The interest rate is a percentage of the loan (principal amount) that the lender charges a borrower for a specific period (generally one year).

Or, the interest rate is the cost of borrowing that a borrower should pay the lender.

In a loan contract:

- The principal is the amount of money that the lender gives the borrower.

- Interest rate is the percentage that the lender charges annually to the borrower.

- The maturity term is the period from starting date to the end of the contract.

The interest rate varies based on the risks, duration, principal, and economic condition.

A lender charges a higher interest rate if the risk is high. For example, if the underlying project is not promising or the borrower has a bad reputation, the rate will be higher.

The interest rate on a long-period loan is higher due to higher uncertainty. For example, the lender can predict more accurately the next 6 months more than 10 years in the future. Thus, he charges a higher interest rate for a 10-year loan and a lower rate for a 6-month loan.

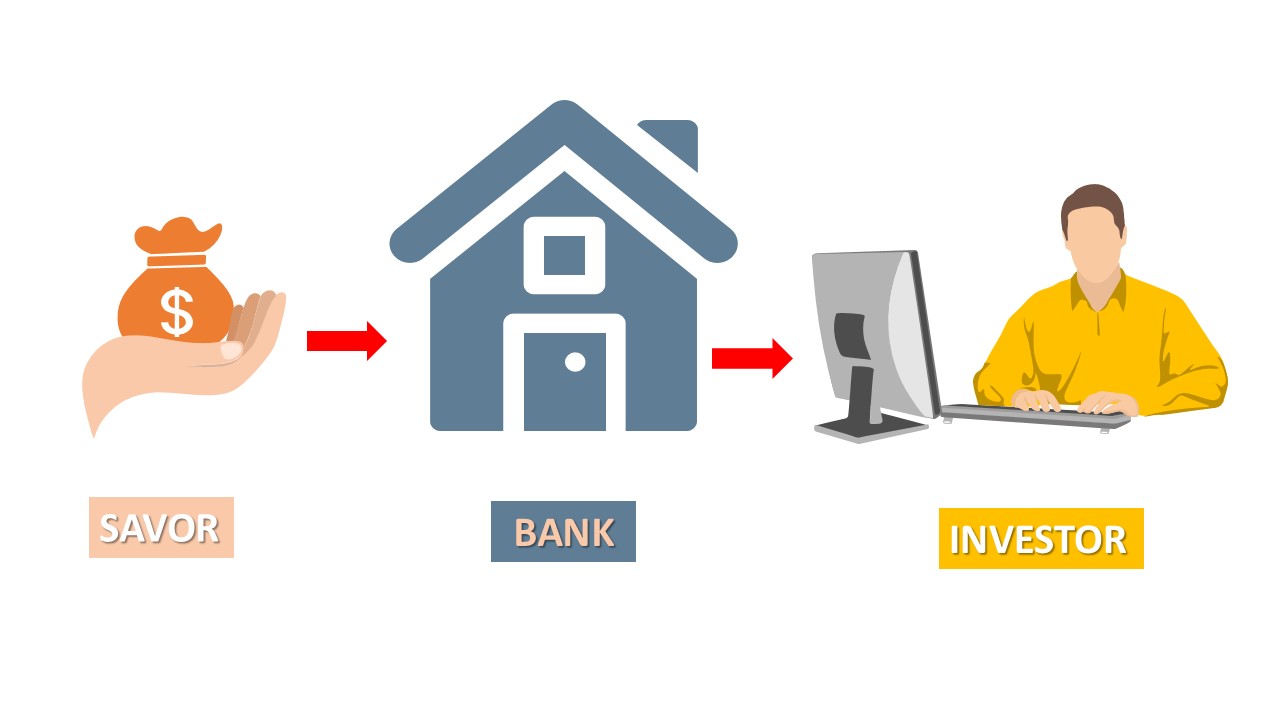

Who Are Lenders?

A lender can be a natural or legal person. The main target of lending is to receive interest.

Here are some of them:

- Individual savors lend (deposit) in a commercial bank.

- Commercial banks deposit their excess reserves in the central bank.

- Commercial banks lend to consumers, individual investors, and companies.

- Banks lend banks. For example, in the overnight market, banks lend to one another to meet the Required Reserve Ratio requirement.

