The Producer Price Index (PPI) measures the average price increase or decrease of goods and services that domestic producers receive. And it is one of the most followed inflation indicators.

In other words, the PPI measures the average selling price change of goods and services in a region or a country. By selling price, I mean that the PPI does not consider discounts, allowances, and other promotional price cuts. It only cares about the amount of money that producers receive.

Do not get confused. Even though the name of this index does not mention “services,” the PPI includes them. Later, you will read more about it.

The Producer Price Index (PPI) is a price or inflation index. Unlike the Consumer Price Index (CPI) which measures price changes from consumers’ perspective, the PPI measures from producers’ points of view. Prices that consumers pay vary hugely from the price that producers receive due to taxes, discounts, subsidies, markup charges, and…

Note: There is no single organization that surveys and produces PPI numbers worldwide. Instead, governmental organizations do the job. So, expect to see differences in methods of organizing data, classification, and even names. For example, in India, investors look at the Wholesales Price Index (WPI) instead of PPI because no entity surveys producers for the Producer Price Index. But, this article helps you to understand all of them.

Producer Price Index (PPI) Classification

The producer price index value is derived by the calculation of thousands of goods that producers sell. It is made of single items and several indexes. Studying every single one of them for a trader or investor is hard and could be useless.

However, if you are working for a survey or research organization, studying PPI elements is necessary. Otherwise, for example, if you are a trader, understanding elements may not benefit you.

So, dividing the PPI into classes is better for individuals who do not want to study the whole.

The PPI itself is classified into indexes. And it varies among nations, depending on the economic structure.

The easiest way to grasp PPI classification is to consider the production chain that starts with the commodity/input/material index, industry (stage of production) index, and finished goods index. Moreover, each of these indexes is categorized into sub-indexes as well.

The Commodity/input Index covers basic materials such as iron ore, oil, gas, and coal. If the inflation in a country rises or falls, this index is probably the first to show off.

The Stage of Production (SOP) index measures the price change of goods that producers pay for manufacturing finished goods. If the commodity index rises, then expect the SOP index to rise too.

The Finished Goods Index measures the price change of goods end consumers buy.

Producer Price Index Calculation

The PPI calculation is simple, and the Laspeyres Index formula is used for it.

In simple words, the Producer Price Index = (Total items producer price this year)/(Total items producer price in the base year)x100

The above formula calculates the PPI of the current year. However, without comparison to the previous year, it is meaningless. So, we deduct the PPI of this year from the previous year to depict changes, whether it is positive or negative.

Moreover, the above formula shows the PPI of the current year. If you wish, you can calculate monthly and quarterly PPI as well.

Reading Producer Price Index

Surveyors and data providers provide the PPI either in numerical value or percentage terms.

If you see PPI in numerical value, it is necessary to know past data for comparison. However, if it is in percentage terms, it is clear that the PPI has risen or fallen by a certain percentage.

For example, the following chart shows the PPI of France produced by the National Institute of Statistics and Economic Studies (insee.fr) of France with the base year of 2015. It is a graph showing the PPI growth value vertically and the timeframe horizontally.

However, in the economic calendar that is on our website, the same data series are shown in percentage terms.

Notice that in percentage terms any number below zero level means a drop compared to the previous month.

For example, if the PPI of last month was -0.5% and this month was -0.2%, it means that the PPI of this month has fallen 0.2% compared to last month. And of course, last month had fallen 0.5% compared to two months earlier.

The Importance of the PPI

The PPI is one of the most important leading economic indicators that tracks prices. This indicator is closely watched by investors, executives, and government officials because it forecasts economic performance earlier than most other indicators.

Its importance comes from the fact that it covers thousands of products and services and the fact that functions of the economy start with production.

A rising Producer Price Index (PPI) means that producers receive a higher price as a result of a higher demand or a higher raw material price.

That is why the PPI alone is not complete. You should look at commodities and raw materials too.

However, mostly it is a positive sign for the economy.

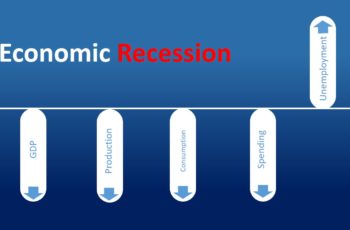

A higher value than expected as a result of an increase in demand shows trust in the economy by consumers. Reasons behind trust can be multiple things, for example, recovery from an economic recession (if there was any) or a cut in the unemployment rate.

However, when the PPI rises as a result of a rise in raw material prices, producers expect a fall in sales volume, supposedly other factors do not change. So, producers will act accordingly. For example, if the PPI rises/falls too much, some producers may change production, recruitment, marketing… plans. Producers’ decisions directly impact the whole economy and indicators such as the Consumer Price Index (CPI) and Gross Domestic Product (GDP).

A certain thing is that the PPI should be interpreted considering other economic indicators too.

United States Producer Price Index (PPI)

The United States Bureau of Labor of Statistics (BLS) produces the PPI monthly and considers 1982 as the base year.

It revises the seasonally adjusted data for the preceding five years and major revisions every ten years.

The United States PPI covers the output of all industries in the goods-producing sectors. Examples are mining, manufacturing, agriculture, natural gas, forestry, recycled goods (competitors to good-producing sectors), and construction industries.

The output of over 70% of the services sectors is also included in the US PPI. Examples are wholesale and retail businesses, transportation, finance, real estate brokering, leasing, and health care.

The United States PPI is classified into industry, commodity, and Commodity-based Final Demand-Intermediate Demand (FD-ID) classes.

The following image shows the latest monthly PPI released by BLS.

China Producer Price Index

The National Bureau of Statistics China releases the PPI for industrial products every month and compares prices in this month with prices in the same month of the previous year.

The NBS releases the Producer Price Index for Industrial Products data along with the Purchasing Price Index for Industrial Producers (PUP). The PUP is the price that producers pay for intermediary goods.

Unlike other countries where the base year lasts long, in China it rotates every five years. Currently, as of 2023, the base year in the calculation of China’s PPI is 2020.

The PPI for industrial products survey covers the prices of industrial products in 40 major industrial categories and over 1300 basic categories. The survey of PUP for industrial producers covers the prices of industrial products in 9 major categories and over 800 basic categories. The PPI survey includes 40,000 industrial companies in China.

Here are the latest China PPI and PUP charts.

Bottom Line

The Producer Price Index measures price change from the producers’ perspective, unlike the Consumer Price Index which measures from consumers’ point of view.

PPIs are produced monthly by governmental organizations and every country measures a little differently from others. However, they all tell the same story which is price changes from the producer’s eyes.

The PPI is a leading indicator during abnormal economic conditions. During normal conditions, the PPI is less likely to impact the stock market or Forex.