Taxes refer to payments by individuals and corporations imposed by the government.

And they are the largest slice of the government’s revenue.

Different agencies collect taxes for various purposes, such as local government, state government, and federal government.

Why Taxes?

The government collects taxes for services that it provides to its citizens.

Governments spend collected revenues on raising the living standard of society, such as public schools, military spending, building infrastructures, building hospitals, paying retirees, etc.

Taxes are tools that are used for the redistribution of wealth from riches to the poor.

The government also uses tax rates to change people’s behavior, such as a higher tax on tobacco in Bosnia and Herzegovina. In Norway, electric car owners pay less tax than combustion engine car owners, persuading citizens to buy electric cars to curb pollution.

Who Pays Taxes?

Individuals and corporations pay for the incomes that they earn.

In some countries like India, age matters. Workers, less than 18 and over 65 pay lower tax rates than those between 18 and 64.

Every type of income is not taxed. Examples are the income of citizens living abroad (except in a few countries such as Belize and the USA) and the money raised for charities.

In some countries, gifts are not taxed even worth millions. So, applicable taxes are different among nations, and you have to check the official website of the tax collector.

The tax rate is levied differently on different products and services. Some countries impose taxes on carbon dioxide emissions. Some countries impose tax only on specific goods or services, such as the UAE, where corporate tax applies only to oil companies.

What Are Tax Deductions and Tax Credits?

Tax deductions and credits refer to the amount of your income you can deduct from taxable income.

Generally, a government offers tax credits to encourage or help a specific social program.

Examples of tax deductions and credits are the self-employed health insurance premium, home-office costs, charity donations, student loan interests, etc.

Tax Systems

Taxes system refers to the range and rates applied to income and corporate profits. Generally, there are three types of tax systems, and they are:

- Flat rate system: The rate of tax is constant;

- Regressive system: The rate of tax declines as the income grows; and

- Progressive system: the tax rate rises as the income of the taxpayer or corporate profit rises.

Probably in every country, the tax system is progressive (at least to my knowledge).

How to Calculate Taxes?

In a progressive income tax system, the income of a taxpayer or corporate profits is divided into brackets. It starts from the lowest rate bracket and ends with the highest. The low tax bracket pays less than the higher bracket.

Let me explain the progressive tax system with the income tax system of Japan.

Data in below image is from www.jetro.go.jp, a government-related organization in Japan.

The following picture shows a progressive income tax system in Japan. The tax deduction is the amount of money a taxpayer can deduct from his gross income while filing for taxes. The remaining income after the tax deduction is taxable.

The Japanese tax rate starts from 5% ending at 45%.

Example

Suppose someone’s income after employment deduction is 8,000,000 yen.

So, let us calculate his income tax.

The first bracket is under 1,950,000 yen which is taxed at 5%. Calculating 5% of 1,950,000 equals 97,500.

So, the first bracket tax payable is 97,500 Yen.

The second bracket is over 1,950,000 yen and under 3,300,000 yen (3,300,000-1,950,000 = 1,350,000) which 1,350,000 of his income is taxed 10%.

0.01*1,350,000 = 135,000

So, the second bracket tax payable is 135,000

The third bracket is over 3,300,000 and under 6,950,000 yen (6,950,000-3,300,000 = 3,650,000) which 3,650,000 of his income is taxed 20%.

0.2*3,650,000=730,000

So, the third bracket tax payable is 730,000 Yen.

The fourth bracket is from 6,950,000 to 9,000,000, which is taxed at 23%.

Since the income of this person is 8,000,000 we deduct 6,950,000 from 8,000,000 which equals to 1,050,000 so, 1,050,000 is taxed 23%.

0.23*1,050,000 = 241,000

So, the fourth bracket tax payable is 241,000 yen.

Finally the total tax payable = 97,500+135,000+730,000+241,000 = 1,203,000

This person with an 8,000,000 yen income pays 1,203,000, which is 15.04% of his all income. You see that although his income tax rate bracket was 23%, he pays only 15.04% of his overall taxable income.

