An economic recession refers to a period in which at least two consecutive quarters’ GDP growth rate is negative.

However, a two executive decline in the GDP growth is not enough. It should accompany at least somehow a decline in real income, spending, and production decline, but the unemployment rate rise.

Officially, in the USA it is the National Bureau of Economic Research (NBER) that declares a recession. If the NEBR says that the economy is not in a recession, citizens accept it.

In an economic cycle, the recession starts after a peak. The recession is also known as contraction, because the economy contracts, the opposite of expansion.

Causes of an Economic Recession

In short, a recession causes malinvestments, too much money supply, and economic shocks.

1. Malinvestments

Malinvestments occur because investors react emotionally by buying assets that rise quickly and without any economic justification. For instance, emotions encourage investors buy bitcoin that has no intrinsic value and does not have all features of money. Bitcoin has some features of money, but not all of them serve as a medium of exchange in an economy.

The purchase of an asset too much overheats the economy, but it can not last forever. Overheating economy refers to a situation where demand grows faster than supply in an unsustainable way which causes inflation to rise. The high demand eventually will fall and cause a recession.

2. Oversupply of Money in the Economy

Printing too much money by the government is another cause of an economic recession. Anything too much will push its price low, and it is true for money too.

Governments supply money generally by a low-interest rate that enables banks to lend at a lower rate, which put too much money in hands of people.

Oversupply of money will put an excessive amount of money in the hands of people. And consumers will rush to market purchasing assets causing unstable inflation and followed by a recession.

3. Economic Shocks

Sometimes unpredicted events happen that cause a recession. Economic shock refers to a fast price increase of some goods, specifically raw materials, that causes the general prices to rise. An example of economic shock is the the covid-19 pandemic that no one predicted in 2018.

Soaring prices will decrease demand and cause a negative economic growth rate.

8 Things that Happen During an Economic Recession

As a consequence of a recession, a nation should pay some prices.

These prices are paid almost by everyone in a country, except those who benefit from the recession. I am going to explain some of these prices in the following.

1. Massive Bankruptcies

Inability to service loans refers to those who cannot pay back their debts.

Borrowers, if they are corporates or individuals, have to pay back their loans.

After a recession, due to a decline in the value of their investment and a rise in the unemployment rate, the number of individuals and corporations rises that can’t pay their loans.

As a result, Massive bankruptcies occur due to the inability to pay back loans and a decline in sales and profit.

2. Psychological Negative Impacts

Psychologically anyone who suffered from a recession will experience anxiety, stress, or depression.

Some people lose their homes, some jobs and some close their businesses.

Psychologically, losses due to recession are painful.

3. Loss of Confidence and Trust

People will lose confidence and trust in the incumbent party. Trust in monetary, banking, and economic systems will fall as well.

Generally, after a recession, the debates about the economic systems rise. Socialists believe that the free market is unstable and unfair to most individuals in society.

4. Low Investment

Trust, economic stability, and confidence are crucial for investors to risk investing in a nation.

During a recession uncertainty and risks are high. Moreover, psychological factors play a huge role, panicking investors to invest more. Thus, investors are not willing to invest as much as they were in the past.

5. Higher Unemployment Rate

New investments are necessary for the growth and maintenance of the production level.

Since investment declines due to a lack of confidence, so does employment.

6. The Decline in Labor Productivity

Productivity is the measurement of output (production of goods and services) per unit input (raw material, workforce, capital…)

The decline of labor productivity happens because workers lose their job. They may need training again or learn a new skill.

7. Real Wage Declines

The real wage also known as the adjusted wage is the wage that is left after adjustment for inflation. The real wage is more important than the nominal wage because it is the real wage that identifies the real purchasing power of salaries paid to workers.

Real wages decline because the unemployment rate rises and companies can find workers at lower wages.

8. Credit Crunch

A credit crunch refers to the economic situation of tight money and the unavailability of credit. Due to a lack of trust, banks cannot provide credit for risky investments.

As a result of the credit crunch, not everyone can receive loans for investment or consumption.

Economics Recession Examples

Since 2000, in the USA, three economic recessions have occurred. Before 2000, many other recessions occurred, but I will not mention them more here.

1. Covid-19 recession

The Covid-19 recession started in Feb of 2020, and it continues in some countries. The Covid-19 virus spread in late 2019 in China and continued spreading globally.

