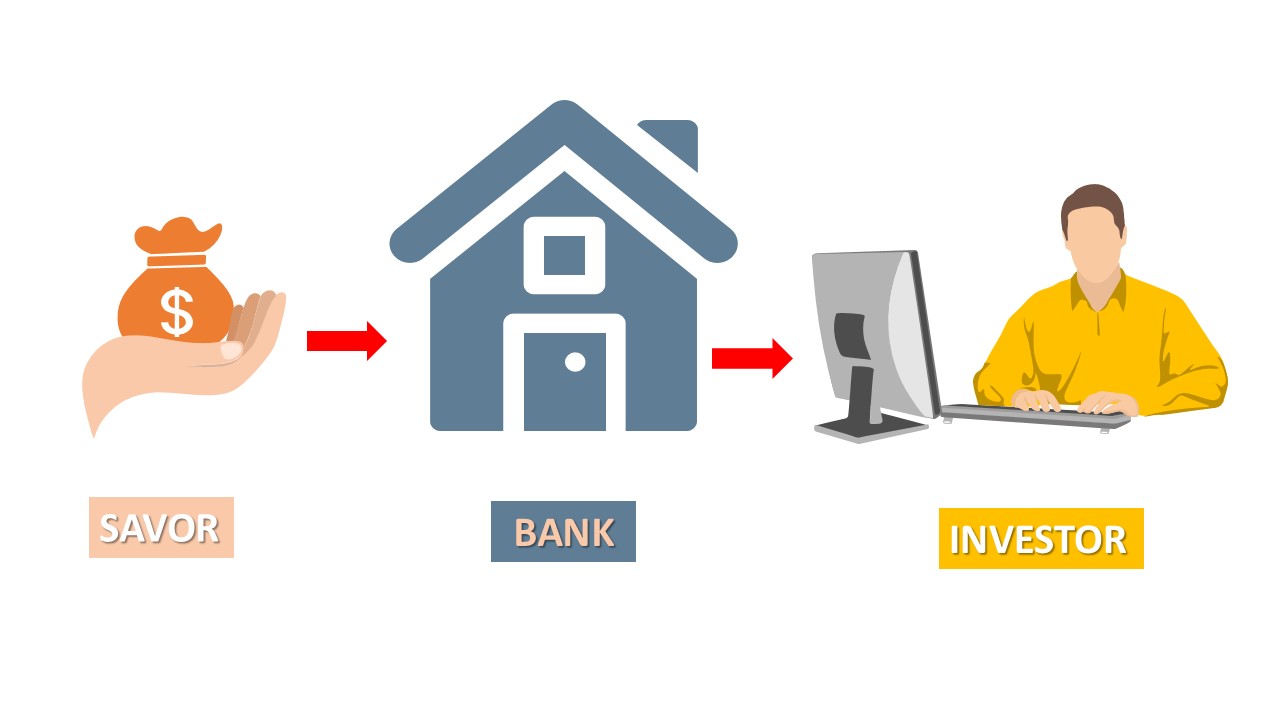

In a banking system, customers deposit in their bank accounts. Then, the bank creates more money depending on the money multiplier and provides loans to its customers multiple times more at a higher rate.

Read more: How Do Banks Make Money And What Are They?

But, in private lending, the money does not enter the bank. Instead, the borrower borrows from a private credit fund with institutional and individual investors. It is an alternative funding method to raise the funds needed to grow their businesses.

Borrowers are generally privately owned companies unable to get loans from banks or issue bonds. But sometimes large companies also raise funds through private lending.

Originally, private lending started in the 1980s when insurance companies began lending directly to companies with strong credit records.

However, it started accelerating after the 2008 financial crisis as an alternative to banks when regulators introduced new laws to stop or limit risky loans.

Today direct lending is a rival to mainstream lending, and its market size has surpassed 1.5 trillion dollars.

How Does Private Credit Work?

Like a publicly traded company, a private business can not issue shares and bonds.

So, a private company that needs funds to grow, expand, or acquire another company looks for loans. There are two options: borrowing from a bank or raising funds through a private credit.

Often during stressful times, banks tighten their lending policy, making for some private companies to get loans impossible or difficult.

During these times, one option is still available, private credit.

The way that private lending works is simple.