Types of Taxes

Classification of taxes, in general, is categorizing incomes or revenues to help understand and tax them differently.

There are no strict rules on how to classify taxes. This article explains common methods of classification and their elements.

Types of taxes can vary based on where you live. In some countries, such as Norway, you pay several types of taxes, including wealth tax. On the other hand, in some countries such as Qatar, you pay 0% in income tax.

Types of Taxes Based on Buckets

In this classification method, we put a related contribution in a bucket that helps digest faster.

There are three types of taxes; income, consumption, and asset taxes.

1. Income Taxes

Income Taxes are levied both on individuals and corporates.

The income tax system and rates vary depending on where you live. Even in the U.S., the tax rates vary from state to state. Generally, the income tax system is a progressive one, which increases the rate as your income increases.

Here is the list.

- Individual Income: It is levied on your salary, investment, and other forms of your income.

- Corporate Income: It is levied on corporate profits after deducting costs from its revenues.

- Social Insurance: It is levied for your insurance programs such as social security and Medicare. Normally, this type of tax is paid both by the employer and the employees.

- Capital Gains: It is levied on the increased value of your assets such as stocks, homes, and cars. Government imposes Capital Gains Taxes only when you sell your assets in profits.

2. Consumption Taxes

You pay consumption taxes when you spend at a flat rate. It does not matter how much or how many you buy, the rate will be the same.

Types of Consumption Taxes

- Sales: Consumers pay sales taxes at a retail store.

- Gross Receipts: It is imposed on gross sales of companies, irrespective of profitability, and without expense deduction. The rate of this type of tax is low, normally around two percent.

- Value-Added: This tax is levied at each stage of the productions and services that add value.

- Excise Duties: Excises are levied on special goods and services, not essential in a nation, and the government tries to discourage people from purchasing.

- Tariffs: Tariffs are levied on imported goods and services to promote internal companies.

3. Asset Taxes

Asset taxes are imposed on things you own.

They are:

- Property: Property taxes are imposed on immovable assets such as land and building. It is a major source of revenue for local governments.

- Inheritance: Inheritance taxes are paid by heirs after a person’s death.

- Gift: Gift taxes are applicable if a person gives another. Not every country has gift taxes. In the U.S., the gift tax is a big chunk of the gift, 40%.

- Wealth: Wealth taxes are imposed on net wealth above a threshold. Wealth tax is not common in the world, only around 10 countries in the world impose it.

Types of Taxes Based on How You Pay

People pay directly and indirectly as taxes.

Direct tax is paid directly by individuals and companies to the tax agencies, such as income tax and corporate tax.

Indirect income tax is paid indirectly by companies. In reality, consumers pay indirect taxes such as sales tax, which buyers pay at the point of sales.

Types of Taxes Based on Payers

There are two types of tax payers: individuals and corporates.

Tax vs Tariff

Governments levy taxes on domestically produced products and services provided. For example, a teacher and manufacturers inside the country pay taxes.

On the other hand, governments levy tariffs on imported goods produced in other countries. For example, China imposes tariffs on soybean imported from the USA, and the USA imposes tariffs on clothes bought from China.

Why the Government Raises or Cuts Tax Rates?

