The Commodity Channel Index (CCI), developed by Donald R. Lambert, is a leading technical indicator that shows overbought and oversold conditions. First, investors were using it for commodity trading, however, you can also use it for trading stocks and other financial assets.

It has the word commodity in its name but does not recognize if the underlying asset is a commodity or stock.

In this article, I talk about Commodity Channel Index (CCI) settings, how to trade, and how it is calculated.

Read more: Momentum Indicator Fully Explained

Commodity Channel Index (CCI) Settings in MT4 and MT5

To open CCI settings, right-click on its line in the indicator window and click on CCI properties.

The CCI properties window in MetaTrader (MT4) has three tabs parameters, levels, and visualization. In MetaTrader (MT5), you have one additional tab, Scale.

Parameters tab:

- Period (the number of candlesticks).

- Apply to (defining what price should be applied). By default, it uses the typical price (HLC/3),

- Style making (how the CCI line should look like)

- Mixed minimum and Fixed maximum lets you define a fixed vertical scale in the indicator window.

In the levels tab, you choose the value of horizontal lines in the indicator chart.

In the scale tab, only available in MetaTrader 5 (MT5), you have the following options:

- Inherit Scale receives settings from predecessor indicator settings.

- Scale by line allows defining scale either by percent or points.

- Fixed Minimum and Fixed Maximum are to choose a fixed number at the bottom and top of the indicator window.

Read more: Moving Average Envelopes Indicator Fully Explained

How to Calculate Commodity Channel Index (CCI)?

The CCI formula is the following:

CCI = (Current Typical Price – SMA of Current Typical Price) / (0.015 x Mean Deviation)

Where;

CCI: Channel Commodity Index

Current Typical Price: (High + Low + Close)/3 or HLC3

SMA: Simple Moving Average

0.015: A constant to make sure that the line of CCI stays between -100 and +100

Mean Deviation: It is a mathematical tool that measures how far, on average, all values are from the middle.

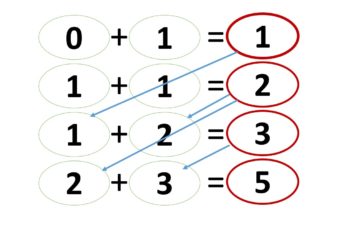

To calculate the mean deviation of a set of data, you have to do the following calculations:

- Find the mean of values

- Find the distance of each value from the mean found in the first step

- Find the mean of distances found in the second step.

I have written about deviation and its calculation in detail in the (What is the Standard Deviation Channel?) article. Click on it to read more if you need it.

How to Trade Commodity Channel Index (CCI)

This indicator is placed under the price chart in the indicator window. The CCI indicator window has two lines, -100 and +100. It measures the difference between the change of the current typical {(H+L+C)/3} price and its average change price.

When the CCI line crosses above +100, it signals bullishness and below -100 bearishness. It is not a must to use these lines, however, professional traders suggest you do so. Having said that, every cross of -100 and +100 lines does not mean a trend has reversed. Crossing these lines by the CCI line should be confirmed by chart patterns and other tools too to make a high-quality decision.

The CCI suggests possible upcoming movements by diverging or converging to the price chart. When the market price is in a downtrend and the CCI starts rising, traders expect a trend reversal from a downtrend to an uptrend or a consolidation. On the other hand, when the market is in an uptrend and the CCI starts falling, traders expect a trend reversal from an uptrend to a downtrend or a correction.

Importantly, you should not place a trade as you see a divergence or divergence on the chart. It is very crucial to confirm your analysis with multiple tools and techniques. Thus, it is recommended to be patient and logical until you are sure that your risk is lower than the reward.

In the above charts on the left side in the selected area, the CCI correctly predicted a downtrend. And, on the right side, it predicted a correction.

Please note that the charts that I show you are good examples. You need to study the chart yourself. You may counter numerous places that the Commodity Channel Index (CCI) has failed to predict.

I recommend you go to your chart and the right and left to see how reliable this indicator is. Additionally, change periods and levels to add to your experience and knowledge.

Read more: Bollinger Bands Indicator: Strategy, Calculation & Examples

Check the CCI In Real Chart

Click on “f(x)>Momentum Indicators>Commodity Channel Index” and set it as you wish to insert the indicator.

Bottom Line

The Commodity Channel Index (CCI) is a leading indicator that starts moving ahead of the price. It predicts possible trend reversal or a correction by diverging or converging to the price. Moreover, there is no perfect trading tool, you need patience and practice to grow and succeed.