The private company instead of going to a bank that has too many requirements meets a private lender. The private lender could be a wealthy individual or an investment fund. This process is quick and direct. The borrower gets money and pays its installments over time.

Types of Private Credit

There are three types of private credit:

1. Distressed and Stressed Debts

Distressed debt is the debt from a financially distressed company that is on the brink of going bankrupt. On the other hand, stressed debt is from a business with serious financial issues, but is not immediately near bankruptcy.

2. Senior Debt

A senior debt is often a secured loan and has priority in payment. This type of debt is above subordinate debts and equity in the finance structure pyramid of a company.

In other words, for receiving a secured debt the borrower pledges some asset as collateral for the loan, and the lender is the first to receive payments from the borrower.

A secured loan carries less risk for the lender if the borrower company goes bankrupt. However, these types of loans typically come with lower interest rates.

3. Mezzanine Debt

Mezzanine debt is a type of debt between senior debt and equity in a company. Senior debt is a type of debt backed by assets and has priority in payment. Equity is the portion of a company that owners claim.

It is called mezzanine debt because it has features from both equity and debt, but it is debt.

It is debt because the issuer should pay interest rates.

The mezzanine debt has features of preferred stock because the lender can have warrants or convertible equity options. Moreover, the issuer can defer payment, which means it has no payment priority.

4. Special Debt

Special debt refers to debt provided for special purposes such as mergers and acquisitions, divestitures or spinoffs, or similar situations.

What Are the Benefits of Private Credit Investment?

Private credit outperforms public loans. However, it carries a higher level of risk. You will read about these risks later in this article.

Now, let us explore some benefits of investing in the private debt market.

1. Higher Rate of Return

Those companies that can not borrow or have difficulties getting loans from banks seek private credit. Of course, giving loans to these companies has higher risks. A higher risk should have a higher return. That is why direct lending has a higher return than other credit assets.

Many private credit loans come with floating rates, which increase when interest rates rise and decrease when fall.

2. Diversification

Diversification is a risk management technique that lowers risk by dividing investments across different financial assets including private lending.

Private credit loans are not publicly traded and are typically valued every quarter. So, after the provision of the loan, investors are free from emotions and protected from short-term volatility.

Instead of focusing on short-term volatility, investors can focus on the performance of the borrower businesses.

