The NFP or Nonfarm Payrolls report reflects the number of new jobs created in the US economy in a given month, excluding farm workers, self-employed, private household workers, active military members, and non-profit organizations.

In other words, NFP shows the number of new jobs created in the USA excluding framers and the stable segment of the job market

The Nonfarm Payrolls indicator includes about 80% of US workers by surveying about 131,000 businesses and government agencies every month.

Thus, this information is hugely valuable for investors, helping to analyze job markets and even monetary policy.

The Importance of NFP in the Economy

The NFP is one of the most significant US economic indicators due to its huge coverage area. Sometimes, it has an immediate impact on the stock and Forex market.

Investors use this indicator to analyze the job market and consumer spending.

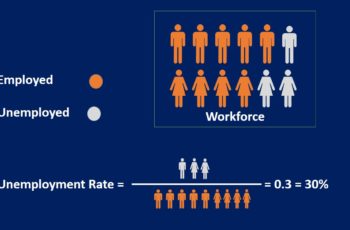

Growth in the new job creation indicates that personal income and personal consumption are growing and the unemployment rate is declining. These changes often lead to economic growth.

Moreover, a decrease in the unemployment rate means that businesses are hiring, investments are increasing, and the economy is strengthening. They all fuel the economy.

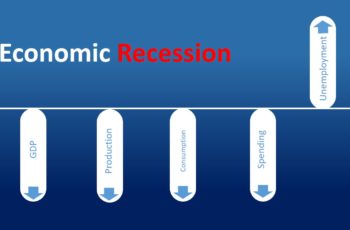

A rapid rise or decline in the NFP reading jolts the Fed officials. A huge jump in the new job numbers could trigger inflation due to a rise in consumption and possibly wages. Contrarily, a sharp drop in the new numbers created may frighten officials about the declining economy which may lead to a recession.

So, using the Nonfarm Payrolls data, the Fed Reserve adjusts its monetary policy. They may consider a possible rise or cut in the interest rate if the inflation becomes out of control.

Impacts of NFP in the Forex Market

The release of the NFT report immediately causes volatility in the Forex market. However, it may last or be a short period such as one hour or even less.

The NFP has an influence on the US dollar quotes in a positive correlation. If job creation or NFP reading is strong, then the USD will strengthen as well and vice versa.

In addition to its impact on the Forex market, it will affect the stock market and gold. Stocks and gold are priced in the USA. Based on the Intermarket Analysis, the Gold and the USD have a negative correlation. However, relationships do not last forever. So, don’t expect them to move oppositely always.