Relative Strength Index (RSI) is a technical indicator that measures the relative strength of the average of the last periods (ex: 14 days) that close higher and the average of the last periods which close lower.

The RSI is different from Relative Strength in the stock market, which compares the relative strength of a financial asset with the performance of an industry, index, or commodities such as gold and oil. Here, in simple words, RSI compares the relative strength of bulls and bears.

The RSI indicator window is placed under the main chart (price chart) ranging from 0 to 100 on a vertical scale.

The standard RSI window has two levels (horizontal lines), 30 and 70, to show overbought or oversold conditions. The 30 line indicates that the relative strength of bears is probably going to finish. The 70 line indicates the opposite specifying that the bulls’ relative strength possibly ends.

Read more: Momentum Indicator Fully Explained

How to Calculate Relative Strength Index (RSI)?

The formula of RSI is the following:

RSI = 100 – (100/1+RS)

RS = (average of x days closed higher)/average of x days closed lower)

Where;

RSI – Relative Strength Index

RS – Relative Strength

X – a period (ex: 14 days)

Read more: Bollinger Bands Indicator Fully Explained

Settings of Relative Strength Index (RSI) in MT4 and MT5

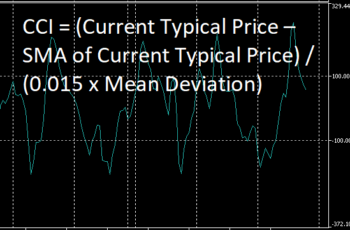

The properties of the Relative Strength Index are the same as Commodity Channel Index (CCI). I have written in detail about it, and click here to read it if you need it.

How to Trade the RSI?

As mentioned, the standard RSI window is under the price chart and has two levels, namely 30 and 70 lines, and its scale range from 0 to 100.

The 70 level shows overbought, and the 30 oversold conditions.

In the setting, you can add another line if you wish. Some traders prefer to add a 50 points line in the middle to help better analysis.

The 70 level shows that the underlying asset is overvalued, and soon the market will reverse its trend or make a correction before it continues rising. Conversely, the 30 level indicates undervalued conditions and soon the price of the underlying asset reverses its direction or makes a correction.

In the above chart, first, after the Relative Strength Index (RSI) line crossed the 70-level, the market corrected before rising continued. The second and third highlighted places show that the RSI was right about overbought conditions, and the market fell after that.

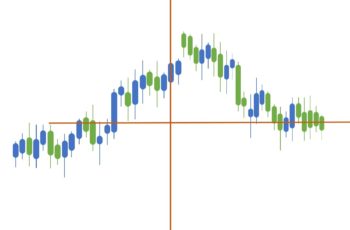

Additionally, the Relative Strength Index (RSI) predicts a trend reversal by not following the price direction. For example, if the price makes new higher highs, but the RSI makes new lower lows, it’s an indication of a trend reversal.

In the above chart, in the highlighted area you see that the price chart is making new higher highs, while the RSI is making the opposite. The RSI was right, and the price direction changed from an uptrend to a downtrend.

The standard RSI period (the number of candlesticks to be counted) is 14 days. You can change the period as you wish. If you selected a shorter period, the RIS line will be more sensitive and vice versa. Long-term investors prefer to choose long, and short-term traders prefer a shorter period.

In the above chart, the 32-period RSI is much smoother than the 14-period.

Read more: Moving Average Envelopes Indicator Explained

Practice RSI In Real Chart

Click on “f(x)>Momentum Indicators>Relative Strength Index” and set it as you wish to insert the indicator.

Bottom Line

The RSI is a great indicator showing overpriced and underpriced assets by the levels such as 30-level and 70-level. Additionally, it predicts a trend reversal by going in the opposite direction other than the price chart.

Of course, the RSI alone is not very helpful if you forget candlestick, chart patterns, and fundamental analysis.