2. 2008 recession

The recession in 2008 started in the USA with falling prices in real estate. Some homeowners could not pay their loans, homebuyers declined to buy more, and banks stopped lending to new buyers.

3. 2001 recession

The 2001 recession started with the bankruptcy of technology companies, and the 9/11 terrorist attack worsened it.

How the Government Can Avoid Economic Recessions?

A recession is a must in a free market due to freedom of choice and bubble creation.

A bubble occurs when people get excited and push the prices of assets without any fundamental reasons. Bubbles exist because not everyone analyzes the economic situation or knows how the economy works.

A bubble occurs when too many malinvestments get funded by cheap money. Both consumers and investors are purchasing heavily because they have access to cheap money. Cheap money means that the interest rate is low, and everyone can buy expensive assets, which results in a bubble.

Too many purchases and malinvestments make the bubble bigger. Finally, there is no option but to burst, called recession.

The government can postpone or prevent the recession with the tools and means that it has.

There are many things that the government and central bank can do to avoid or postpone the recession, and some of them are:

1. Free Money

Government can postpose a recession by sending checks to everyone that has suffered stimulating consumption, which results in a sales increase by a corporation hoping to prevent the unemployment rate increase somehow.

2. Entering Market As a Market Participant

Government can purchase investors’ assets at a higher price (ex: to buy houses that their owners can’t afford mortgages) that can prevent the recession.

3. Cutting the Interest Rate

The central bank, the bank of the government, can prevent recession by cutting the interest rates and the required rate of reserve (RRR).

Cutting the interest rate of RRR enables banks to provide loans at lower interest rates, assisting in preventing the liquidation of malinvestments and investment increases.

As a result, an increase in investment and prevention of malinvestment liquidation will keep the economy going.

How to Predict an Economic Recession?

The short answer is that no one can certainly predict a recession.

However, it does not mean that you can not have a clue when the economy is not doing well.

Yield Curve

The yield curve describes the relationship between the par yield on a bond to the remaining time to maturity.

There are three types of yield curves.

First, economically, the yield on short-term bonds should be lower than on long-term bonds, because long-term is less certain, and have high risks. If a yield curve shows the yield of a short-term bond less than the long-term, it is a normal yield curve. And it represents a healthy economy.

Second, sometimes the yield curve is flat. It indicates reluctance. Economists and investors are not worried about it, however, an inverted yield curve may follow the flat curve.

Third, when the economy is not doing, well the yield curve becomes inverted. An inverted yield curve means that the yield on short-term bonds is more expensive than on long-term bonds. It is not normal for the curve because it means that the short-term is riskier than the long-term. Investors predict a recession if the yield curve stays inverted for months. On daily basis, the curve can be inverted without worry. However, it becomes problematic when the inverted yield curve lasts long.

To see how looks a yield curve today, check out the Euro Area yield curves.

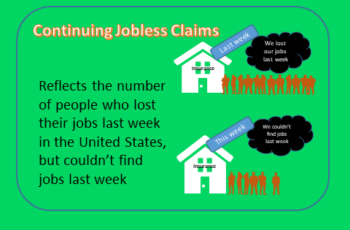

Unemployment Rate

The unemployment rate is the percentage of the unemployed workforce. People to be part of the workforce should be of working age, willing to work, and seeking jobs in the last thirty days.

As the unemployment rate rises, it indicates a problem in the economy.

Unemployed people will cut their consumption and will not produce goods and services in society.

The unemployment increase is a big problem in a nation because they do not buy enough to encourage manufacturers to produce, and at the same time, they do not produce.

Real Wage

The real wage is the purchasing power of the wage paid to employees. And the real wage cuts the inflation that reduces the buying power.

A decline in real wage forces consumers to buy less compared to the past which leads to low production. And low production level will cause less employment, adding to the problem.

Production level

Production level in a country tells about the input costs.

Input costs are raw materials, labor force, and capital.

A high production cost will be followed by a price hike, inflation, and a decline in purchasing power. These are all burdens on consumers and producers that could lead to a recession.

Trading Activities By Insiders

Insiders are those who manage a company such as executives. Examples of executives are Chief Executive Officer (CEO), Chief Financial Officer (CFO), and Chief Operation Officer (COO).

The selling of shares by executives of a few companies does not say anything. It becomes an indicator of a recession when executives of too many companies start selling.