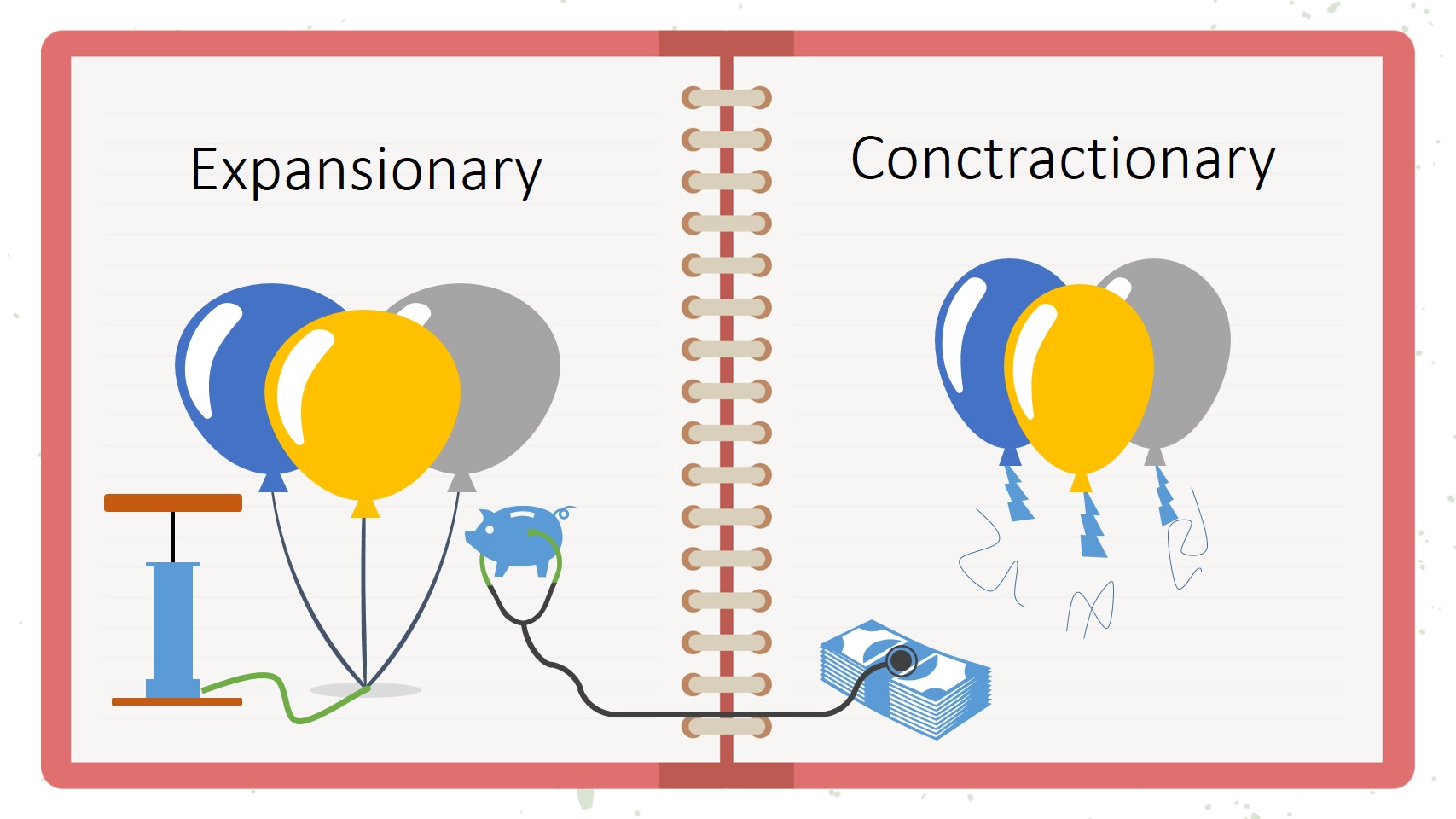

3. A Hedge Against Inflation

The lender can opt floating interest rate which increases or decreases with the central bank’s rate. This feature makes private credit an excellent hedge against inflation and rising interest rates.

If inflation rises, the central bank raises the overnight lending rate between banks, and banks follow by adjusting their charging rate to their customers. A rising interest has a negative correlation with the stock market and old bonds. However, if the borrower pays a floating rate, the interest rate rises as the inflation and overnight borrowing rate rise.

What Are the Risks of Investing in Private Credit?

The private credit risks are the same as mainstream credit, but the degree will differ depending on the borrower’s condition and broader market conditions.

However, this type of asset class carries a higher risk than other fixed-income loans.

So, knowing the private lending risks involved is necessary before saying yes to a proposal.

The following are common private credit risks.

1. Interest Rate Risks

Generally, private lending loans come with floating rates, which follow the central bank’s (Fed in the USA) interest rate. Moreover, private companies seek private credit during tight credit policies by commercial banks.

Here is the risk.

If the central bank cuts the interest rate, the return on private lending declines. In addition, the private borrower also may seek funding from banks that may cause unused funds. Furthermore, if the interest rate falls, investing in stock is a better option which increases the cost of opportunity.

2. Weaker Credit Profile of the Borrower

The return on investment of private lending is related to the borrowers’ success.

Typically, businesses seeking private credit have short operation history and their future is not as clear as established companies. Moreover, is very likely that other financial institutions such as banks and credit unions have denied lending. It means these companies may have weaker credit profiles and therefore the risk of defaulting on the loan is higher.

3. Illiquidity Of Private Credit

Private credit is a highly illiquid investment.

Liquidity means how quickly you can convert your asset to cash.

Converting your investment in private lending to cash is hard. Moreover, if you find a buyer, you may be forced to bear losses if you sell them.

As a result, understand that private lending is a long-term investment.

4. Weak Underwriting Standards

Underwriting standards are guidelines by lending institutions such as private credit funds, banks, and credit unions for deciding if a borrower is worthy of credit.

Moreover, underwriting standards help protect lenders against excessive risk and losses by setting how much debt should the borrower receive, duration, conditions, and interest rates.

Among lenders, the direct lending industry has lower underwriting standards than banks and credit unions. The lack of a high standard increases the risk level for lenders.

