Fundamental analysis is examining a company’s ability to generate revenues considering the environment of the company and its internal ability in a predefined period.

There are probably countless forces that impact the performance of a business, inside and outside forces. Inside forces are the company’s operating performance, financial performance, and policy toward everything that matters to the company. Outside forces influence performances not controlled by the company. It can be new technology, GDP growth rate, unemployment rate, new competitors, etc.

Fundamental investors consider a company’s performance in the long run and analyze the direction of many elements that impact a company. It can be tax policy changes, incentives, government spending, foreign governments’ policies, and so forth.

Nowadays, even a tweet can change a company’s stock price or the price of companies in a specific industry for the short term.

We cannot rely solely on some specific indicators or statements for selecting a company for investing in. Before making an investment decision, especially for the long term, consider all possible components that may impact the company.

Five Layers of Fundamental Analysis

The fundamental analysis begins with the global economy, followed by a region, nation, industry, and the concerned company.

The Global Economy and Trends

The global economy also goes up and down, peeks, and collapses.

The global economy could be in a downtrend. For example, during world wars, the 2008 financial recession, and the 2020 coronavirus pandemic all stopped the world economy from growing while most of the time the world economy was growing.

Investors forecast the global economy by studying international relations, a region’s economic performance, and big economies such as USA and China.

International relations among countries are noticeable on news TV channels or reading news on the internet. There is always news about the interrelations of countries among them. Every relationship between two countries cannot change the course of the global economy, but major ones can. A poor relationship between two small countries cannot change the trend of the international market however, relations between big nations such as USA and Europe definitely can. Relations between Middle East countries can affect the oil price, following the oil price affects oil producers and consumers, thus resulting in global economic changes.

The size of the impact on the global economy depends on the size of the players. The USA, European Union, and China are the largest economies and thus, have powerful ramifications.

An investor should try to predict global situations by reading statistics, news, or economic history. During the last 1000 years, many empires rose and fell. Zero lasted forever. As a result, studying the world order is necessary.

The world’s economic and political players rotate always. Chengiz Khan’s empire, Roman Empire, British Empire, and Persian Empire, Dutch Empire collapsed rose and collapsed. Once India’s economy during Mughal Empire was over 30% of the world GDP but collapsed. Everything is going up and downs, and so are economies, businesses, powers, etc.

Some Factors that Help Long-term Analysis:

- World’s population growth and pattern;

- International relations among big economies;

- The population growth rate in different regions and different countries;

- The median age in various countries;

- Technological trends in several countries;

- Urbanization in potential big economies;

- Educational trends in regions and countries;

- And so on.

None of the above or other indicators can predict 100% correctly that the risk comes. No one can foresee 100%. That is why Yahoo couldn’t survive.

The reaction of investors to global changes comes from expectations. Some investors expect one thing and another, another thing. So investors must be wise and patient enough.

Regional Economy

A specific region in the world also may suffer from its economy. For example, gulf countries’ economy depends on oil too much, and the price of oil can have a big impact on the whole region from Iraq and end in Oman. In the Middle East, if the price of oil drops, the purchasing power of all Middle East nations will go down. The fall in income has negative impacts on all other industries. For instance, people will spend less on supercars and eat out less frequently.

The European economy is dependent on all 28 nation members. They are tight together. If one of them fails, it impacts every other nation. If Germany’s economy rises and its export increase to China, it helps the whole unit as the forex enters the block. Citizens of neighboring nations also may find jobs in Germany. Because citizens of every member can live, work … in any country in this block. If France gets competitive advantages in manufacturing computers, the whole European block benefits by purchasing cheaper than buying from the United States of America.

National Economy

A nation can suffer from a bad economy due to being dependent on a small number of industries, war, or even its relation with other countries. For example, the United States sanctioned Venezuela due to bad relations, and the country went into recession.