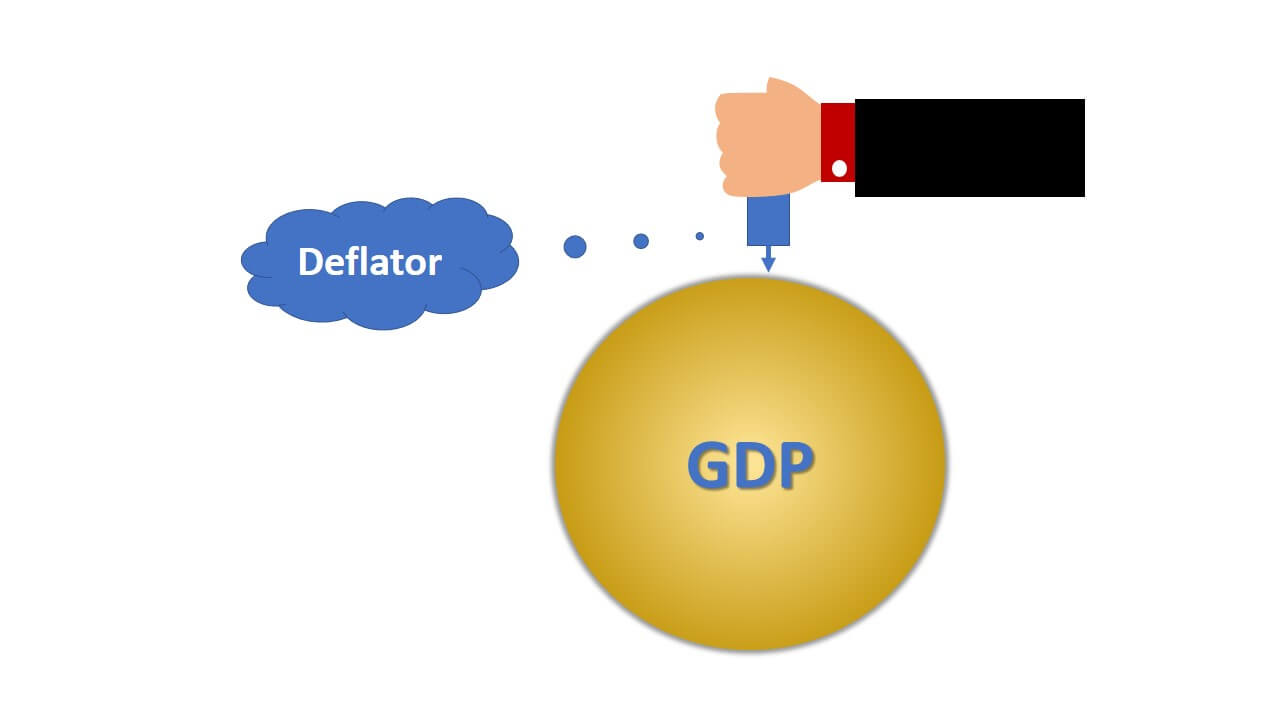

Tax cuts disposable income of individuals. Disposable income is the amount of cash that a person can spend. In other words, if you cut taxes from your salary, the remaining is disposable income.

A high tax rate cuts purchasing power of individuals by cutting disposable income. And a low tax rate enables individuals to buy more.

When the Government Cuts Tax Rates?

A government cuts corporate and personal taxes for various purposes. It depends on economic problems that force the government to change tax rates.

Generally, a government cuts taxes for the following purposes.

- To reduce unemployment: A lower tax rate increases corporate profits. Higher profits induce businesses to increase investment and hire more employees.

- To increase the purchasing power of individuals: A low tax rate enables individuals to increase consumption which leads to more production and growth of GDP.

- To avoid recession: lower tax rates boost consumption and investment, which may avoid recession.

When the Government Raises Tax Rates?

Governments do not raise taxes easily. It is dangerous, and people do not like it.

However, sometimes there is no option but to raise taxes.

And the government raises taxes in the following situations:

- To decrease public debt or budget deficit: Governments boost the economy by borrowing money (running deficit) from the public when the spending exceeds its revenue. Over time, the public debt increases due to the accumulation of new debts and interests payable to old debts. When the government thinks of high public debt (or high budget deficit) as unhealthy, try to increase its revenue by raising tax rates.

- To move toward a more socialist economy: In a socialist country tax rates and government spending are higher than in capitalist countries. They impose more tax rates to provide free services such as education, health care, etc. The incumbent party may prefer a more socialist nation and raise taxes for this purpose.

Final Words

Taxes are the major revenue sources of governments. Governments need revenue to pay for their expenditures such as the military, public infrastructures, etc.

Taxpayers are businesses and individuals. And they pay taxes on income, tariffs, sales, property, etc.

Tax systems are flat, regressive, and progressive systems.

Finally, governments raise or cut tax rates for economic purposes.