What Are Engulfing Patterns?

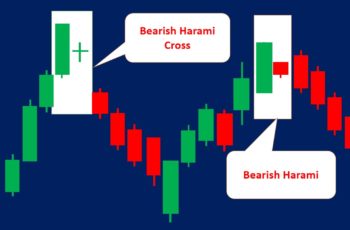

Engulfing candlestick patterns are reversal structures made of two candles, in which the second candle engulfs (wraps) the first candle.

There are two types of engulfing patterns: bullish that forms at the bottom of a trend and bearish establishing at the top.

In an engulfing pattern, the two candles must be opposite in color. You will read more explanations later in this article.

This article explains engulfing patterns, how to trade them, and six examples separately in the following.

This article elaborates on types of engulfing patterns, examples, and how to trade them.

Bullish Engulfing Pattern

Bullish engulfing candlestick pattern is a reversal chart pattern. It occurs at the bottom of a trend and suggests a future uptrend. Plus, charts create bullish engulfing patterns at the end of a bullish consolidation pattern, and we consider it a small uptrend.

In bullish engulfing candlestick pattern the first candlestick is a small red, and the second is a tall bullish candlestick that engulfs (wraps) the first candle. Or, the opening price of the second candle is lower than the closing price of the first candle, and the closing price of the second candle is above the opening price of the first candle.

In a bullish engulfing pattern, the first candle must be red and the second green.

The left pattern, in the above chart, is a bullish engulfing pattern.

Bearish Engulfing Pattern

A bearish engulfing candlestick pattern is the opposite of a bullish engulfing pattern. It is a reversal pattern that occurs at the top of a trend and suggests a future downtrend. Moreover, it appears at the end of a bearish consolidation pattern, and we consider this pattern a small downtrend when a bearish engulfing pattern forms.

In this pattern, the first candle is small and green, and the second candle is tall and red.

Or in other words, the closing price of the second candle needs to be below the opening price of the first candle, and the opening price above the closing price of the first candle.

In the above chart, the right pattern is a bearish engulfing pattern.

Difference Between Bullish and Bearish Engulfing Pattern

The difference between Bullish Engulfing Candlestick Patterns are:

- The bullish engulfing pattern occurs at the bottom of a trend, and the bearish at the top. After a bullish pattern, an uptrend is expected, and after a bearish pattern and downtrend.

- In a bullish engulfing, the first candlestick is red and the second candlestick green, while it is the opposite in the Bearish Engulfing Candlestick.

How to Trade Engulfing Patterns?

In an engulfing pattern, the first day/candlestick is relatively calm. After hours or before the market opens, some investors sell (in a bullish engulfing pattern), and some buy (in a bearish engulfing pattern).

However, the news or signals that convinced these investors fail to sustain the downtrend (in a bullish engulfing pattern) and the uptrend (in a bearish engulfing pattern). And, the market changes its direction.

An engulfing pattern completes after the closing price of the second candle. It means that you do not consider two candles as an engulfing pattern before the closing price of the second candle.

Since the closing price of the first candle and the opening price of the second candle are not the same, a strictly defined engulfing candlestick pattern does not form in the forex and crypto markets. So, show some flexibility in defining engulfing patterns in these markets. This case is also true for short-term candlesticks such as 10-minute and hourly charts.

Here are features to consider while facing engulfing candlestick patterns:

- Before an engulfing pattern, there should be a trend or correction pattern. There should be a downtrend (or a bullish continuation pattern) before a bullish engulfing pattern and an uptrend (or a bearish continuation pattern) before a bearish engulfing pattern.

- If an engulfing pattern fails to reverse the trend, then the price will continue in its prior direction.

- A successful engulfing pattern creates or confirms a support or resistance area/line. Or in other words, the bottom of a bullish engulfing pattern becomes a support line, and the top of a bearish engulfing pattern becomes a resistance line.

