Bollinger developed the Bollinger Bands Indicator. It is a technical indicator that measures the volatility of a financial asset.

Bollinger Bands is placed on the price chart, containing three lines. The middle line is a moving average (can be any type of MA), and the two others located above and under the moving average are bands. In the following, I have explained the calculation formula of MA and two upper and lower bands.

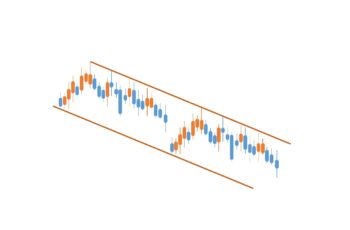

The upper and lower lines diverge as the volatility increases and converge as the volatility decreases.

Due to being very famous almost, every trading soft-wares have this indicator.

In the above chart you see that when the volatility is low, the upper and lower bands tend to get closer. And when the volatility is high, the distance between them gets wider.

Before I continue writing, I want to let know how to insert a Bollinger Bands indicator for those who do not know. If you understand, skip it.

Read more: Moving Average Envelopes Indicator Fully Explained

How to Insert Bollinger Bands Indicator into Your Chart in MT4

The MetaTrader 4 is the most famous trading platform in the market. That is why I chose this software.

To insert Bollinger Bands go to Insert>Indicators>Trend> and click on Bollinger Bands.

Bollinger Bands Settings in MT4

For the first time that you insert the Bollinger Bands Indicator, the settings window pops up. Moreover, you can open it by right-clicking on any of its lines and clicking on “Bands Properties”.

The window of Bands Properties has three tabs: Parameters, Levels, and Visualization.

In the parameters tab, you can select period (number of candlesticks), shift (toward the right or left), coefficient of deviation(distance between bands and the centerline), application price, and style it. Deviation Coefficient and period selection are crucial to understanding, and I have explained them in the upcoming paragraphs. If you are interested to know about the application price, I have discussed it in detail in the middle of this article.

Levels and Visualization are the same as other tools’ Levels and Visualization.

How to Calculate Bollinger Bands Lines?

The Bollinger Bands has three lines: centerline and two outer lines.

The centerline is a moving average. You can apply any price to this moving average that you want.

A moving average formula is the following:

MA = (sum of n prices)/n

In the above formula, “n” is the number of candlesticks, and MA is the Moving Average.

The upper line (upper band) formula is the following:

UB = MA + DN(StdDev)

LB = MA – DN(StdDev)

In the above formulas:

UB – Upper Band

MA – Moving Average

DN – Deviation number (the number that Standard Deviation is multiplied)

StdDev – Standard Deviation of the number of candlesticks used in the indicator.

How to trade Bollinger Bands Indicator?

Bollinger Bands Indicator has one band above and another under the moving average. To trade professionally, you need to test and apply for various numbers in MA and the Standard Deviation Number. Because price actions depend on numerous factors and you need to study under many circumstances to add to your knowledge.

I suggest you play with Bollinger Bands and go back on your chart and study deeply.

Moving Average in Bollinger Bands

The moving average (MA) in Bollinger Bands defines the overall trend of an asset. Pick the correct number.

I recommend you to go to your chart and play with it.

Select the number of moving average periods as you are comfortable. If you are a long-term investor, you may need to select a higher number, and as a short-term trader, you may need a smaller number.

I think it is not a good idea to recommend a specific MA. Because from asset to asset, you need different MA. So, I highly recommend you to experience it yourself. Recommending a specific number for a moving average is difficult due to many factors that affect your analysis, such as mentality, emotional strength, assets, etc.

Example of MA in BB

In the Bollinger Bands Indicator, a higher moving average period makes the outer bands less smooth. Oppositely, a slower moving average period makes upper and lower bands smoother.

In the above chart, the outer bands do not look very smooth. And, the price has crossed bands multiple times.

In the above chart, I doubled the MA in BB Indicator. You see that the distance between bands is wider than in the previous chart. Moreover, the upper and lower bands are smoother than the “32-period” moving average Bollinger Bands.

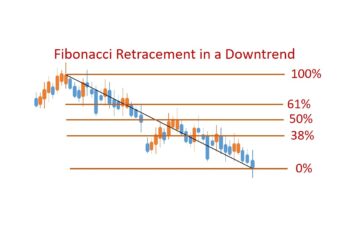

Deviation in Bollinger Bands Indicator

The distance between the moving average and bands can be broader or narrower. It is the deviation number in Bollinger Bands Settings that defines the distance.

Long-term traders select a higher standard deviation number, while short-term traders select a lower number.

Statisticians agree that in a normal distribution approximately:

- One Standard Deviation of the mean cover 68% of data set;

- Two Standard Deviations of the mean cover 95% of data set; and

- Three Standard Deviations of the mean cover 99.7% of data set.

I like to repeat again and again: experience it yourself while you are reading articles on srading.com.

Based on the chart and financial asset, you have to select a deviation that the price moves between upper and lower bands around 95% of the time. You need to test and analyze the chart of an asset and go back to see if you have chosen the right deviation.

You should not select a very low standard deviation number because it will signal too frequently and make you emotional leading to losses. It should not be too wide because you will miss a lot of signals that could make you money.

When Bollinger Bands Indicator converges, it means that the market is in correction. Narrower the distance between bands represents a more reliable correction.

The best time to go long using Bollinger Bands after a correction is when the price is above the moving average and the trend is confirmed by other tools such as MACD Indicator and chart patterns. On the other hand, if the price breaks the lower band, and the breakout of the pattern is confirmed by other tools, it is time to look for sale signals.

Example of StdDev in BB

As the standard deviation number becomes bigger, the distance between upper and lower bands gets wider and vice versa.

Study the Bollinger Bands In Real Chart

Click on “f(x)>Overlap Studies>Bollinger Bands” and set it as you wish to insert the indicator.

Bottom Line

Bollinger Bands Indicator is a great tool if you use it properly.

To understand it better and apply the strategies you need to play with it and go back in the past to see various situations.

You can not look at all charts for 24 hours, so if you missed an opportunity, it is not a good time to enter the market. It will be better to wait for correction. And when the correction support or resistance lines broke place a trade.

Moreover, combine your analysis with other techniques such as fundamental analysis, inter-market analysis, wave analysis, chart patterns, candlestick patterns, and an oscillator.

When many techniques confirm a signal, it is more powerful, and you have a higher chance of winning a trade.