The Personal Income and Outlays is a report about consumers’ income and expenditures. This report is also known as the Personal Consumption Report which the Bureau of Economic Analysis (BEA) releases monthly.

In other words, this report contains two main sections:

- Personal income – which is the total income of individuals residing in the USA in a month; and

- Personal outlays – the total amount of money the USA residents spend on durable goods and non-durable goods and services in the same month.

Using personal income data, taxes, and inflation, the BEA also calculates disposable income (income after taxes) and chained dollars. The chained dollar is a measure used to express real prices. In this method, the value of the current year relative to the year before and relative to the reference year is calculated.

The Personal outlays value refers to consumer spending or personal consumption expenditures (PCE). It reflects the amount of money that US residents spent and those who paid on their behalf. The BEA uses the PCE to calculate the PCE Index and the Core PCE.

Importance of the Personal Income and Outlays

Consumption is the largest part of the Gross Domestic Product in the developed nations. So, examining expenditures is essential for investors to forecast the economic behavior of the USA and frankly others.

The BEA releases the real personal consumption expenditures products and services list in a table that has 402 rows. It contains extremely valuable data about spending money on various goods and services.

This table divides goods and services into segments. Each segment lists related products or services. For example, durable goods are divided into below sections:

- Motor vehicles and parts;

- Furnishing and durable household equipment;

- Recreational goods and vehicles; and

- Other durable goods.

The amount of money spent by Americans on the list of products and services gives great insight to policymakers, company executives, and investors. This help investors decide where to invest, and help policymakers to focus on weak segment of the economy.

For example, an increase in used cars may indicate a shortage of cars during a rising economy that may convince investors to buy auto stocks.

An increase in spending also may indicate consumer confidence in the economy which could lead to more growth.

However, too much increase in spending is not good as well. It could lead to an overheating economy and too much inflation that cuts the purchasing power of money.

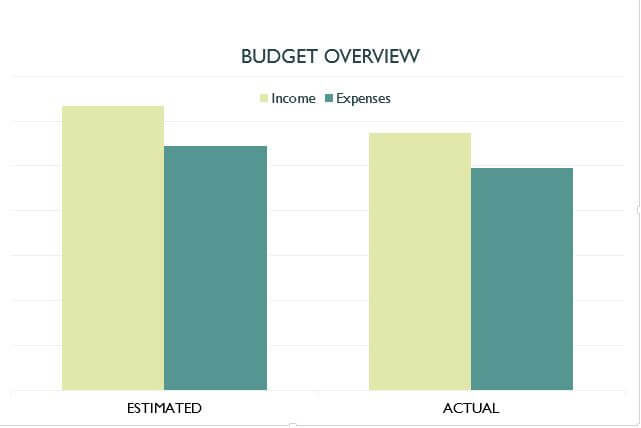

The difference between income and expenditures is saving. This report gives investors an insight into residents’ savings. Often savings go to investments that could help the job market.

Bottom Line

The Personal Income and Outlays report shows the amount of money spent by the USA residents in a month.

This report contains a list of products and services that consumers paid for them. It gives a great insight into policymakers and investors to gauge the economic activity of the USA.