Private Credit Differences from Other Types of Loans

The debt market size in the world is huge. In the US alone, it stands at about $53 trillion.

It means that the private lending size is around 3% of all debts.

Below are key differences between private credit and other type of loans.

1. Flexibility

Unlike bank loans and bond issuances, in private credit, the lender and borrower negotiate to meet the borrower’s needs in terms of size, type, or timing of transactions.

Banks have tight terms and conditions that a borrower needs to meet to get loans. Based on written conditions, a bank specifies how much a borrower can borrow, what type of loans can a business borrow, and when they can borrow. For example, during a recession, requirements become stricter making it impossible or hard for a private company to borrow. Some new private companies have no credit profile and do not meet the bank’s requirements.

On the other hand, private lending is adjusted to suit a borrower’s needs. For example, distressed debt is highly specialized, and banks are not interested however, a private lender who specializes in the borrowers’ business may provide loans.

2. Speed

Generally, getting loans from a private lender takes less time than banks and bond issuance.

For example, an SBA loan in the USA can take months. Moreover, issuing bonds also may take several months.

On the other hand, direct lending is fast, and negotiation may last a short period and close the deal.

3. Confidentiality

When a business applies for loans from a bank, the bank requires some documents such as a business plan, financial statements, sales, and so on.

If the bank approves lending, it shares data with credit rating agencies. Once, a credit rating agency receives this information, it shares it with its subscribers.

It is not the same with direct lending. In a private credit, the negotiation takes place between the lender and the borrower without sharing info with a third party.

Understanding Private Credit Fund

A private credit fund is an investment firm that provides debts to private companies. Some firms only specialize in private lending. However, private equity firms, hedge funds, or other asset managers also invest in private lending.

Private credit funds make money by charging fees to investors for managing their investments and share of profit. The management fee is based on the Asset Under Management (AUM). Share of profit, also known as carried interest, is a share of profits earned by managers of investment funds.

Carried interest encourages managers to do their best to maximize the return on investment. And managers only receive this compensation if the fund achieves a minimum return known as the hurdle rate.

According to a study by Callan, the median management fee for private credit funds is 1.5%, and the median carried interest percentage is 15%. In terms of interests, private credits have higher rates than traditional fixed-income investments.

How to Invest In Private Credit?

Generally, there are two ways to invest in private credit: directly and through a credit fund or an investment firm.

First, if you want to lend directly, you have to be rich. This is how it used to be.

Second, you give your money to an investment fund with a fiduciary contract.

Any private lending contract must follow all regulations. So, if you do not know about related regulations, give your money to an investment manager or firm specializing in private debt investing to invest on your behalf.

Assure your trustee is experienced and transparent and understands their processing work and strategies.

Private Credit vs Private Equity

Private lending is providing loans to a private business. Conversely, private equity is stock in a private company that is not publicly traded.

Both investments are not available to the public, that is the similarity.

But, first, explore what private equity is.

Understanding Private Equity

Private equity investment means buying ownership of a private company.

The investment company that manages this investment is called a private equity fund.

Generally, investment funds such as endowments, pension funds, sovereign wealth funds, and wealthy individuals back private equity funds.

The private equity fund’s job is to restructure, cut costs, refinance (typically with debt), and resell or take it to the public via IPO or SPAC at a profit. This process of adding values typically takes several years.

Compared to private credit, total private equity AUM reached $7.6 trillion in 2022, which is three times larger according to S&P Global.

Critics claim that private equity firms focus on turning a quick profit, destroys long-term value, and harms workers

Private equity firms charge investors a management fee (generally 2%) and a 20% cut of resulting profit from the resale of the company.

Differences Between Private Equity and Private Credit

A complete comparison between private credit and private equity requires a new article.

However, the following table shows key differences between private lending and private equity in approximate terms.

| Factor | Private Credit | Private Equity |

|---|---|---|

| Investment Type | Loan | Equity |

| Risk | High | High |

| Size of Market (2023) in USA | 2.7 Trillion USD | 7 Trillion USD |

| Return on Investment | Known | Unknown |

| Time-horizon | Short | Long |

| Management Fee | 1.5% | 2% |

| Managers Reward in Profits | 15% | 20% |