- The sizes of the candles making the engulfing pattern are crucial. A small first candle means the current trend is losing momentum and increasing the chance of reversal. A tall second candle indicates a fierce fight for a new direction raising the reversal chance.

However, if the two candles are almost the same size, even defined as engulfing patterns, the market will continue in its current direction or go sideways. - Look at candles before the engulfing pattern to see any weakening signs of the trend. Candles with tall lower tails indicate an exhausted downtrend. And candles with upper long tails indicate an exhausted uptrend.

- Look for confirmation if you are confident. It makes your decision more objective than subjective.

- Consider other technical techniques with engulfing candlestick patterns, such as technical indicators and chart patterns.

- Blend engulfing patterns (actually, all chart patterns) with fundamental data and news.

How potent an engulfing pattern is, depends on how many above features exist on the chart. For example, it is more reliable if it forms in a key support or resistance area, and there are several other pieces of evidence.

There is no 100% guaranteed method in trading chart patterns, including engulfing patterns. That is why you should consider reversal a possibility while trading engulfing structures. It is not guaranteed.

Engulfing Candlestick Patterns Examples

As mentioned, there are two types of engulfing patterns: bullish and bearish.

They predict reversal, but not always. Its chances of success increase as more signals confirm engulfing candlestick patterns.

Here I have brought six examples, two for each of bullish, bearish, and engulfing patterns that failed for possible reasons.

Bullish Engulfing Pattern Examples

Here are two examples of bullish engulfing patterns. The first example is from Twitter stock and the second is from Netflix.

First Bullish Engulfing Pattern Example

On 23-24 Feb of 2022, in the daily chart, the Twitter stock made a bullish engulfing pattern.

This engulfing pattern was successful. Some of the biggest reasons that helped it to become a resistance area:

- The first candle is small, and the second candle is very tall. The second candle was so tall that engulfed two candles. As mentioned earlier, in a bullish engulfing pattern, a small first candle and a tall second candle are signs of strength.

- The momentum indicator at the bottom was not confirming the downtrend before this pattern. It is another signal that the current direction (before this pattern) is losing strength.

Since it had only two of several features of a strong engulfing pattern, the market hesitated to rise sharply. But its bottom became a potent resistance area.

After this pattern, the market pulled back but did not touch the new support line. And the market rallied by over 70%.

Second Bullish Engulfing Pattern Example

On 2nd April and 6th April (in between, there were holidays) the Netflix stock made a bullish engulfing pattern.

Some of its features are the followings:

- The first candle of this pattern is so tiny that can be considered a doji. The second candle opens below the doji but closes way up. The doji and the closing price of second, because it was way up, are showing strengths. Additionally, candles before this pattern are small in the body, a signal of weakness in falling more. Moreover, you see a bearish engulfing pattern a few candles before this pattern that both candles have large bodies. Technically, if both candles are similar in size, they should not be considered a potent engulfing pattern.

- There is a powerful support area at the bottom of this engulfing pattern. And a huge gap (window) supports it. Technically, a window is stronger than any other candlestick pattern.

Even though there were only two supporting factors, it was successful due to the huge gap that preceded it.

Bearish Engulfing Patterns Examples

Bearish engulfing patterns appear in the chart of volatile stocks. Twitter is one of these stocks.

Since Twitter’s IPO, it has gone up and down several times. Thus, there should be some bearish engulfing pattern in its chart.

I looked at its chart and found some. Here are two examples of bearish engulfing patterns from the Twitter stock chart.

First Example of Bearish Engulfing Pattern

In late April, Twitter stock made a strong bearish engulfing pattern.

This pattern was so strong that Twitter stock fell by nearly 70% from the top of this pattern.

Some reasons that made this bearish engulfing pattern succeed are the followings:

- The first candle of this pattern is tiny compared to the second candle. It is a signal for a potent bearish trend. Additionally, the first candle has no lower tail (shadow) but a medium upper shadow.

