A broker to attract various types of investors offers several types of forex account. Their fees, leverage, swap, margin call, and spread are different among these accounts because every one them is designed for a specific type of client.

Before opening an account, I recommend you to read the description of all types of accounts that a broker offer.

In this article, I explain the most common types of accounts that several brokers offer.

Please remember that what you read here is just a general introduction and not applicable to every broker.

Standard Account

Among various types of forex accounts, the standard account is the most popular one. Traders pay close attention to this type of account to compare one broker to another.

Generally, a standard account has the following features:

- the lot size will be 100k of your base currency;

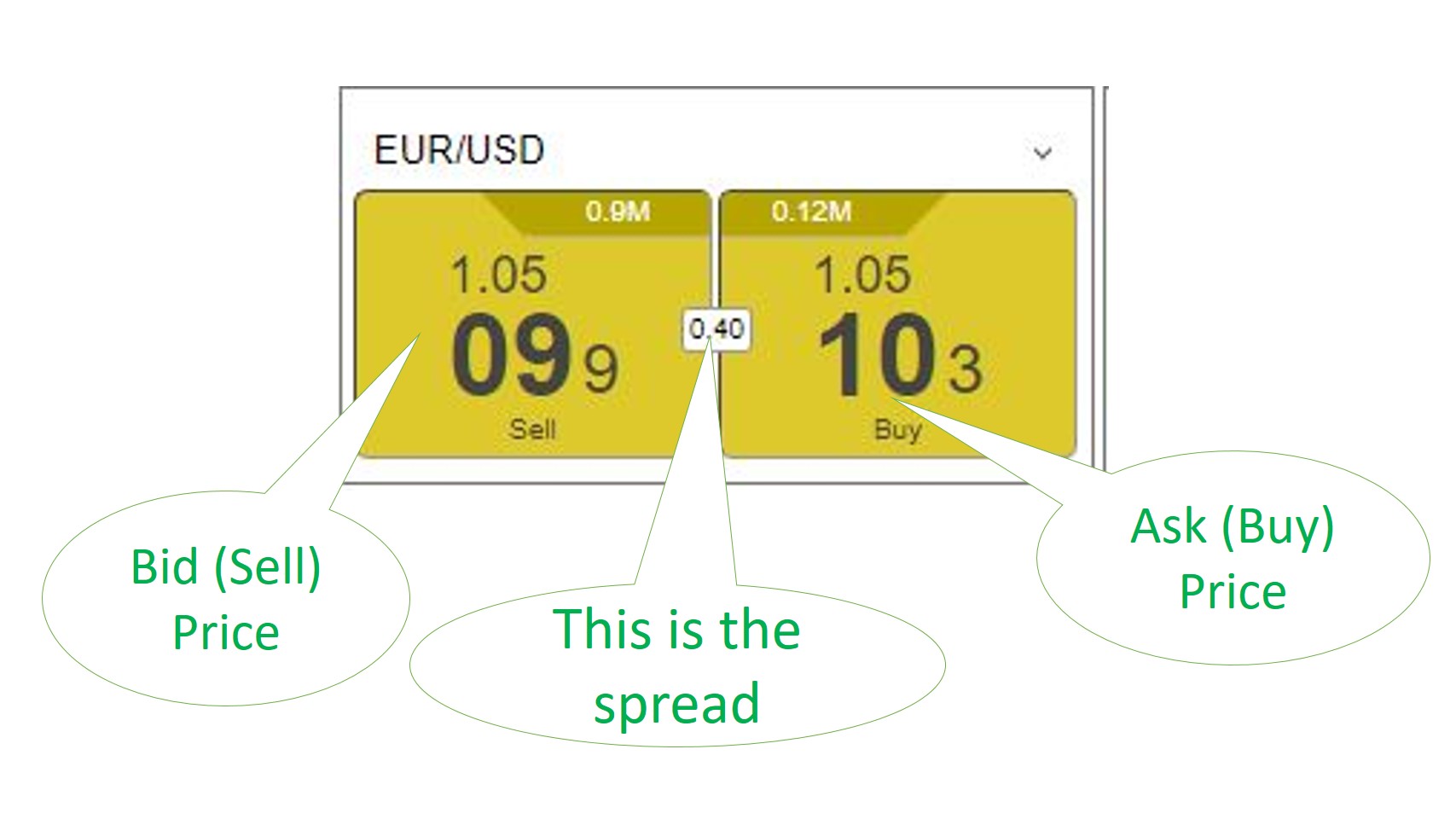

- The spreads are normal;

- Your broker charges you SWAP;

- This type of forex account is not ECN; and

- in most cases, you will not be charged commissions.

Islamic Account

Because in Islam, interest paid to the lender is Haram, some broker offers Islamic Account, also known as a SWAP free account.

Some brokers will offer you an Islamic account if you live in an Islamic country or you are a Muslim.

Some brokers that offer only ECN accounts, may not be able to afford an ECN Islamic account.

General features of an Islamic Account are:

- It is not ECN;

- The spread charged to Islamic Account holders is higher than other types of accounts; and

- Islamic Accounts are not connected to the interbank exchange due to being Market Maker.

Zero Spread Account

The spread of the Zero Spread Account is zero. This is what its name comes from.

General features of Zero Spread Accounts are:

- The commission charged for every trade is higher than any other type of account;

- You may need to deposit a large sum of money to open a Zero Spread Account; and

- It is not very common among brokers.

Pro Account

Pro Accounts are designed for professional traders who deposit much higher amounts than most retail traders.

General features of Pro Account are:

- The spread of Pro Accounts is lower than standard and Islamic accounts;

- The Margin Call of a Pro Account is also lower than Standard Account;

- The commission is lower; and

- Available leverage is higher.