Who Are Borrowers?

Borrowers borrow money to spend or invest. Like lenders, they can be legal or natural persons.

Here are some of the borrowers:

- Individuals borrow money to buy home appliances, cars, and houses.

- Individual investors borrow to invest in the stock market.

- Students borrow to carry out their studying costs.

- Companies borrow for investment to make a profit.

- Banks that shortfall the RRR, borrow from other banks to meet reserve requirements.

What Are Interest Rates that Central Banks Administer?

Interest rates that central banks set or administer are the most influential monetary policy of a country. And they have different names in various countries.

A central bank may set (raise or cut) or administer one or several interest rates. It depends on a nation’s law.

These rates affect everyone in a country, such as consumers, businesses, employment, exchange rate, etc.

That is why everyone pays attention to these rates.

Commercial banks like low-interest rates more than any other borrowers because the number of borrowers will increase, resulting in more revenue.

This article briefly introduces these tools in the USA, the UK, and Canada.

Interest Rates That the Fed Reserve of the USA Set

- The federal funds rate: This is the most important interest rate in the USA. It is the rate that depository institutions such as banks and credit unions lend to one another to finance their short-term requirements. The Fed requires banks to keep a minimum amount of customers’ deposits as a reserve known as Required Reserve Ratio (RRR) for unexpected events. If a bank holds cash less than the RRR, it borrows from other banks known at the fed funds rate, also called the overnight interest rate.

- Interest on excess reserve: The Fed pays interest on excess reserve balances (IORB rate) to banks that deposit in the Fed more than the required reserve ratio. And the Fed changes it on daily basis except for federal holidays.

- Discount rate: It is the interest rate that the Fed charges banks on the loans that they receive.

Interests that the Bank of England Set or Administer

- Bank Rate: It is the most important interest rate in In the UK, also known as the base rate. It is the same as the discount and the interest rate on excess reserves in the USA, at the same time. It means that the Bank of England pays the same rate on the short-term loan it gives commercial banks and their deposits in the Bank of England.

- Sterling Overnight Index Average (SONIA): It is an overnight interest rate index in the UK, the Bank of England governs and publishes every business day. SONIA reflects the average rates that a borrower (bank) pays the lender (also bank) in an overnight market.

Interests Rates that the Bank of Canada Set

- Policy interest rate: The “policy interest rate” is the most important rate in Canada. It is the overnight rate that banks charge one another in the overnight market. This rate is also known as the target rate.

- Deposit and bank rates: The deposit rate is the interest rate that the Bank of Canada pays other banks for their deposits. This rate is the same as the policy interest rate. However, the Bank of Canada charges other banks for the borrowed amount a higher rate known as the bank rate. And the difference between the bank rate and the deposit rate is +0.25% which is known as Operating Band.

What Is the Prime Interest Rate?

Prime interest is the lowest rate that banks charge their most creditworthy customers. It is also known as the base rate.

Each bank defines its prime rate. The central bank does set it.

Generally, the prime rate is about 3% above the overnight rate that banks charge each other.

The prime rate acts as a benchmark rate in a bank. Other interest rates such as credit card, home, and car are above the prime rate.

What Is the Mortgage Rate?

The mortgage rate is the interest that a lender (bank) charges a homeowner who borrowed to finance his home.

A mortgage is different from a student loan and a credit card. A mortgage is collateralized by the home. It means that if the borrower becomes unable to pay his loan on time, the bank can sell the house to take back its money.

A mortgage rate can be fixed or variable. The interest on the fixed rate is the same for the contract period, while the variable changes as the central bank change the overnight rate.

What Is Real Interest Rate?

It is the inflation-adjusted nominal interest rate.

The nominal interest rate is what lenders charge borrowers.

Understanding real interest rate is essential for lenders, borrowers, and savors. It reflects the true cost of borrowing for borrowers, the true return on loans for lenders, and the real saving rate for savors.

The calculation of the real interest rate is simple.