- Two weeks earlier, there is a dark cloud cover pattern. Even though it was not a strong dark cloud cover, it was a supporting signal for an upcoming downtrend. Moreover, six months earlier, this area played the role of a strong resistance area.

- The second candle broke a powerful support area made by a bullish gap. Breaking a gap (window) is one of the most potent signals for a bearish move.

- The momentum, one of the leading technical indicators warned as well. Before this pattern, it was falling even though the stock was rising.

- The most significant reason that Twitter stock fell was news of its earnings. In the previous quarter Twitter reported $479M, but this time it was down to $436M, a 20% decline. Furthermore, it slashed its revenue outlook.

There could be other reasons too. Probably the above reasons were the most significant.

Second Example of Bearish Engulfing Pattern

On the 6th and 9th Sep (the 7th and 8th were holidays) of 2019, the Twitter stock made a bearish engulfing pattern.

It was the time that Donald Trump was still in power.

This bearish engulfing pattern predicted and succeeded in a downtrend for the following reasons:

- The top of this pattern was a major resistance area in the past. The support and resistance area influence the strength of a candlestick pattern.

- Volatility in candles before this pattern were showing intensive fights between bulls and bears. Too many changes in the colors of candles represent fights between buyers and sellers. So, it means that bears were building confidence to change the market direction.

- At the bottom, the momentum indicator was not confirming the price chart. On average, the price was rising, but this indicator was falling. Convergence between a leading technical indicator and the price is a sign weak trend. And, a weak trend can lose power easily.

- The first candle was like a hanging man, even not a perfect one. A hanging man itself is a bearish reversal pattern. Moreover, the second candle closed way below, which is a reason for bears to short.

The above four reasons, even not strong reasons, were enough to bring down the price.

Examples of Engulfing Patterns that Failed

Trading in the financial market is somehow playing with probabilities. It can happen and can fail.

An investor who researches and works hard intelligently, can decrease the chance of failure and increases the chance of success.

Sometimes a pattern (including engulfing pattern) appears due to one or several reasons. An investor should be careful to gather data and analyze the underlying asset to cut his risk.

Here are two examples of engulfing patterns with some reasons that failed:

First Example of Failed Engulfing Pattern

In late July, Alphabet Inc (Google’s parent company) made a bearish engulfing pattern. However, it turned out to be unsuccessful.

There are pieces of evidence in the chart showing us why it failed.

And, they are the followings:

- This pattern appeared when the whole stock market was rising. Alphabet is an established company. And generally, an established company does not fall when indices are rising.

- Before this pattern, there is a bullish gap. A gap is more potent than an engulfing pattern. That is why you need confirmation to trade this pattern. If you waited for confirmation, the next candlestick opens much higher than the closing price of the second candle in the engulfing pattern. It is another reason to doubt.

- The momentum indicator at the bottom does not confirm an overbought condition. Even if the momentum line is above the zero level, it is not enough to consider Alphabet an overpriced stock.

Second Example of Failed Engulfing Pattern

On 21-22 Oct 2013, the Netflix stock made a bearish engulfing pattern that turned to fail.

This pattern looked perfect by any definition.

However, the pattern was supported by other signals.

These are possible reasons that instead of falling Netflix continued rising:

- Overall the stock market was rising. For example, the SP 500 was smoothly rising.

- Fundamentally, on 21st Oct, the first candle of the pattern was the earning day. And, Netflix reported better than expected, both profit (8% higher) and revenue (0.69% higher).

- There was not any bad news about Netflix.

As a result, the creation of a bearish engulfing pattern was purely due to speculation. There was no strong signal to pull the price down.

Bottom Line

Engulfing candlestick patterns are among the most powerful reversal candlestick patterns.

However, there should be sufficient reasons to count on it.

Every time you see an engulfing pattern, look for supporting reasons to see if there are some or not.

Idrus

Nice reading really appreciated. But how can I get a copies or to download