When trading activities by insiders increase, it could mean that they are not confident about the economic perspective. Like investment funds, public companies have advisors from financial and other industries too. Probably, they are advising executives to sell their holdings due to a possible recession.

Should the Government Prevent Economic Recessions?

The government does not want a recession for political reasons. The incumbent party does not like recession harming its reputation and losing elections.

More importantly, the government wants to show other nations how strong their economy is and how rich their country is.

According to free-market principles, the government should not prevent a recession. Free-market says that government should be as small as possible and let the market forces correct themselves and grow freely.

However, recessions seem necessary for the following reasons:

1. The Economy Needs Corrections

During a booming economy, the allocation of resources is not error-free. Without any fundamental reason, people purchase assets because their prices are rising. There are also a lot of malinvestments that cannot pay off their debts and are inefficient. Simply the vast amount of resources is allocated where they should not be.

During a recession, investors liquidate a large number of malinvestments. Malinvestment liquidation assists the relocation of resources from less efficient to more efficient investments and prevents the bubble from becoming larger.

The recession adjusts the overvalued assets that people were speculating with their prices. After a recession investors will be speculating more carefully and price assets more fairly.

2. Government Intervention May Damage the Economy

Intervention by the government makes the situation worse by stimulating an inefficient economy. Government intervention makes the economic situation even worse by reflating the bubble.

A recession also occurs due to mismanagement by the government by making huge mistakes. By intervention to prevent a recession, the government will add several others.

Government intervention will make malinvestments last longer. The government spends more resources that have to be invested somewhere else.

3. Government Interventions Leads to More Recession

If the government stops intervention, there will be more recessions, but smaller in size.

Small recessions help the economy stay aware of bad investments and inefficient allocation of resources.

In addition, the unemployment rate rise will be smaller compared to a recession, which occurs when even the government and central bank cannot control it because the recession that the government delayed will be much bigger.

4. Government Intervention Discourages People to Save

The government usually intervenes by boosting consumption. Growing the economy this way is not healthy because it will discourage people from saving.

When there is no saving, there will not be any investment.

Saving encourages investment, helping the economy grow healthy.

Investment decreases the unemployment rate and increases productivity by exposing employees to real economic problems.

Additionally, if the government boosts consumption by helicopter money, it discourages people from looking for jobs. When people get free money, they will not work for a low salary. Free money discourages unemployed workers to seek jobs as well.

Government intervention may help the economy to prevent or postpone the recession, but this will be short-term. With the intervention, the bubble will get bigger, and when it busts, the number of consequences will be huge.

Economic Recession vs Bubble

A bubble indicates a high price of an asset/s without any fundamental justification. It means that one asset or multiple assets can be in a bubble. On the other hand, in a recession, the whole economy is not doing well.

Moreover, a bubble may burst or may not. On the flip side, a recession occurs after the burst of a big portion of the economy. For example, Tesla stocks might be in a bubble, but may not burst for years.

Furthermore, a bubble that bursts may impact the stock market and may not. Only when a huge number of stocks are in a bubble, if burst instead of correction, a recession become possible. For example, Snap Inc. has been in a bubble many times but did not impact the stock market at all, but the housing market bubble in 2008 due to its huge size led the economy into recession.

Recession vs Depression

According to the NBER “a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” Technically, recession means two consecutive quarters of GDP’s negative growth rate, according to economists.

However, depression refers to a period of economic activity in which the economic activity decline lasts for years. In simple words, a long lasting recession is depression.

Where Global Recessions Start From?

The United States is leading the cycle due to being the biggest economy and importer in the world. In addition, its currency is an international reserve and trade currency which impacts all other nations that trade in USD or hold USD as a reserve. When a cycle starts in the United States, most other countries follow it but not all of them.

Except for China and Australia, countries that have close ties with the United States follow much closer Unites States’ business cycle. Canada, Mexico, and United Kingdom are good examples of the United States’ trading partner that follows the United States business cycle.

There are countries that which the United States business cycle doesn’t impact heavily. Australia is a good example that has not experienced a recession in decades due to China being Australia’s biggest trading partner, although the USA is Australia’s political ally.

The United States is the biggest trading partner of China. However, it has not experienced a recession like Australia in decades because it focuses on its internal economic growth when there is a recession elsewhere. Other nations like North Korea which the USA doesn’t have a trading relationship with them, do not follow the recession in the USA.