Real interest rate = nominal interest rate – inflation rate

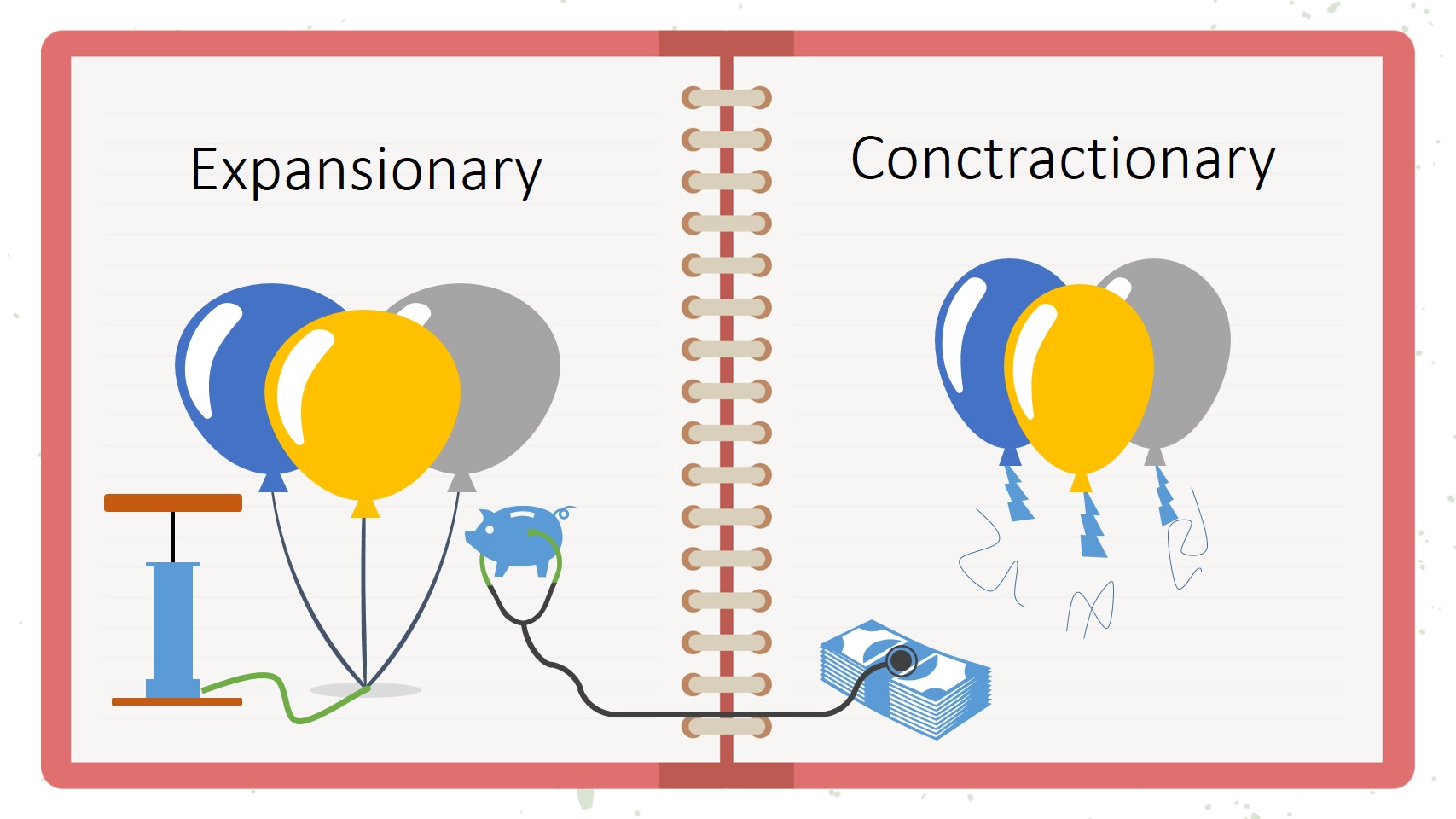

What Happens When Central Banks Cut Interest Rates?

The central bank cut interest rates to manage the macro economy.

A cut in the interest rate increase the money supply. And it means that money is cheaper.

A low-interest rate has advantages and disadvantages.

Advantages of a Low-Interest Rate

- Lower cost of borrowing: A low rate decreases the cost of borrowing. It benefits businesses and individuals. Businesses need to borrow for expansion or growth and individuals need to borrow for buying homes, cars, etc.

