Fibonacci Retracement is the most useful and most popular among the Fibonacci tools. Probably every technical trader uses the Fibonacci Retracement.

Traders use this tool to gauge the percentage of pullback and the points of possible support and resistance lines.

For example: in the above chart starting point of impulse is 100%, and the end of it is 0%. If the price fall below 0%, it has expanded instead of retracement. On the other hand, if the price moves upward to 50%, it has retraced 50%. Traders pay more attention to these levels for possible resistance lines.

Generally, traders utilize Fibonacci Retracement to define entry points. They are waiting for a pullback to catch opportunities.

Read more: What are Fibonacci Numbers, Golden Ratios, and Tools

Does Fibonacci Retracement Work?

In my personal view, this tool is a great tool for measuring the percentage of a pullback, especially for wave traders. However, you can not rely on it to define your entry or exit points.

I believe that the market does not respect Fibonacci Levels because the number of factors that affect prices is countless.

What is better than experience? Apply this tool on charts to see if you can rely on it or not.

Read more: What is A Fibonacci Expansion & How to Place It?

Placing Fibonacci Retracement Correctly in MT4 and MT5

To insert this tool in MT4 and MT5, go to Insert>Fibonacci and click on Retracement.

To place it correctly, click on a start of wave or impulse and drag it to the end of the wave.

Here is another way to insert this tool

By default, you see some retracement levels predicting possible pullback prices.

For example, if the price pullback to 50% of the initial wave, we say it has retraced 50% or 0.5 of the impulse.

Among all Fibonacci ratios, according to some technical traders, the 0.38, 0.5, and 0.68 are golden ratios. They call these ratios golden because of their strengths and more repetitive occurrence.

Properties of Fibonacci Retracement in MT4 and MT5

Properties of Fibonacci Retracement are the same as other drawing tools except for the Fibo levels in the Fibo window. I have written in detail the properties of Fibonacci Expansion at the end of this article. Go and read if you need.

In the Fibo level tab, you can add and delete some of them. Additionally, you can style it somehow.

Example of Fibonacci Retracement

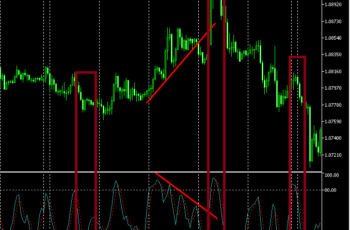

I added this tool to the weekly EURUSD chart. I placed it at the start of an impulse on 2020.03.22 and the end of the impulse, on 2020.12.27.

On the chart, you can see that the price retraced to 38% on 2021.03.28, and 61.8% on 2021.11.21.

On the chart, the 23% and 50% levels did not act as a support area, however, they did as resistance lines.