The retail price index measures the weighted average selling price change of a basket of goods and services to consumers at retailers.

And it is released monthly.

The retail purchase is the final destination that goods and services travel to. A product in a retail store comes from raw materials and goes through production, wholesaler, and retail store.

So, it is an important indicator that helps to understand consumers’ expectations and behaviors, followed by businesses’ reactions.

The Importance of Retail Price Index

The RPI is a method of measuring inflation. And it is one of the best ways to gauge how the economy impacts ordinary consumers.

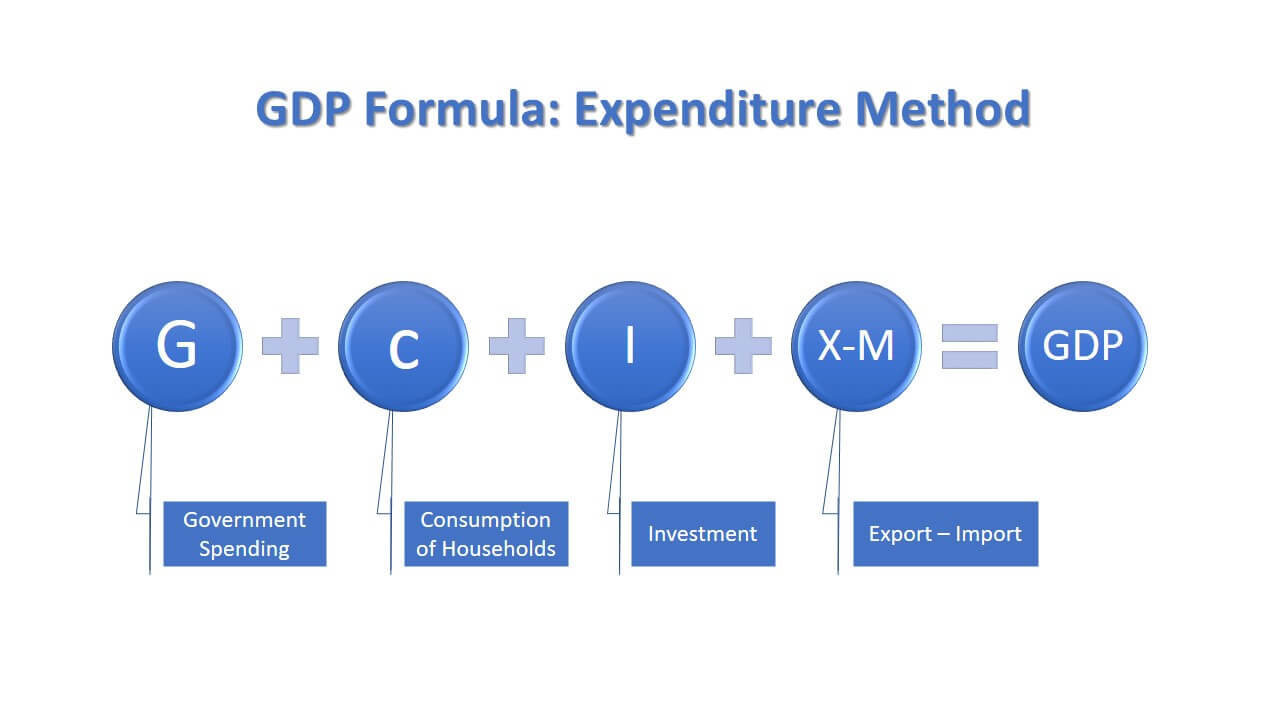

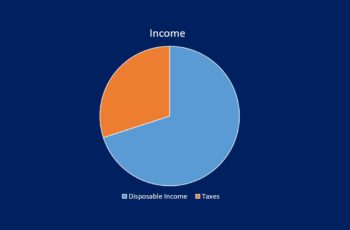

Moreover, consumption in most developed nations constitutes the largest portion of their GDPs. For example, in the USA, private consumption made 67.7 % of its Nominal GDP in Sep 2023, according to CEIC.

Governments track the RPI to make macroeconomic decisions that lead to economic improvement. And businesses track to adjust their prices and orders from suppliers.

So, due to consumption accounting for a huge portion of the economy and retail price impacts on ordinary people, its importance cannot be ignored.

Retail Price Index Impacts on the Market

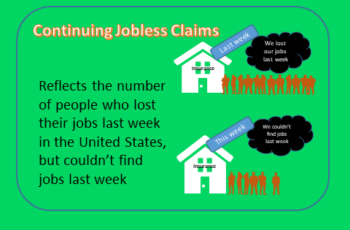

Retail Sales number reflects a change in the retail sales in the reported month compared to the previous one.

However, comparing two months of retail sales may not give a solid picture due to seasonality. Retail sales numbers are affected by the new year, Christmas, and other discount events. That is why showing the retail sales number and a currency pair or a stock index graph does not show relations.

But that does not mean that the retail price index is useless.

It can be a good and helpful indicator if the actual number differs from forecasted.

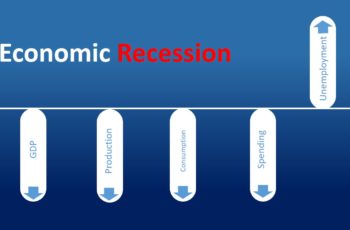

A slowdown in the retail sales growth shows a cut in the consumer spending level. This may lead to a decline in economic activity and hurt the domestic currency. The opposite is true if there is a positive growth in the retail sales reading.

Every economic calendar provides the forecasted number. A higher-than-expected reading is a positive sign for the economy and respected currency, while a lower-than-expected is a negative for the respected economy and its currency.