- Unemployment reduction: In a low-interest rate consumers increase consumption or demand. Businesses respond to higher demand, by hiring more employees and raise of production. As a result, the unemployment rate declines.

- Economic growth: More investments and consumption lead to more economic growth.

- Boost of exports: A cut in the interest rate lowers the exchange rate of a currency. It benefits exporters because domestic products become cheaper than goods produced in other countries. Moreover, exports bring foreign exchange, bringing trust to the economy.

Disadvantages of a Low-Interest Rate

- High Inflation: A low-interest rate causes rising inflation. When the money is cheap people will increase their demand resulting in a higher inflation rate. A low inflation rate may create a bubble, increase the business cycle speed and cause a recession.

- Low saving: A low-interest rate discourages saving by individuals. People prefer to consume or invest in risky assets when the rate is low. A low saving rate today creates difficulties for the future.

What Happens When Central Banks Raise Interest Rates?

When the interest rate rises, the amount of money in the economy shrinks. And a higher interest rate means that the money is expensive.

Here are the advantages and disadvantages of a high rate.

Advantages of High-Interest Rate

- Low inflation: A higher interest rate discourage consumers and investment from borrowing. It results in cutting the demand side of the economy. And a lower demand pushes the average prices or inflation down.

- Higher saving rate: Banks pay a higher interest rate to depositors when it is higher. And a higher rate encourages people to save more and receive interest.

Disadvantages of High-Interest Rate

- Higher cost of borrowing: High-interest rate means money is expensive. Businesses will reduce investment when the cost of borrowing is high, and consumers will consume less. Moreover, demand for goods and services declines, and investing and buying homes become less attractive. Many people may need a home, and some businesses may need to expand. But, they are not able due to the high-interest rate.

- Slow economic growth: Because a high-interest rate leads to less investment, economic growth will slow down.

- Unemployment rise: A high-interest rate slows the economy, investment, and consumption. Thus, a high-interest rate results in a rising unemployment rate.

- Decline exports: A higher interest rate makes the national currency stronger than foreign currencies. A strong currency increases imports and decreases exports. Moreover, imports decrease the forex reserve which is bad for the economy.

What Is the Consumer Credit Score?

A credit score is a number that indicates how likely a person will pay his debt on time.

A credit score is a three-digit number ranging from 300 to 850 points. A higher number is better for borrowers. And a good credit score is above 700 which is generally the average.

It impacts both the interest rate and the chance of getting a loan. The credit score influences any loan provision and its rates, such as home, credit card, and car loans.

The credit reporting agency extracts the credit score from a report. It is similar to an exam paper, with the report (containing information about a borrower’s credit situation) resembling the exam paper and the score resembling the mark that a student gets.

A credit reporting agency in the USA is known as a consumer reporting agency, a credit reporting body in Australia, a credit reference agency in the UK, a credit bureau in Canada, and a credit information company in India.

Credit reporting agencies collect and organize the credit history of millions of people globally. And they calculate the credit score using payment history, the amount owed, length of the credit history, new credit, and types of credit.

Credit score systems enable banks to calculate the risk of loan payments cheaply and quickly. Without credit score systems banks will charge even creditworthy people a higher interest rate due to a higher risk of not knowing them.

What Is the Credit Rating of Companies?

The credit rating of a company measures its creditworthiness. It is measured by credit rating agencies such as Moody’s and Fitch.

Credit rating agencies use letters and (+ and -) signs. And each of them uses a specific combination of letters and signs.

Here is an example of how Moody’s rating works.

The position of companies from bottom to top decreases. Contrarily the creditworthiness increases.

Click here to read the full explanation by “Moody’s” about the above table.

How to Find Interest Rates?

Finding today’s interest rates is crucial for investors to analyze economic activities.

There are two sources: official and third-party websites.

Central banks set or administer these rates, so you can simply find the interest by going to the official website. Or, just google it.

Third-party websites publish interest rates in a widget interest rate calendar, economic calendar, or a table.

The following is the interest rate calendar that provides rates of major economies. Click here to go to the dedicated page for the interest rate calendar.

The economic calendar publishes the interest rate of each central bank separately, and its historical data.

This is Fed Rate historical data chart.