Introduction

A trend is the price direction behavior of a financial asset either upward or downward. When it goes sideways, there is no trend.

An uptrend in the financial market is also called a bull market. And a downtrend is also called a bear market.

All participants of every financial market use trends in their analysis. It does not matter what financial asset you are trading. And, here what you read can be applied to all of them.

A trend can be a long-term trend or a short-term. A longer period (timeframe) shows a long-term trend, and a shorter period shows a short-term trend.

Trends commonly used for analysis are monthly, weekly, daily, four hourly, hourly, 30 minutes, 15 minutes, 5 minutes, and 1 minute.

Investors use different periods for trend analysis. Long-term investors rely on the longer period charts, and short-term investors rely on shorter periods.

Traders commonly use shorter periods, and investors use longer periods. Traders are those who actively buy and sell financial assets. Investors are those market participants that keep their positions for months and years.

How to Determine a Trend?

There is no strict rule on how to determine a trend.

Generally, investors determine a trend in four ways: using moving averages, a specific percent rise and fall, trendlines, and patterns. And my favorite one is the pattern technique.

Notice that the direction of a market needs to be confirmed by other tools and techniques. None of the techniques that you will read below; can make you a successful trader alone.

Determining a Trend Using Moving Averages

Some traders prefer to determine a direction in the financial market simply by using a moving average.

They believe that if on average, the price is rising, there is a bull market, and if it is falling, there is a bear market.

Different traders apply various periods (number of candlesticks) in a moving average to determine a trend. However, the 52 moving average and 32 moving average are more common among investors.

In a 32 Simple Moving Average chart, when the price falls below the moving average, there is a downtrend (bear market). On the other hand, if the price rise above this MA, there is a new uptrend.

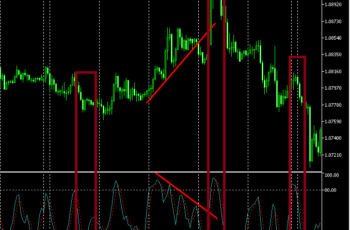

Example of Trend Reversal Recognition Using MA

Here is a chart that shows both successful and failed recognition trend reversal using Moving Average (MA).

In the above chart, you see that a MA successfully recognized a trend reversal only once (marked with a rectangle shape) but failed four times (marked with circles).

Recognition of a trend and trend reversal using MA is risky. It crosses frequently in a sideways period, making a trader confused about whether to place a trade or not.

If you use this method, it is helpful to combine your analysis with other techniques. In the above chart, on the left side, after the price crossed the MA line, it also formed a small correction pattern, and the MACD indicator confirmed that bears are in power.

Trend Determination by Specific Percent Rise and Fall in the Market

There is a type of investor who determines a trend by a specific percent rise and fall in price.

Commonly, stock investors use this type of analysis. Other investors such as forex and commodity don’t use this method, because these assets do not fluctuate 20% easily.

For example, if an index drops 20% from its last major high, the trend has changed from an uptrend to a downtrend. And, if an index rises 20% from a recent low, the trend has changed from a downtrend to an uptrend.

In March 2020, all major indexes in the USA fell 20% and started a new trend for a short period.

In the above chart, you see that SP 500 fell below 20% and continued going down for some time. This direction did not last for a long time, and a bullish market resumed again in April 2020.

Generally, in the stock market, an uptrend lasts longer than a downtrend. On the other hand, in the forex and oil market, the market direction changes frequently. Thus, recognition of a trend by a specific percent fall and rise is not useful in other markets except the stock market.

Determining a Trend by Trendlines

Some traders determine the direction of a market by drawing trendlines.

In an uptrend, investors draw the trendline by connecting two or more bottoms in the chart. On the other hand, in a downtrend, a trader draws a trendline by connecting two or more tops to determine market direction.

In this method, as the time pass, a trader should adjust his trendlines because the market moves in a way that a trader cannot control.

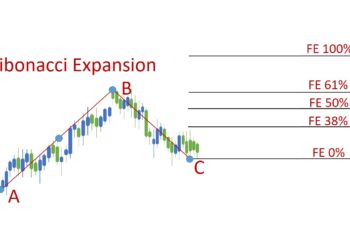

Determining Direction of a Market by Patterns

The pattern technique is my favorite method for the recognition of market direction. In my opinion, this method is the best one.

In this method, you just look at the chart for correction patterns. And you may need to drag the trendline to draw the patterns.

If the price direction is upward and the market makes a bullish correction, then the market is still in an uptrend. On the other hand, in an uptrend, if the market pulls back, makes a bearish consolidation, and finally breaks the correction pattern downward, then the trend has changed.

In a downtrend, if the price is falling and then make a bearish consolidation pattern, it indicates that we are still in a downtrend. Conversely, in a downtrend, if the market pushes back, makes a bullish correction pattern, and finally breaks the pattern upward, then the market trend has changed from a downtrend to an uptrend.

The Slope of a Trend

Trend slope can be steep and shallow. When the trend slope is steep, the volume of trading activities is high, and when the trend slope is shallow, the trading volume is low. And, when trading volume is very low, the market moves sideways, which is not any trend in the market.

Trade With Market Direction

Trends usually continue for a very long period.

When a trend is established, no one knows how long it will continue. That is why you have to trade with trends.

However, a direction does not mean that it continues forever. It can reverse from upward to downward and downward to upward. The job of an investor or trader is to act according to trends.

If the trend is established after a big fundamental change, it is very likely to be a bad idea to trade against the trend. Because, as mentioned, no one knows the end of a direction in the financial market.

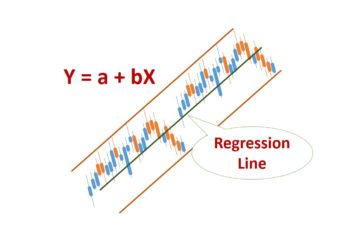

Trend Channel

Traders draw trend channels by drawing two parallel lines, one at the top and the other at the bottom of a trend. On the top, the line is drawn by connecting higher points and the bottom line by lower points.

Trend channels help traders to understand how volatile the market is. A wider channel reflects a more volatile market, and a narrower channel reflects a less volatile market.

Trend channels cannot be perfect or even cannot be drawn in a trend that volatility changes over time, so you should not stick strictly. For example, if at the start of the trend volatility is high, and at the end of the trend volatility is low, a trend channel will not exist. Instead, by drawing lines at the top and bottom of the graph, you will get a nice pattern.

Bottom Line

A direction can last from days to years. So, to become a successful trader, you have to trade with the trend.

The difficult part of trading the price direction is the recognition of the trend.

There are various ways to determine price movement directions. However, we found that the best method among all of them is the pattern technique. Pattern technique is easier to trade, more reliable, and helps you to manage your emotion better.