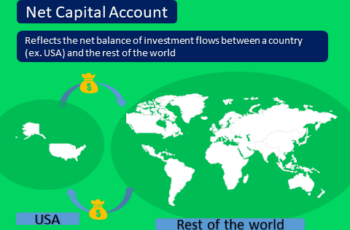

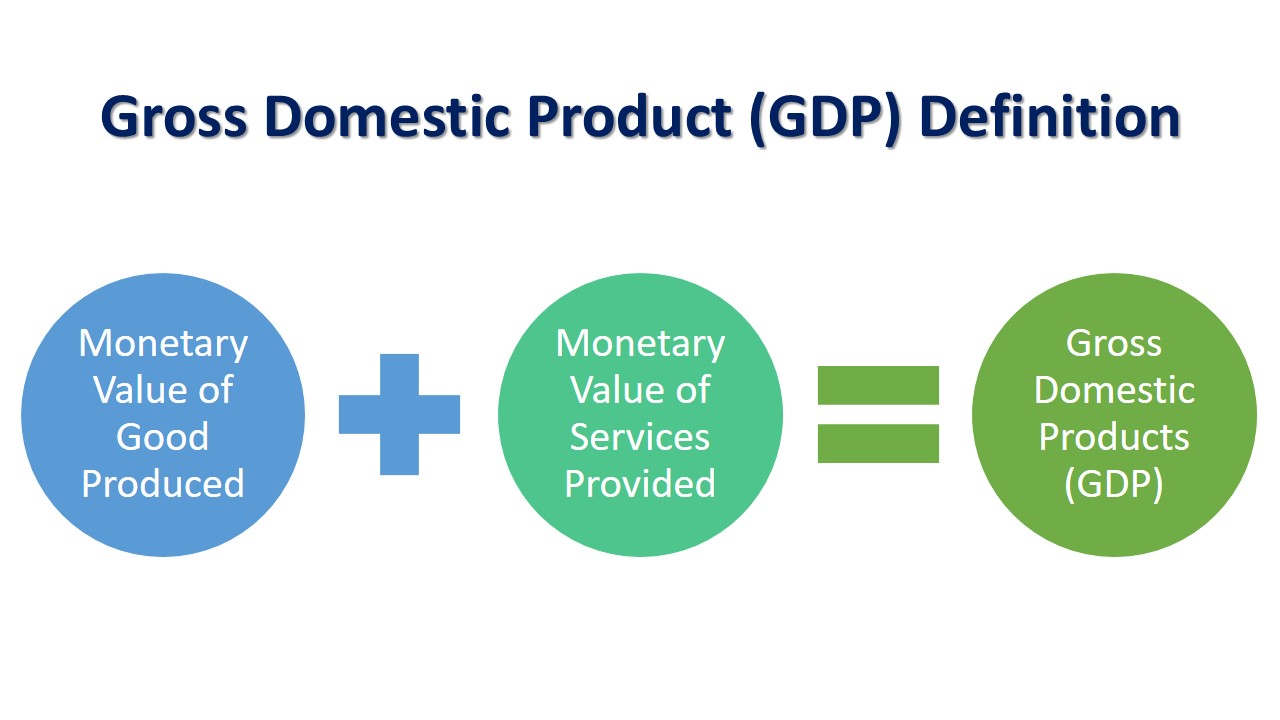

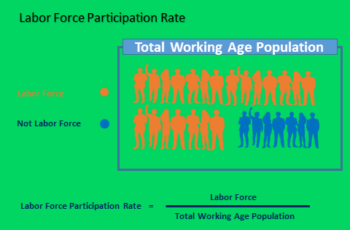

A country’s economy mainly depends on its domestic industries. Mostly, its citizens consume domestically produced goods and provide domestic services. Investors forecast the economy of a nation by studying its economic indicators such as GDP, inflation, interest rates, etc. Additionally, studying international relations is also essential.

Industry Analysis

The industry also has ups and downs. For example, after the United States invaded Afghanistan in 2001, demand for construction materials and expertise went up because of the reconstruction of destroyed infrastructures and the building of new infrastructure and finally started going down from 2014 onward.

The collapse of oil prices in early 2020 due to the coronavirus pandemic is another good example, convincing us to study industries as well.

The rise and fall of a sector directly or indirectly impact all sectors in a nation. The rise in gas prices has a direct impact on the auto industry, for example.

Performance of a Company Analysis

Before investing in a company, you should understand how the company does business. Understand the sources of its revenues, its sales strategy, expenses, and the destination of its expenditures.

You need to understand because the stock price has a trend, raw materials, customers’ expectations, and desires, and the technologies used by the company also follow a trend. Try to understand the industry and the company as much as possible.

Two Types of Fundamental Analysis

There are two types of fundamental analysis: macroanalysis and microanalysis.

Macro Analysis appraises world, regional, and internal economies, as well as political situations. Microanalysis examines a company’s financial statements, sales policies, accounting ratios, promotion policies, etc.